- Bitcoin transaction fees hit 2015 lows, now under 5% of miner revenue as network activity dwindles.

- AI industries drive up energy and hardware costs, pressuring miners to secure cheaper power or efficient equipment.

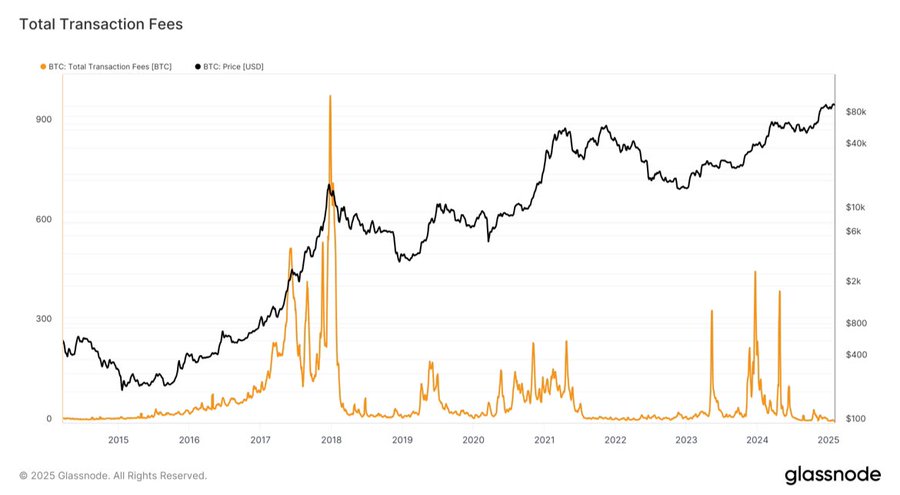

Bitcoin miners face two primary challenges: transaction fees have dropped to their lowest levels since 2015, and competition from artificial intelligence (AI) industries is increasing operational costs. These pressures threaten profitability for mining operations, particularly smaller ones.

Transaction fees, which miners earn for processing Bitcoin transactions, now account for less than 5% of their total revenue. Analyst James Van Straten confirms this figure matches levels last seen during the 2015 market downturn.

Fees typically rise when network activity increases, but reduced trading volumes and fewer transactions have prolonged the decline.

Total transaction fees have just hit the lowest level since 2015 bear market.

Miners now getting hit from both the AI and $BTC side now. pic.twitter.com/EXn7Hsn9BT

— James Van Straten (@btcjvs) February 2, 2025

At the same time, AI companies are competing for the same resources miners rely on, including electricity and advanced computer hardware.

Data centers running AI models require large amounts of power, driving up energy costs in regions where miners operate. AI-powered trading tools also reduce demand for high-fee transactions by optimizing payment timing, indirectly lowering miner income.

The combination of lower revenue and higher costs forces miners to adapt. Smaller operations struggle to cover expenses, leading to closures or asset sales. Larger companies benefit from economies of scale, securing cheaper energy deals or upgrading to more efficient equipment. Industry consolidation is accelerating as a result.

Bitcoin’s upcoming halving in 2028 will cut mining rewards by half, increasing reliance on transaction fees. However, fee recovery remains uncertain. The Lightning Network, a secondary payment system, now handles 14.51% of Bitcoin transactions, easing congestion on the main network. While this helps users, it does not directly boost miner revenue.

Some miners are relocating to areas with lower electricity costs or repurposing infrastructure for AI-related services. These strategies require upfront investment, which many smaller firms lack. Institutional miners, with greater financial reserves, continue expanding their market share.

The hash rate could decline if profitability erodes further. A sustained drop might weaken network security, though no immediate risks have materialized.

Beyond resource competition, automated trading systems alter transaction patterns, creating unpredictable fees. Miners must now balance short-term survival tactics with long-term bets on Bitcoin’s adoption trends.

The post Bitcoin Miners Confront Falling Fees and AI Competition in Resource Battle appeared first on ETHNews.