- Peter Brandt identifies $71,000 as the critical level for Bitcoin to confirm continuation of its bullish trend.

- Analyst Willy Woo predicts a cooling-off period for Bitcoin, suggesting a cautious market outlook for the next weeks.

Peter Brandt, recently commented on Bitcoin’s price, indicating that a sustained push above $71,000 is crucial for confirming the cryptocurrency’s bullish momentum.

The recent rally in Bitcoin did NOT disturb the 7-month sequence of lower highs and lower lows. $BTC

Only a close above 71,000 confirmed by a new ATH will indicate that the trend from the Nov 2022 low remains in force pic.twitter.com/lFO9A20VPD— Peter Brandt (@PeterLBrandt) October 2, 2024

Despite a notable rally in September, Bitcoin’s price pattern has not escaped a seven-month trend of lower highs and lower lows. Brandt suggests that only a close above $71,000, coupled with a new all-time high, would solidify the trend that began from its November 2022 low.

Currently, Bitcoin remains 16% below its peak of nearly $74,000, reached in March. The digital currency experienced a sharp decline to $60,315 earlier today amid geopolitical tensions, as we reported on ETHNews. According to ETHNews data. As of now, it trades at approximately $61,488.

The path to recovery is fraught with uncertainty. ETHNews Analysts point out that the cryptocurrency’s chart structure is hesitant to enter bullish territory, with a return to its all-time high of $73,679 potentially more protracted than some optimists expect.

Structure mid term is bearish moving to neutral and trying to get bullish. ATH will take time.

Short term structure suggests 1-3 wks stand down to cool off before the next bullish attempt.

I don’t think we get Uptober, sideways Oct, and Nov-Dec for laser eye parties.

Long term…

— Willy Woo (@woonomic) October 2, 2024

“The mid-term structure is bearish, shifting to neutral and trying to turn bullish. A new all-time high will take time” stated Willy Woo, in a recent X post.

Woo anticipates that Bitcoin may undergo a cooling-off period over the next one to three weeks, setting the stage for another bullish push. However, he tempers expectations for the immediate future:

“I don’t expect an ‘Uptober’; rather, a sideways October, and then November-December could be times for cautious optimism” he added.

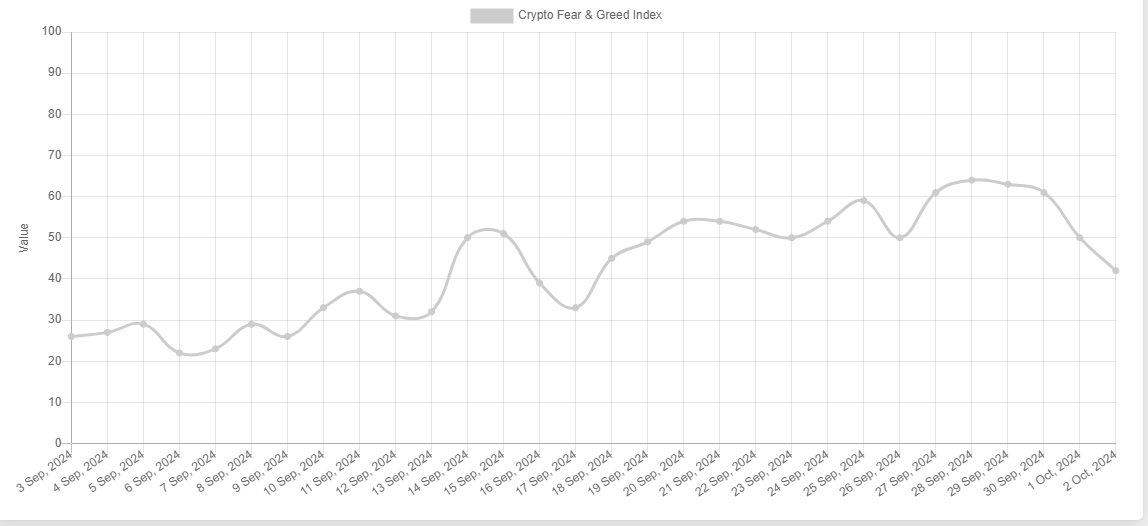

Further compounding the market’s nervousness, the Crypto Fear & Greed Index has recently moved from “Greed” to “Fear,” dropping 8 points to a score of 42, reflecting growing investor apprehension.

This shift in sentiment coincided with a drawdown in Bitcoin’s value, which triggered approximately $128.49 million in liquidations of long positions.

This volatility follows a period of robust performance where Bitcoin surged 25% over 21 days, reaching a high of $66,331 on September 27, before it began to consolidate and retrace back toward $60,000.

Brandt’s analysis underscores a critical junction for Bitcoin

He asserts that without a definitive break above $71,000 and a new record high, it is premature to declare the continuation of the bullish trend from late 2022.

The coming weeks will be crucial for traders and investors watching to see if Bitcoin can regain its former strength or if it continues to grapple with market uncertainty.

Bitcoin (BTC) is currently priced at $60,618.79, down 3.57% for the day, with its price fluctuating between $60,618.79 and $61,886.57. Over the past year, it has traded between $26,558.32 and $73,750.07. With a market capitalization of $1.198 trillion and a 24-hour trading volume of $51.67 billion, Bitcoin’s circulating supply stands at 19.76 million.

The post Can Bitcoin Overcome the $71K Hurdle to Launch Its Bull Run? appeared first on ETHNews.