- Ethereum’s price fell by 23.4% to $2,171, more steeply than Bitcoin’s 18% drop during the same period.

- Major institutional sell-offs, including Grayscale’s sale of 600,000 ETH, contributed to Ethereum’s sharp decline in value.

During the recent global market downturn, Ethereum recorded a more pronounced fall than Bitcoin. On a day marked by widespread sell-offs, Ethereum’s price decreased by 23.4%, dropping to $2,171, while Bitcoin decreased by 18%, momentarily reaching a low of $49,000.

The larger decline in Ethereum’s value can be attributed to several factors beyond the general market trend. According to ETHNews, while both cryptocurrencies were affected by the downturn in traditional and crypto markets, Ethereum was subjected to additional pressures.

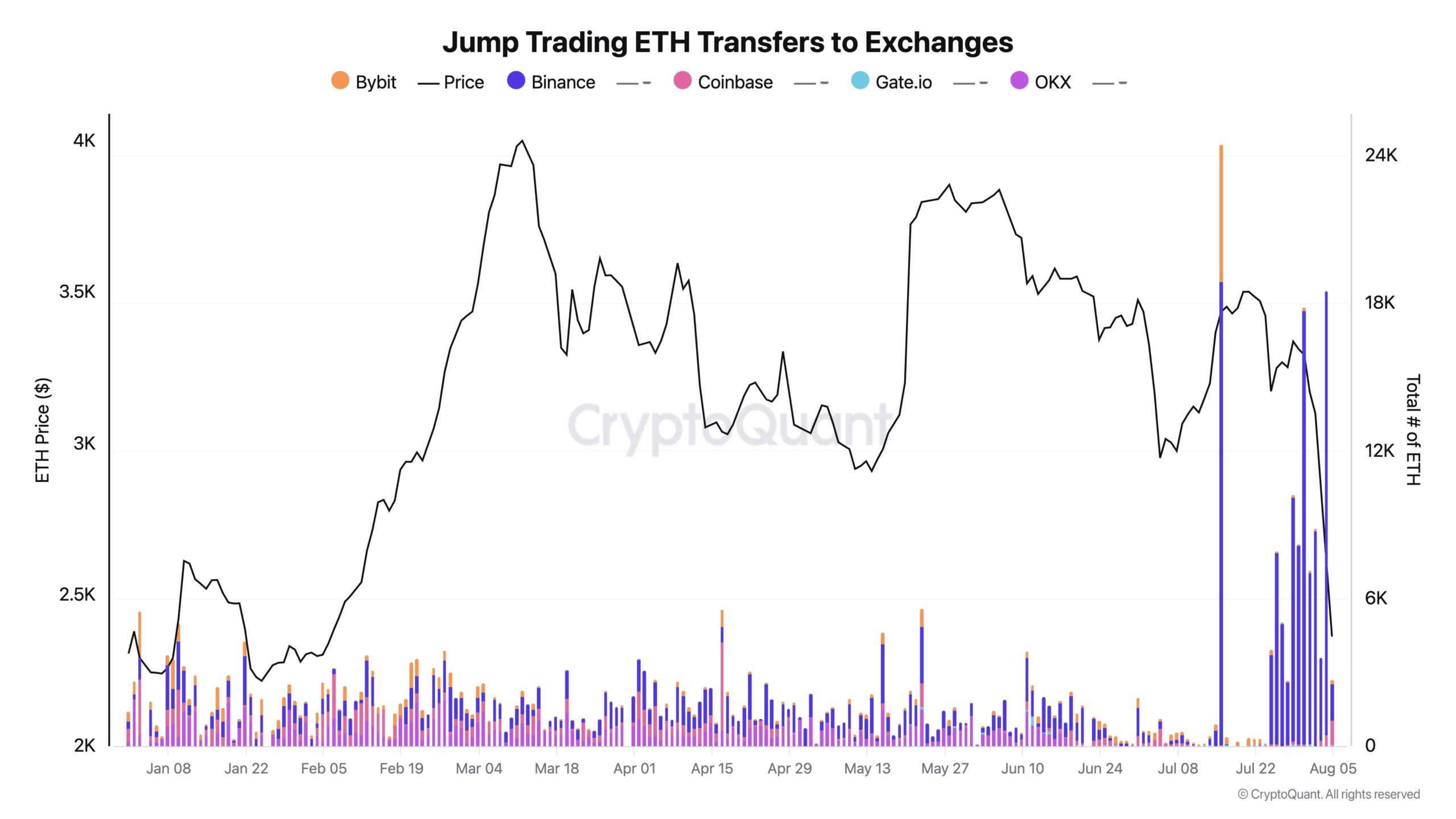

Specifically, significant institutional sell-offs exacerbated Ethereum’s decline. Data indicate that entities such as Jump Trading, Grayscale, and Paradigm liquidated Ethereum holdings, contributing to an increased supply on the market without corresponding demand.

Grayscale, for instance, is reported to have sold around 600,000 ETH starting from late July, coinciding with the launch of Ether ETFs. Similarly, market makers like Wintermute and Flow Traders significantly reduced their Ethereum holdings, which compounded the downward pressure on its price.

In contrast, the blockchain sector is also influencing Ethereum’s market position. The emergence of Solana as a viable alternative to Ethereum is noteworthy, given its adoption in decentralized exchanges and the increasing number of active addresses.

Solana’s lower transaction fees and scalable infrastructure are attracting developers and users, potentially diverting resources from Ethereum.

Looking forward, the trajectory for Ethereum’s price remains uncertain. Analysts suggest that continued selling pressure could push Ethereum’s price down towards $2,010, potentially testing further support near $1,795. Conversely, a resurgence in buying activity could lift the price towards resistance levels between $2,500 and $2,700.

Ethereum (ETH) is currently priced at $2,517.81, showing a 3.80% increase over the last 24 hours, with a day’s range of $2,418.87 to $2,552.31 and a 52-week range of $1,523.24 to $4,092.28.

With a market cap of $302.785 billion and a circulating supply of 120.26 million ETH, the trading volume in the last 24 hours was $30.65 billion, indicating strong market interest and liquidity.

Ethereum is experiencing a bullish trend, with potential resistance at $2,600 and further growth possible towards $2,700.

The post Is Solana to Blame for Ethereum’s Massive Price Drop? appeared first on ETHNews.