- Bitcoin rose to $97,177 as BitMEX’s buy ratio hit 5.7, signaling strong demand in derivatives markets.

- The aggregate buy/sell ratio across exchanges was 1.013, showing a slight dominance of buyers.

- BTC faces key resistance at $98,667; breaking it could push prices toward $100,000.

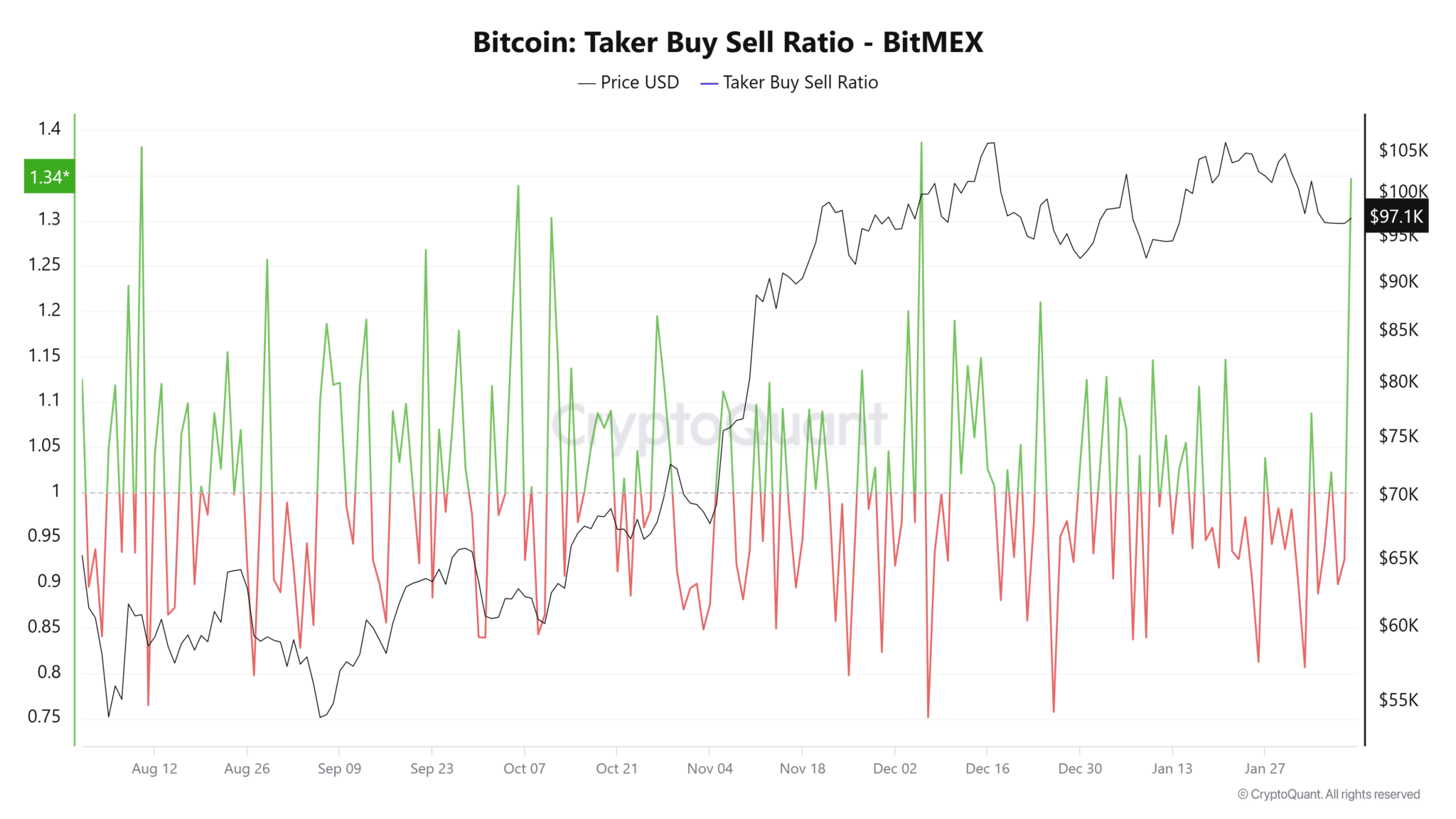

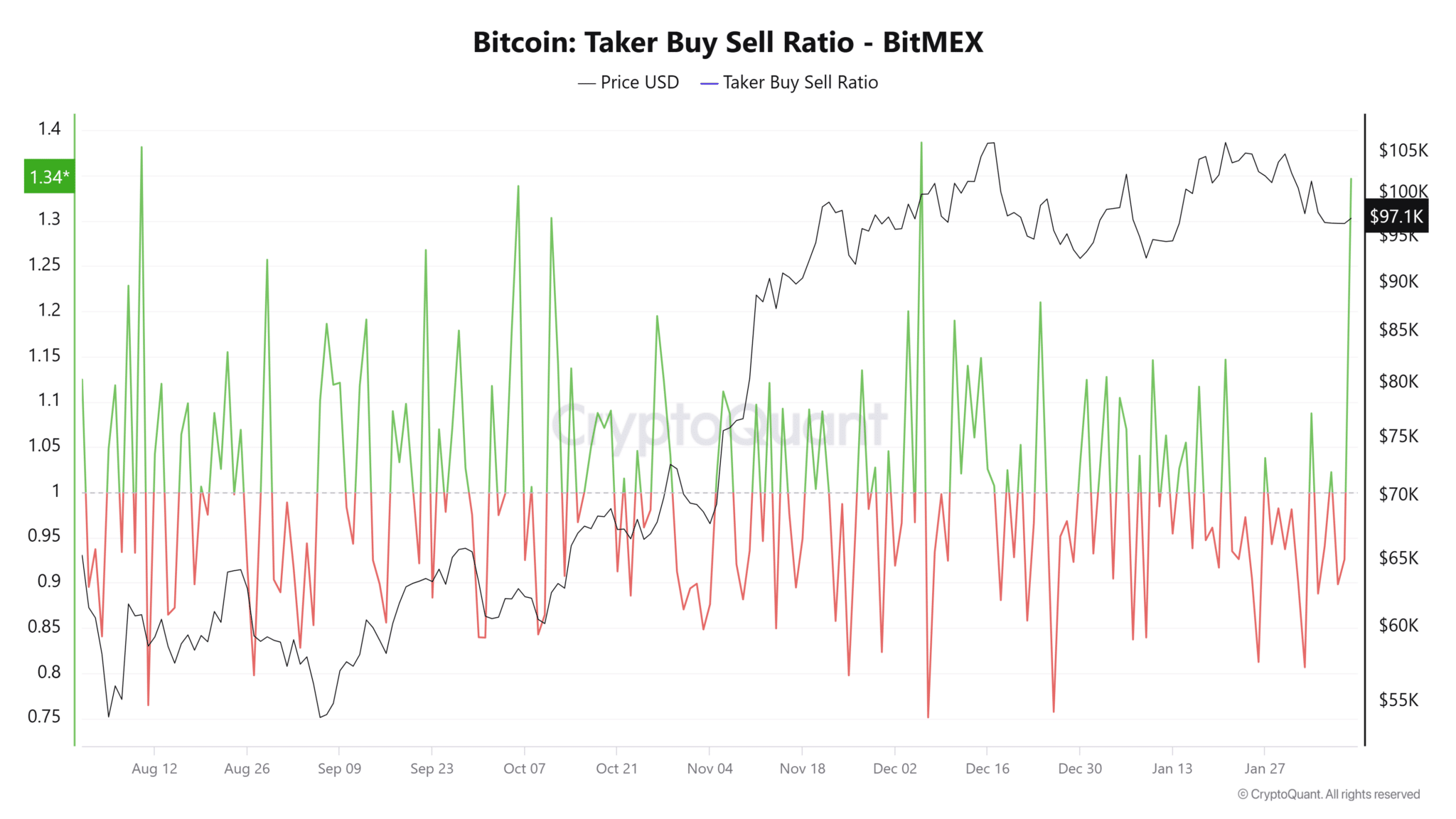

Bitcoin’s price climbed to $97,177 on February 12, 2025, as buying activity spiked across major exchanges. Data from BitMEX and HTX Global revealed a sharp rise in demand, with BitMEX’s Taker Buy Sell Ratio hitting 5.7—its highest level in six months.

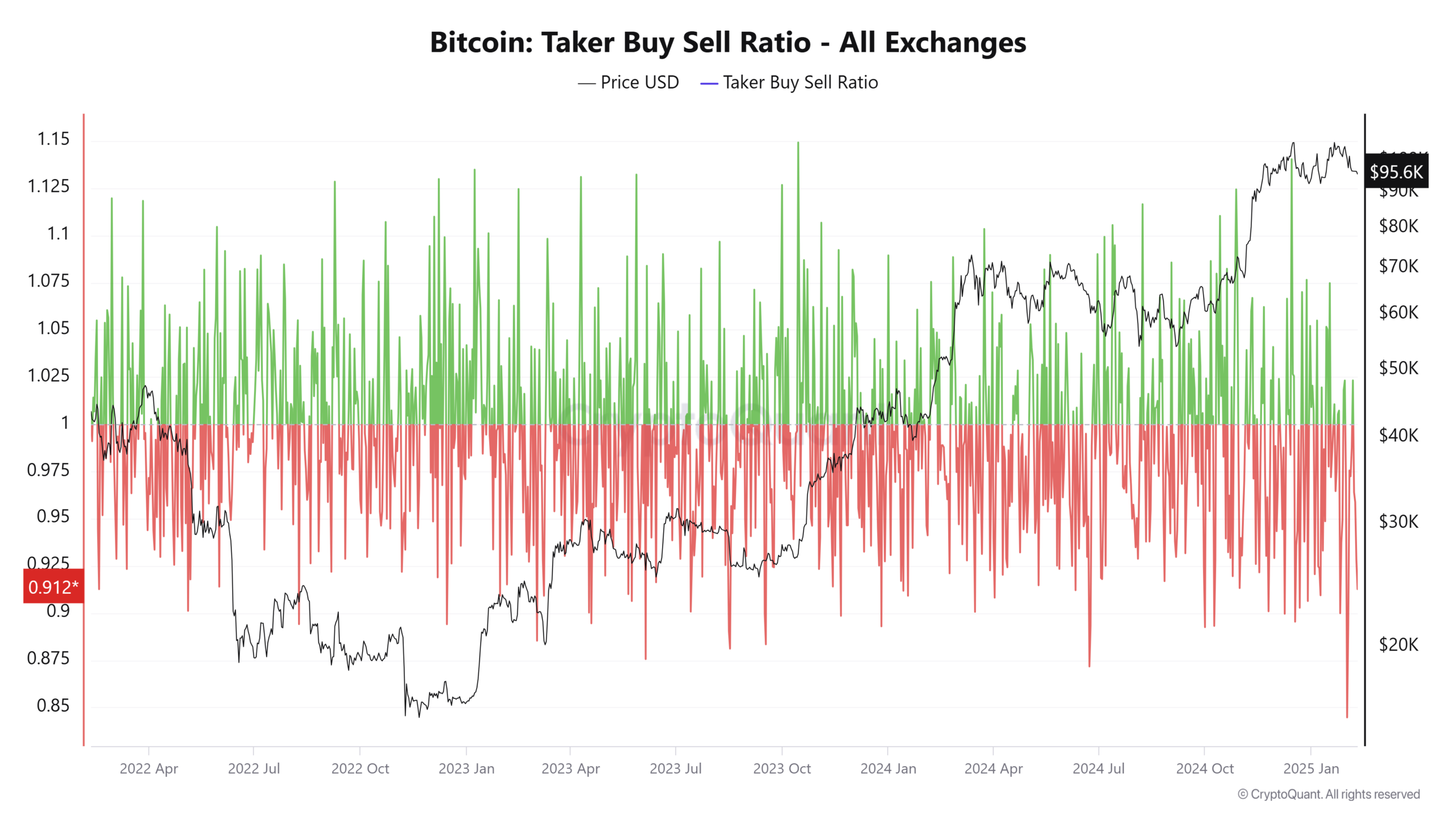

This metric, which compares buy orders to sell orders, signals heightened bullish sentiment among derivatives traders. Meanwhile, HTX Global reported a ratio of 0.4, reflecting balanced but growing interest in spot markets.

The aggregate Taker Buy Sell Ratio across all exchanges stood at 1.013, indicating buyers slightly outnumbered sellers. Historical patterns suggest sustained ratios above 1 often precede price rallies. However, analysts caution that rapid shifts in this metric can foreshadow volatility, urging traders to monitor order book depth.

Bitcoin now faces a critical technical hurdle: the 50-day moving average at $98,667. A successful breach of this resistance could propel prices toward $100,000, a psychological threshold last tested in late 2024.

Conversely, failure to hold momentum might trap Bitcoin in a consolidation range between $96,000 and $97,000. The coin’s ability to reclaim this level will likely dictate short-term market direction.

Several factors may explain the surge in buying pressure. Institutional investors appear to be accumulating Bitcoin ahead of potential macroeconomic shifts, including anticipated U.S. interest rate cuts.

Derivatives data also hints at short sellers exiting positions, which can amplify upward price movements. Additionally, renewed discussions about crypto adoption in emerging markets and regulatory clarity in Europe may be bolstering confidence.

Market participants remain divided on Bitcoin’s near-term trajectory. While the Taker Buy Sell Ratio suggests optimism, lingering macroeconomic risks—such as geopolitical tensions and inflation concerns—could temper gains.

For now, the $98,667 resistance serves as a litmus test for bullish resolve. A breakout above this level would mark Bitcoin’s first sustained move beyond its 50-day average since January, potentially reigniting broader market momentum.

As traders await clearer signals, Bitcoin’s recent performance underscores its dual role as both a speculative asset and a hedge against traditional market fluctuations. The coming days will determine whether current buying pressure reflects transient enthusiasm or the foundation of a more durable rally.

The post Bitcoin Buying Pressure Surges as Traders Eye Key Resistance Level appeared first on ETHNews.