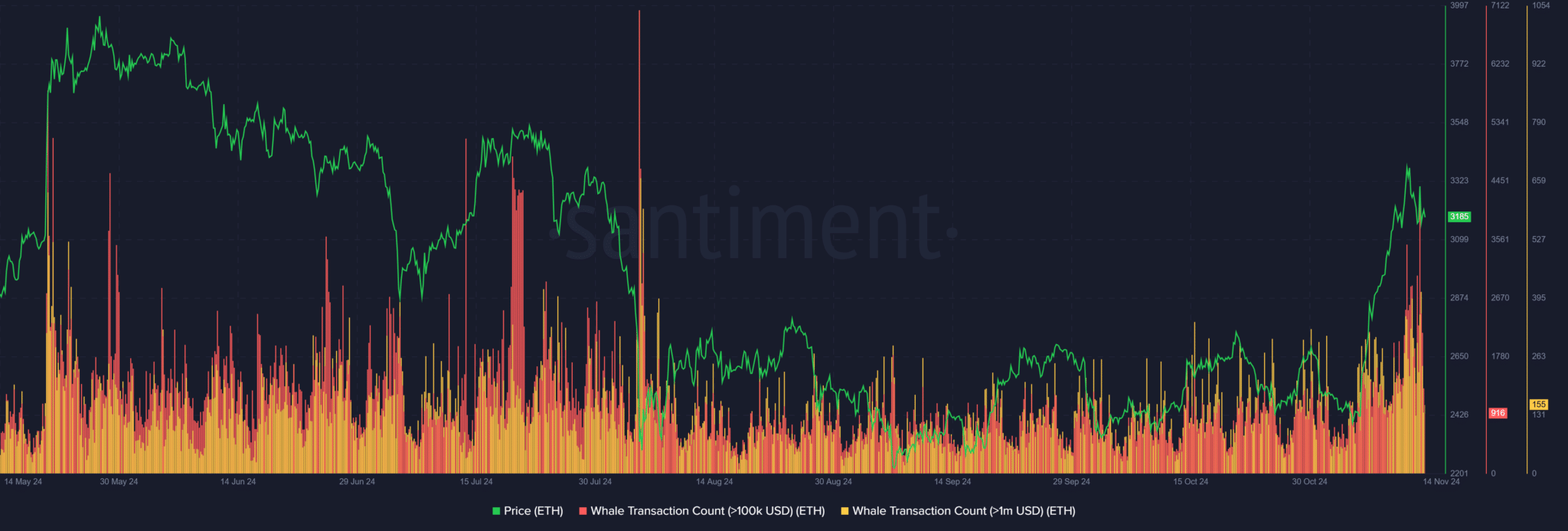

- Whale transactions escalate in late October, correlating with Ethereum’s price rally; key indicator of bullish market sentiment.

- Technical indicators like RSI at 67 and strong OBV suggest potential for further growth, Ethereum tests $3,500 resistance.

Ethereum (ETH) has witnessed a notable 20% increase in its price over the last week, primarily influenced by significant whale activities and a decrease in the number of coins held on exchanges.

These movements suggest a robust confidence in Ethereum, as major investors increase their holdings and reduce available market supply, pushing the price upward.

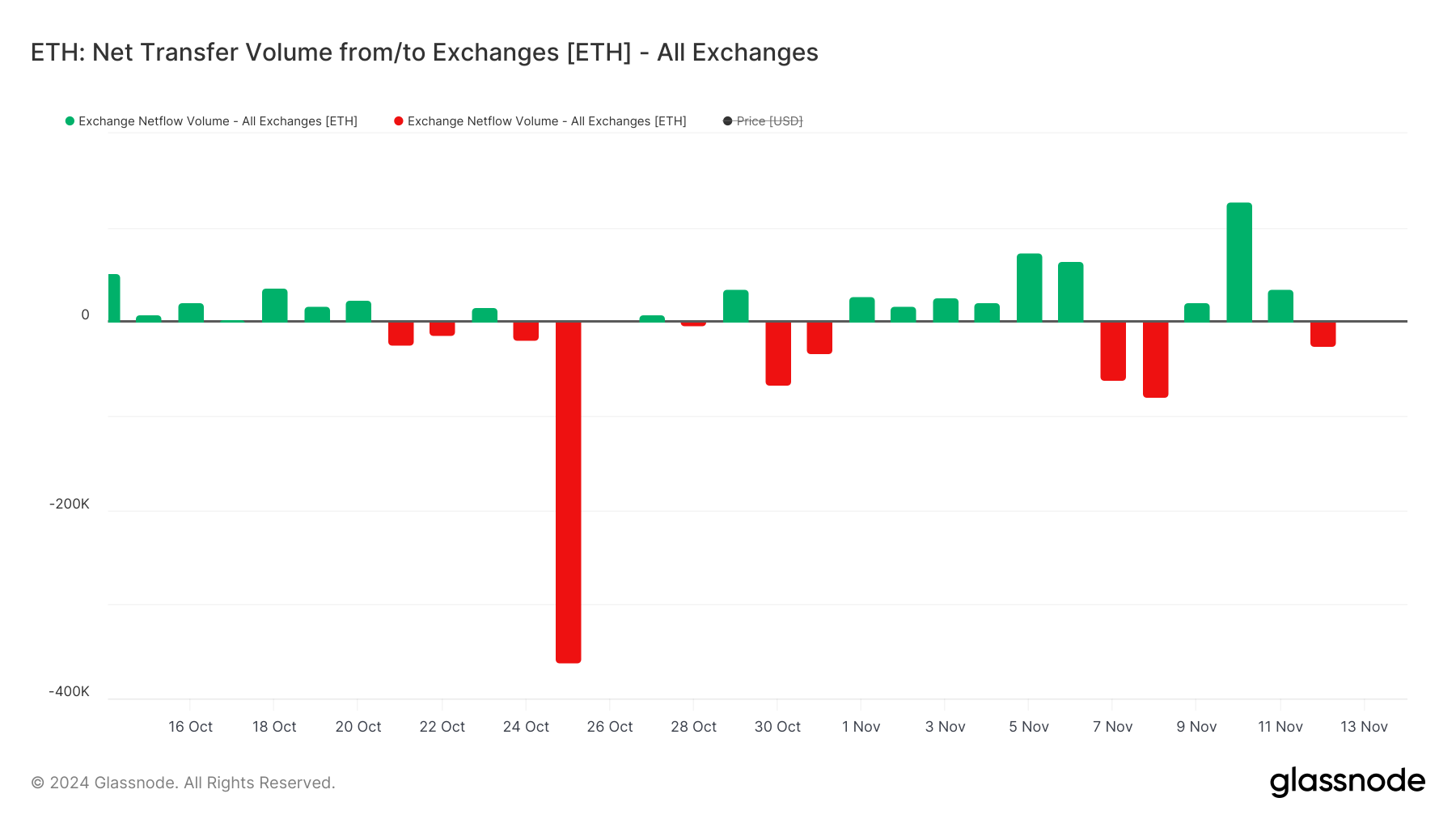

The surge in Ethereum’s value is closely linked to substantial exchange outflows recorded around October 26th, which signal a strong holder sentiment as substantial amounts of ETH were moved off exchanges.

This trend has been particularly pronounced over the past week and coincides with Ethereum’s price appreciation, underscoring a bullish market sentiment driven by a tightening of liquid supply.

Despite these positive signs, Ethereum has experienced minor price corrections that have placed it at a critical juncture.

It is now testing crucial support and resistance levels which are expected to determine the future trajectory of its price movement. The market is currently poised, waiting to see which direction Ethereum will take.

Whale Influence and Price Implications

The increase in whale transactions towards the end of October and into early November has aligned with Ethereum’s recent price rally. Such activities typically indicate market moves as these large holders often have the capital influence to sway market directions.

The presence of whales is generally seen as both a marker and a mover of market, suggesting their crucial role in Ethereum’s current market position.

However, as Ethereum approaches critical resistance levels, there has been a noticeable slowdown in whale transactions, which may suggest a phase of profit-taking or a cautious approach due to the recent price peak.

Looking forward, continuous engagement from whales will be essential for maintaining the current upward momentum. Should whale activity decrease significantly, Ethereum could face a potential correction or increased market volatility.

Despite the possibility of minor pullbacks, Ethereum’s strong whale accumulation, combined with technical indicators, points to further potential upside. The Relative Strength Index (RSI) remains at 67, indicating sustained bullish momentum without veering into overbought territory.

Moreover, the On-Balance Volume (OBV) metric shows robust buying pressure, reinforcing the ongoing demand for Ethereum.

Ethereum is currently trading above Exponential Moving Average (EMA) lines, with the $3,500 level acting as immediate resistance. Surpassing this could open the path towards $3,700, and potentially up to $4,000.

While minor corrections may reflect routine profit-taking, the overarching market conditions bolstered by strong whale activity suggest Ethereum could be gearing up to challenge, if not exceed, its all-time high, provided it maintains support above the $3,000 mark.

The current price of Ethereum (ETH) is $3,175.4 USD, showing a decline of 0.50% today.

Key Observations:

- Price Trend: Despite today’s minor pullback, ETH has experienced a strong rally, with a weekly gain of 16.57% and a monthly rise of 20.81%. Year-to-date, Ethereum is up 39.16%, indicating a positive overall trend.

- Market Capitalization: Ethereum’s market cap stands at $382.39 billion USD, with a 24-hour trading volume of $45.16 billion USD. The volume-to-market cap ratio of 0.1211 suggests strong liquidity and market activity.

Technical Analysis

Ethereum is approaching a key resistance zone around $3,200 USD. A breakout above this level could lead to a rally towards $3,500 USD. Conversely, if the resistance holds, ETH may correct towards the support level at $3,000 USD.

The post Ethereum’s Bullish Week: Unpacking the Role of Whales and Exchange appeared first on ETHNews.