- UK Chancellor Rachael Reeves considers selling £3.9 billion in Bitcoin to fund economic policies, mirroring Germany’s move.

- Analysts suggest easing UK crypto regulations could attract investment and stabilize market amid government sell-off.

The UK government, led by newly appointed Chancellor of the Exchequer Rachael Reeves, is reportedly considering selling off its Bitcoin holdings, valued at approximately £3.9 billion.

This recent action by the German government that resulted in a notable decline in Bitcoin’s market price. Reeves, a former economist at the Bank of England, may use the proceeds from the sale to support her economic policies.

The Bitcoin assets in question were acquired by the UK government through legal seizures, including a major case against money launderer Jian Wen. Initially valued at about £2 billion, these assets have appreciated to their current value.

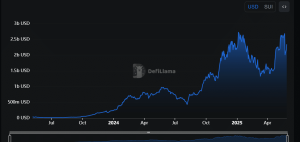

Germany’s recent sale of about 50,000 BTC, which caused a 15% decrease in Bitcoin’s price, serves as a cautionary tale for the UK’s potential sale. This historical precedent suggests that a large-scale liquidation could similarly impact Bitcoin’s market price significantly.

Analysts have raised concerns that selling these Bitcoin could introduce volatility to the market and depress Bitcoin prices. They suggest that Reeves could mitigate potential negative impacts by easing the UK’s strict cryptocurrency regulations. This regulatory adjustment could attract investments and demonstrate the government’s support for innovation in technology.

There’s a convenient pile of cash Labour chancellor Rachel Reeves might find handy – Britain’s £3.9 billion seized Bitcoin stash, writes @MerrynSW https://t.co/iTufWjWHaJ

— Bloomberg Opinion (@opinion) July 19, 2024

As Reeves contemplates this sale, the cryptocurrency community and financial analysts are closely monitoring the situation. The management of these assets is crucial, as it could provide a recurring source of funds for the government while influencing Bitcoin’s market.

Currently, Bitcoin’s price has shown some recovery, trading above $66,100, despite a recent drop to $57,146. The trading volume has increased by 11% to $30.11 billion, indicating ongoing market sensitivity to developments related to government holdings of the cryptocurrency.

The post Potential UK Bitcoin Sell-Off Mirrors Germany’s Move, Could Impact Global Crypto Market appeared first on ETHNews.