- Bitcoin’s on-chain activity lags behind 2021 peaks as ETFs attract $57.5B, reshaping its role as a reserve asset.

- CZ claims Bitcoin’s high fees and slow blocks push investors toward ETFs, decoupling price from blockchain metrics.

Bitcoin’s on-chain transaction volume remains below levels seen during its 2021 peak, sparking debates about the cryptocurrency’s current trajectory. Analysts note that reduced network activity contrasts with rising institutional interest, particularly through exchange-traded funds (ETFs).

My gut feeling is that BTC is now more of a reserve asset and less of a transaction currency due to high fees and long block times. A lot of the new money is buying ETFs, which don’t reflect in on-chain TX. I could be wrong.

— CZ

BNB (@cz_binance) February 16, 2025

Former Binance CEO Changpeng Zhao (CZ) argues this shift reflects Bitcoin’s evolution from a transactional currency to a reserve asset.

CZ attributes the decline in on-chain metrics to ETF adoption.

“BTC is now more of a reserve asset due to high fees and long block times. New money buys ETFs, which don’t show up in on-chain transactions,” he stated.

This aligns with analysis from Fidelity’s Chris Kuiper, who linked empty Bitcoin mempools — queues for unconfirmed transactions — to ETF dominance. Over $57.5 billion in net assets now sit in BlackRock’s iShares Bitcoin Trust (IBIT), per SoSoValue data.

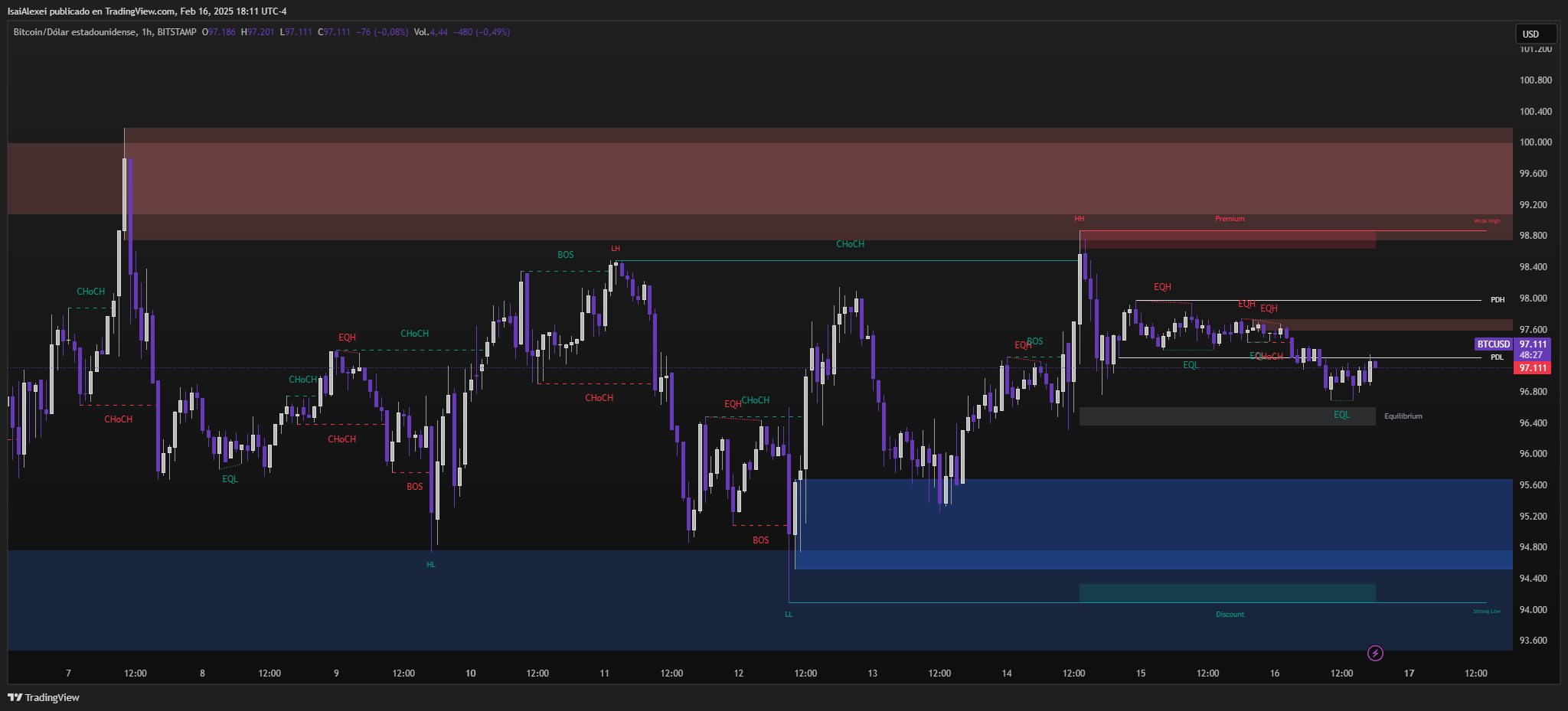

Bitcoin currently trades near $97,190, down from February’s $100,000 level. The cryptocurrency’s volatility recently hit its lowest point since late 2023, prompting speculation about imminent price moves.

While some interpret stagnant on-chain activity as bearish, others view ETF inflows as a counterbalance. Institutional products allow exposure without direct blockchain interaction, potentially decoupling price action from traditional network metrics.

Critics argue that ETF growth could dilute Bitcoin’s decentralized ethos, concentrating holdings among a few custodians. Proponents counter that mainstream adoption necessitates such financial instruments, even if they obscure on-chain visibility.

ETHNEws market observers now watch two factors: ETF flow trends and potential shifts in blockchain usage. A surge in institutional demand could propel prices despite muted retail participation, while renewed on-chain activity might signal broader utility. For now, Bitcoin’s identity remains in flux, straddling the line between digital gold and a transformative payment network.

The coming months will test whether ETF-driven demand can sustain momentum independently or if a resurgence in transactional use becomes necessary for long-term growth. As CZ noted, the market is uncharted — a reality that leaves both optimists and skeptics parsing data for clues.

The post CZ’s Warning: ETFs Are Killing Bitcoin’s Decentralization – Here’s the $100K Secret appeared first on ETHNews.