- Bitcoin’s 1-5% order-book depth fell below 135M units, signaling potential price floors amid reduced sell-side liquidity.

- Retail leverage (ELR) spiked during minor recoveries, mirroring pre-2022 crash patterns and raising liquidation risks.

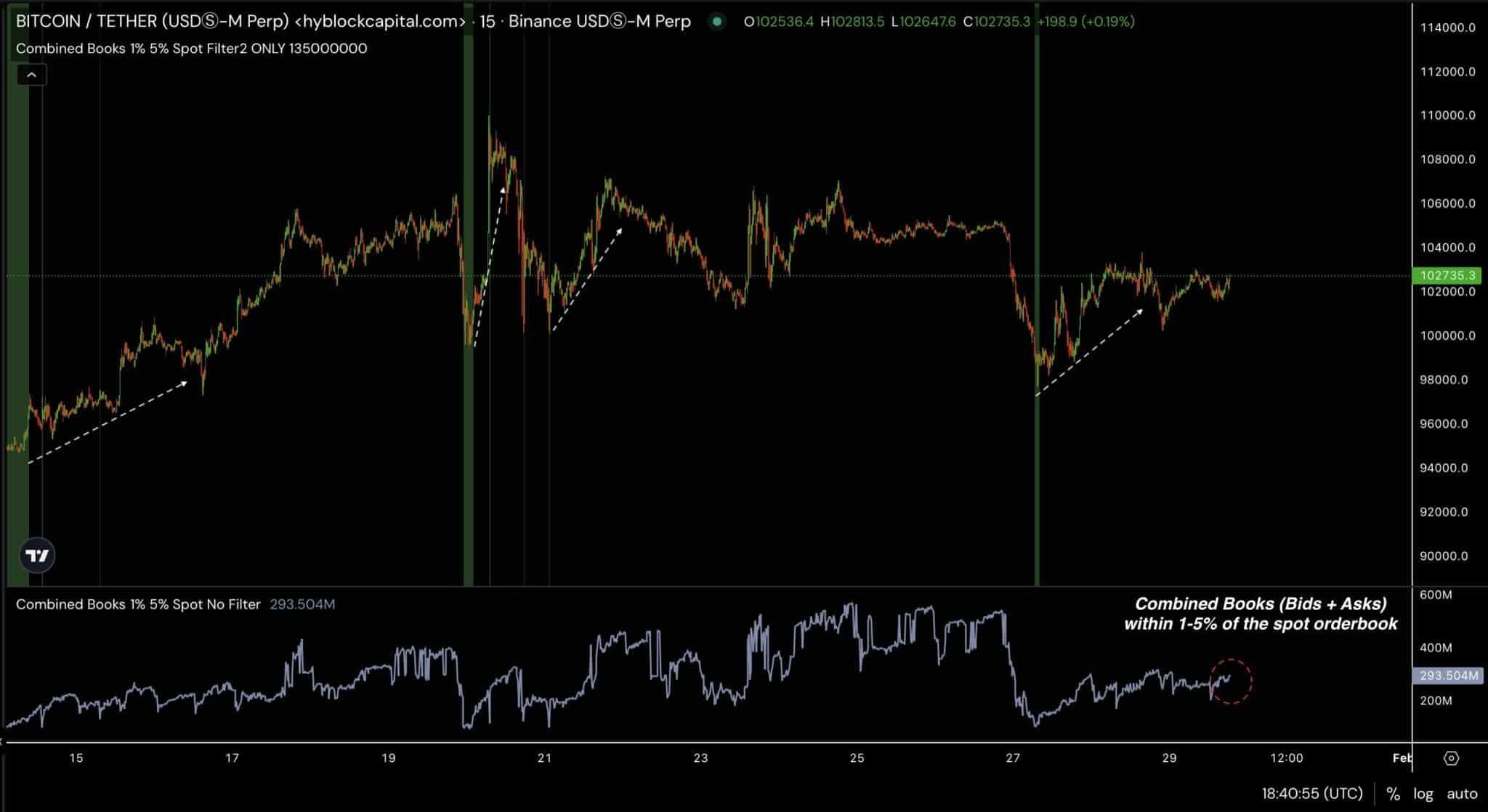

Bitcoin’s 1-5% order-book depth dropped below 135 million units in January, a level historically linked to short-term price recoveries. Data shows this metric preceded rebounds on January 13 and 21, suggesting reduced sell pressure. ETHNews analysts correlate sustained low liquidity with upward trends but note sudden depth increases often precede volatility.

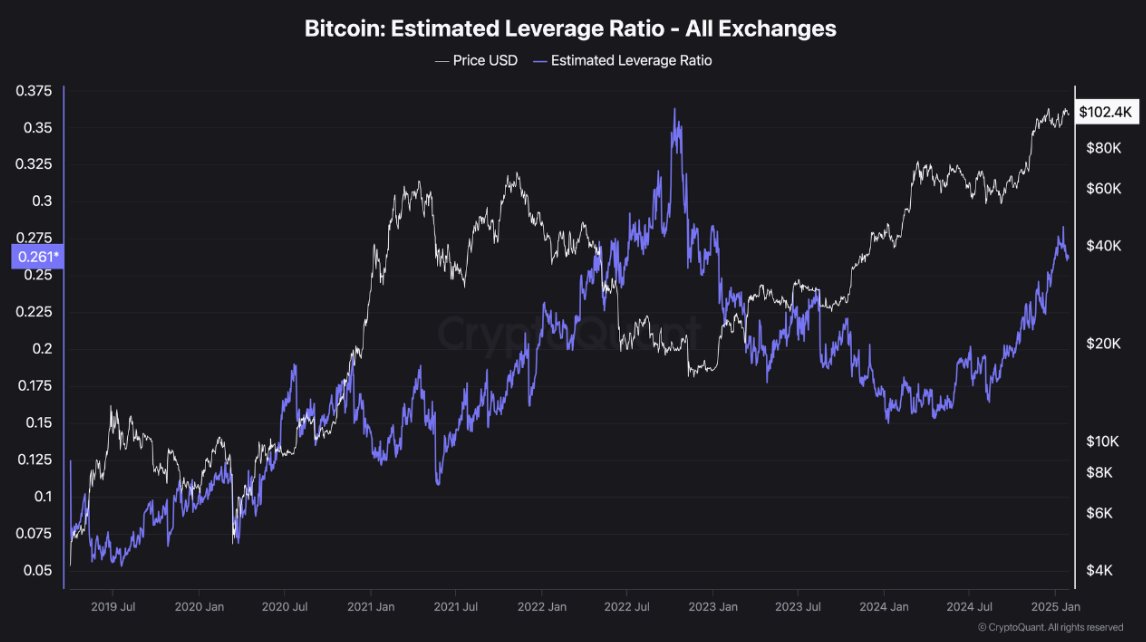

Retail traders increased Bitcoin derivatives exposure, raising the Estimated Leverage Ratio (ELR). Higher ELR reflects greater borrowing for futures trades, mirroring patterns seen before 2022’s 60% price drop. Despite risks, retail activity persists, driven by expectations of quick gains.

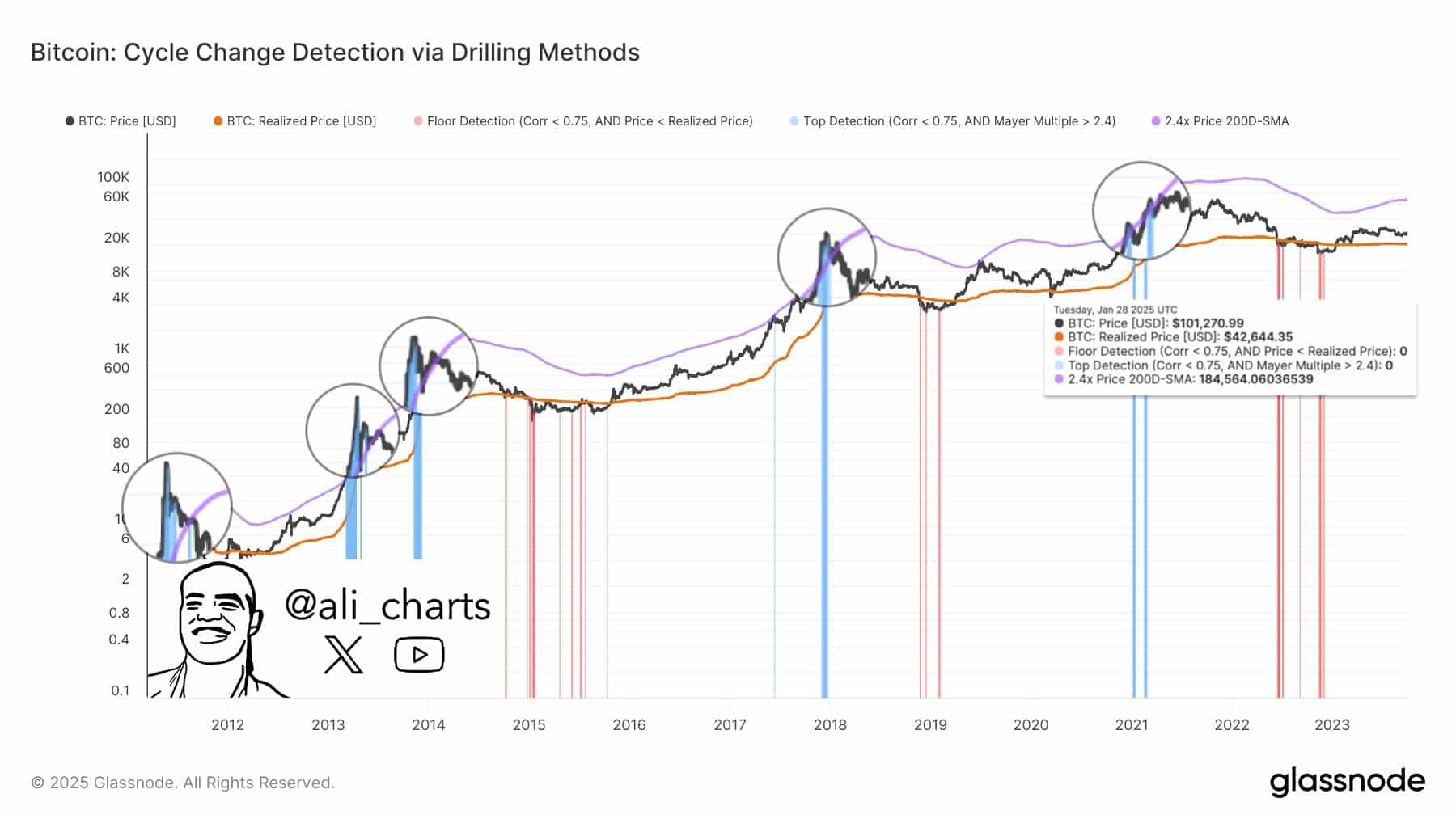

Bitcoin currently trades below $105,600, a threshold set at 2.4x its 200-day moving average. Past cycles show prices corrected after exceeding this multiple, as seen during 2021’s $60,000 peak. Traders monitor this level for potential breakout signals, though current momentum remains subdued.

Thin order books reduce immediate sell liquidity, potentially supporting prices. However, high leverage ratios amplify downside risks if positions unwind abruptly. The ELR’s rise suggests traders prioritize short-term speculation over stability, creating conditions for rapid price swings.

ETHNews analyst observers emphasize tracking liquidity metrics and leverage trends to assess near-term risks. While shallow order depth may delay sell-offs, elevated borrowing leaves markets vulnerable to cascading liquidations. Historical parallels indicate current conditions favor cautious trading strategies until liquidity or leverage patterns stabilize.

The current price of Bitcoin (BTC) is $105,094 USD, marking a 1.30% increase in the past 24 hours. Over the past week, BTC has gained 1.42%, while its performance over the last month shows a strong 13.48% increase. The long-term trend remains bullish, with a 144.80% gain over the last year, and a 1,010% growth over five years.

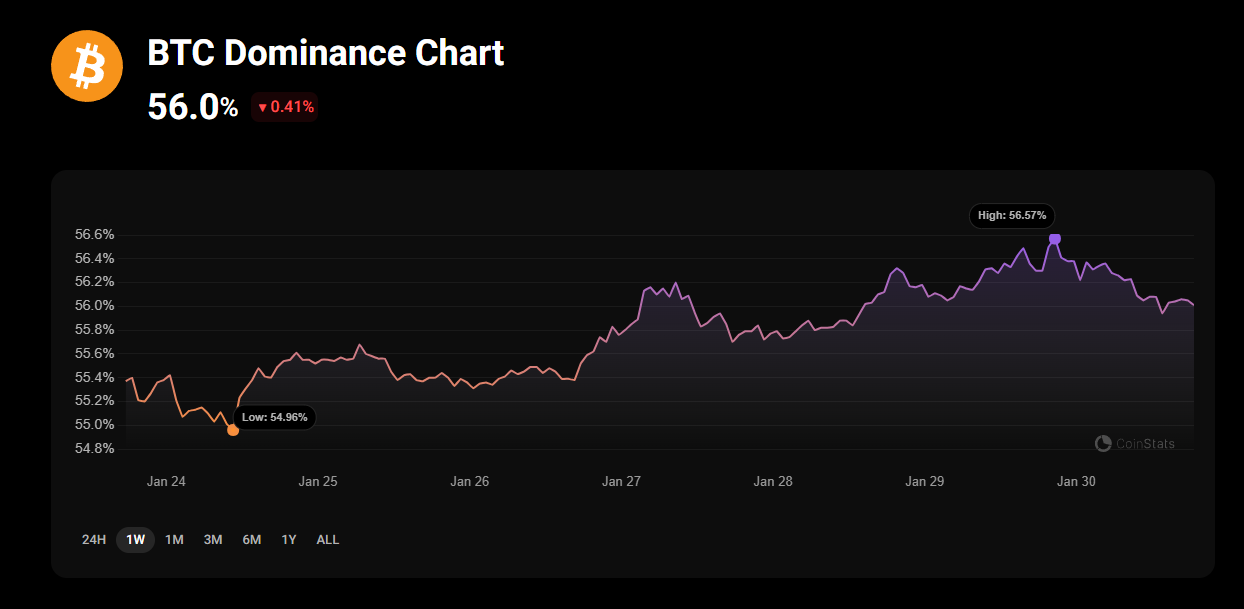

The Bitcoin dominance rate remains strong at 55.8%, reinforcing its position as the market leader. Analysts are closely watching BTC’s next move, with some projections targeting $117,000 if it breaks key resistance levels, while a rejection could send it back to $95,000-$100,000 for accumulation.

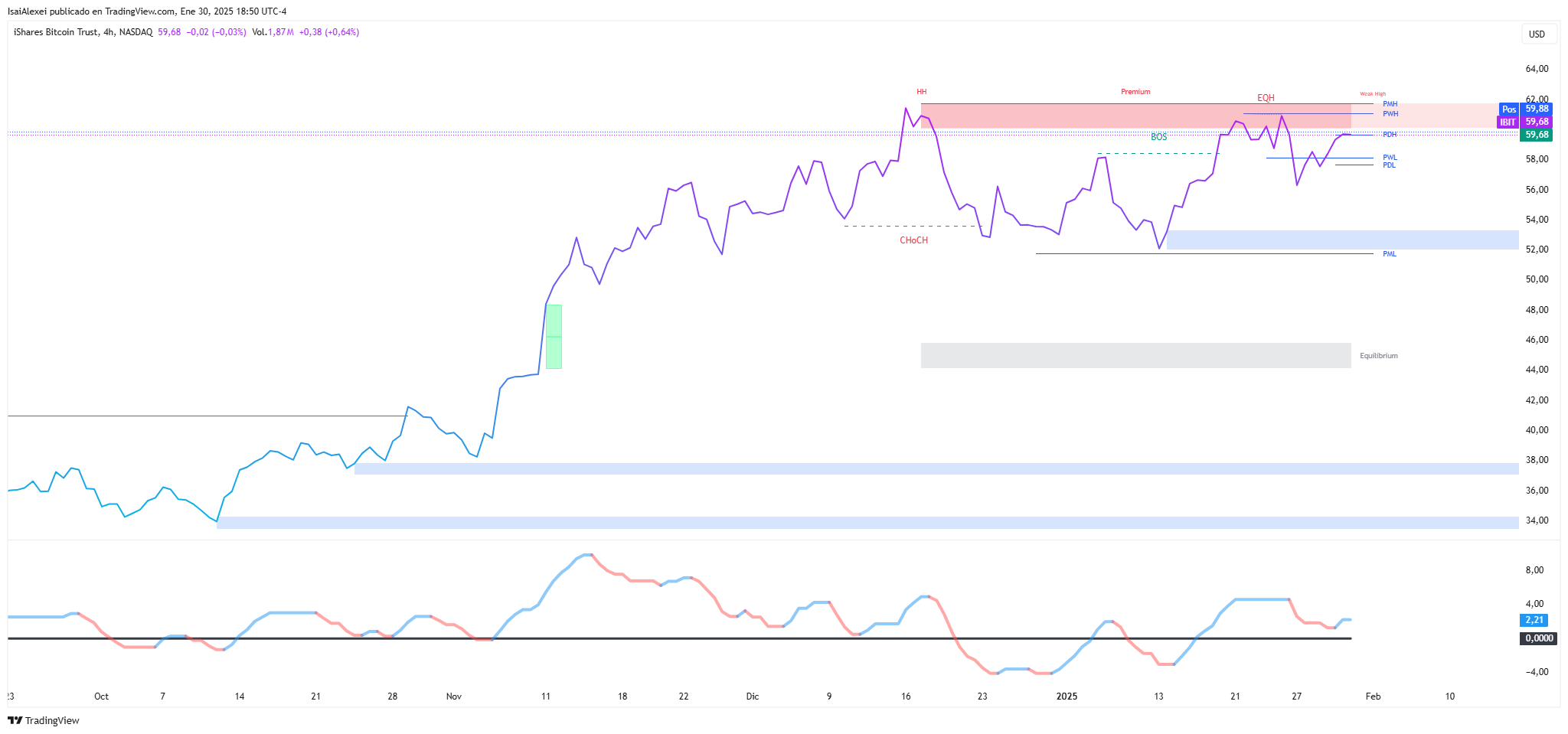

Bitcoin ETF Market Overview

The Bitcoin ETF market has seen increasing institutional interest, contributing to BTC’s rise past $100K. As of today, the iShares Bitcoin Trust (IBIT) is trading at $59.72, reflecting 0.64% daily growth.

Bitcoin ETFs have significantly boosted liquidity in the crypto market, offering traditional investors exposure to BTC without the need for direct ownership.

The post Bitcoin Liquidity and Leverage Trends Signal Caution for Traders appeared first on ETHNews.