- Bitcoin ETFs, particularly BlackRock’s IBIT, are accumulating Bitcoin rapidly, with U.S. ETFs holding about 645,899 BTC.

- BlackRock, a major asset management firm with around $10 trillion in assets, has a significant presence in crypto through Bitcoin ETFs

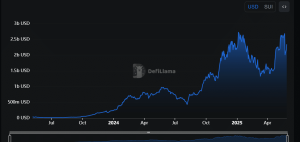

Bloomberg’s senior analyst, Eric Balchunas, recently shared insights highlighting the accelerating accumulation of Bitcoin by ETFs. Presently, these funds collectively hold approximately 909,700 BTC. Excluding Grayscale’s contribution, U.S. ETF holdings account for 645,899 BTC. BlackRock’s IBIT leads among ETFs with 347,767 BTC, followed by Grayscale at 263,801 BTC, and Fidelity’s FBTC with 176,626 BTC.

Didn’t realize US ETFs are on track to pass Satoshi in bitcoin held in October. BlackRock alone is already #3 and on pace to be #1 late next year, and will likely stay there for a very long time Ht @EdmondsonShaun pic.twitter.com/QGsO00zrxp

— Eric Balchunas (@EricBalchunas) August 12, 2024

BlackRock Expands Its Crypto Presence

BlackRock, the world’s largest Asset Management Company (AMC) has further established its presence in the crypto space. BlackRock, which oversees around $10 trillion in assets, has exposure to crypto through Bitcoin ETFs, stablecoins, and tokenized assets. Its iShares Bitcoin ETF, for instance, has assets under management of nearly $21 billion.

This move is in line with the firm’s focus on digital assets, especially its partnership with Circle, the issuer of the USDC stablecoin. This partnership was launched in 2022 and is based on the use of USDC reserves for investments in the Circle Reserve Fund; currently, the circulating supply of USDC is above $34 billion.

The creator of Bitcoin, Satoshi Nakamoto, is estimated to hold approximately 1. 1 million BTC, making him the biggest individual holder. Nevertheless, this is a rather contentious estimate. According to BitMEX Research, there are studies that indicate that Nakamoto could have mined less than 700,000 BTC. With the ongoing accumulation of ETFs, it is becoming more possible to outpace Nakamoto’s holdings.

Major Bitcoin Holders Emerge Beyond ETFs

Besides ETFs and individual investors, exchanges, and governments also hold large amounts of Bitcoins. Due to regulation challenges, Binance Exchange is the second largest BTC holder with more than 550000 coins. MicroStrategy, the biggest public corporation invested in BTC currently, has 226,500 BTC.

Moreover, the Bitfinex crypto exchange has 221,315 BTC. The US and Chinese governments are also on the list, mainly because of the assets seized from criminal activities. It is important to mention that Coinbase, which is one of the leading companies in the crypto industry, was not mentioned by Balchunas in his list. The argument is that Coinbase is a custodian, meaning that it holds the Bitcoin on behalf of its clients but does not own the currency.

BlackRock’s investments are not restricted to buying cryptocurrencies directly. The AMC has also invested in Securitize, a blockchain company that focuses on digital assets such as tokenized money market funds. According to data by Token Terminal, BlackRock’s investment in Securitize shows the firm’s overall plan of incorporating blockchain into its services.

Ethereum ETFs Rebound with Recent Inflows

Similarly, Ethereum-based spot ETFs also experienced a recovery with a total inflow of $4. 9 million after experiencing outflows in the previous three trading days. Fidelity’s FETH had the highest inflow at $4 million, while Bitwise’s ETHW recorded a $2. 9 million inflow. BlackRock’s iShares Ethereum Trust (ETHA) had no inflow or outflow on the day.

Grayscale’s Ethereum Trust (ETHE) has recorded no outflows since August 12, the first such zero-flow day since the product started trading on July 23. This stopped the outflow, and the rise in the Ethereum market capitalization, which increased by 6. 4% to trade above $2,700, signifies a bull market.

The post Senior ETF Analyst on Satoshi Nakamoto: Likely to Lose Bitcoin’s Top Holder Status by Year-End — WIll This Influence BTC Price Targets appeared first on ETHNews.