- Tron founder emphasizes focus on blockchain development over leverage trading amid widespread market liquidations.

- Bitcoin’s price swings sharply, dropping to $50,000 then recovering to $52,800, as trading volume surges by 161%.

Tron founder Justin Sun has publicly denied rumors that he suffered substantial financial losses due to liquidations in leverage trading. This clarification came after the cryptocurrency market experienced an 18% decrease within 24 hours, which led to speculation about Sun’s financial state.

Justin Sun potentially getting liquidated could be the reason for that nasty -20% wick on $ETH https://t.co/amPsbnmrbu

— Johnny (@CryptoGodJohn) August 5, 2024

Reports had suggested that Sun was hit with over $152 million in liquidations, but he dismissed these as unfounded.

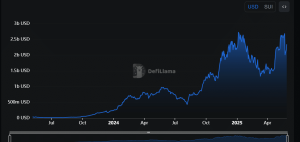

The decline in the crypto market began during the Asian trading hours on Monday, resulting in more than $1 billion in liquidations across the market. Many traders with leveraged positions faced severe financial setbacks.

Amid these market conditions, rumors that Sun was significantly affected. However, Sun stated that he and his team do not typically engage in leverage trading, noting that such strategies do not contribute positively to the market.

The rumors about our positions being liquidated are false. We rarely engage in leveraged trading strategies because we believe such trades do not significantly benefit the industry. Instead, we prefer to engage in activities that provide greater support to the industry and…

— H.E. Justin Sun 孙宇晨 (@justinsuntron) August 5, 2024

Instead, Sun emphasized his dedication to supporting the cryptocurrency industry through more sustainable activities. He reported that his efforts are focused on developing blockchain projects, staking, operating nodes, and helping other project teams to provide liquidity. Sun argued that these activities are more beneficial to the industry’s long-term development than high-risk trading tactics.

Market volatility remains high as Bitcoin’s value briefly fell to $50,000 before rising again to $52,800. During this fluctuation, the daily trading volume increased dramatically by 161% to $71.8 billion, indicating a heightened level of trading activity.

#Bitcoin traded below $50K. It’s down about 22% since Friday’s U.S. stock market close, and It’s now down 45% priced in #gold since its Nov. 2021 high almost three years ago. It’s back above $50K now, but wait until the stock market opens and ETF holders can finally sell too.

— Peter Schiff (@PeterSchiff) August 5, 2024

Amidst broader economic concerns, Bitcoin critic Peter Schiff predicted further downturns, especially with the start of trading in U.S. markets. He suggested a possible 30% drop in the Bitcoin ETF market.

Meanwhile, discussions about a potential U.S. recession continue, with some reports suggesting that the Federal Reserve might announce a significant rate cut of 50 basis points before September to mitigate economic risks.

The post Justin Sun’s Financial Disaster? The Truth Behind the $152 Million Rumor! appeared first on ETHNews.