- Ethereum’s network metrics, such as active addresses and transaction volumes, show significant growth over the last 30 days.

- Technical analysis predicts Ethereum could reach new highs by Q3 2024 if current price levels below $2,300 are maintained.

Recent data indicates an uptick in Ethereum wallet activities, despite prevailing fears in the cryptocurrency market. Market analysts highlight this trend as potentially indicative of a bullish phase for Ethereum (ETH).

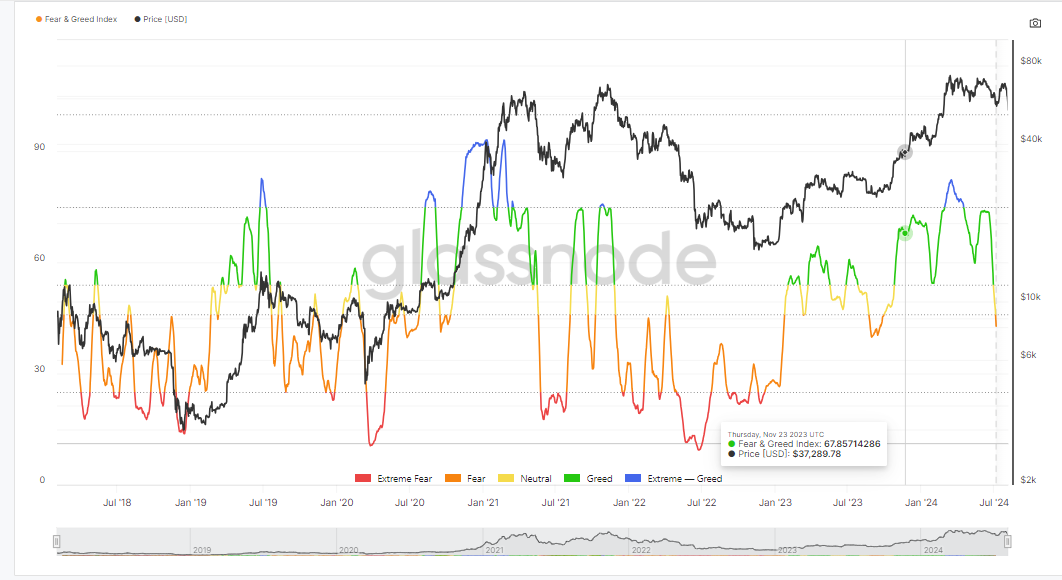

“Be greedy when others are fearful” pic.twitter.com/HKvrL5pobW

— Quinten | 048.eth (@QuintenFrancois) August 5, 2024

Market analyst, in a recent post on X, pointed out that current market fear might be a suitable time for buying cryptocurrencies.

Glassnode data supports this view, showing that similar periods of market fear have historically led to substantial price rallies for various cryptocurrencies.

Amid concerns of a global recession and potential geopolitical conflicts, Ethereum’s network metrics show signs of growth. According to ETHNews analytics provided by Santiment, there has been a noticeable increase in Ethereum’s network activities.

Metrics such as the increase in active wallet addresses, currency circulation, network growth, and transaction volume over the last 30 days have all risen.

This pattern of increased Ethereum network activity is occurring in a market environment similar to the conditions during the Covid-19 market crash, when Ethereum reached low prices that prompted widespread selling among new investors.

However, following that period, Ethereum experienced a significant price recovery. Current conditions suggest a potential for similar price behavior in the near future.

The present situation tests Ethereum’s price resilience. Technical analysis shows that Ethereum’s price action is revisiting levels that previously indicated a breakout. If this pattern holds, Ethereum might achieve a new all-time high by the third quarter of 2024.

Investment strategy recommendations include purchasing Ethereum aggressively when its price falls below $2,300, anticipating potential future gains as the market recovers.

Ethereum demonstrates robust network activity that could foresee a recovery, despite the ongoing market fear. Current analyses and historical patterns suggest that Ethereum’s network and price might have the potential for significant growth in the coming months.

The post Why Now Might Be the Perfect Time to Buy Ethereum—Industry Expert Weighs In! appeared first on ETHNews.