- Cardano shows potential recovery, trading in an ascending triangle, but faces short-term bearish pressure as RSI and MACD indicate selling momentum.

- Despite a 5.72% drop, ADA’s increased trading volume suggests growing interest, with key resistance levels in focus for potential breakout.

Cardano (ADA) has been recovering recently, showing signs of strength despite previous market turbulence. The token’s price has displayed some resilience as ADA looks to break through key resistance levels in the near future. The token’s performance over the past few months shows shifts in market sentiment, with increasing buying activity pushing prices higher.

Over the past few days, as reported by ETHNews, Cardano’s price has experienced fluctuations, with a sharp downward movement from its peak in early February. Currently priced at $0.7325, ADA is down by 5.72% in the last 24 hours. Despite this, the token has shown potential recovery as it trades inside an ascending triangle pattern. This suggests that ADA may be on the verge of a breakout if it can manage to surpass certain key price levels.

The price action has been marked by periods of stability, especially in the latter part of January and early February. However, recent data points out that market sentiment appears to be shifting positively despite ADA’s price decline.

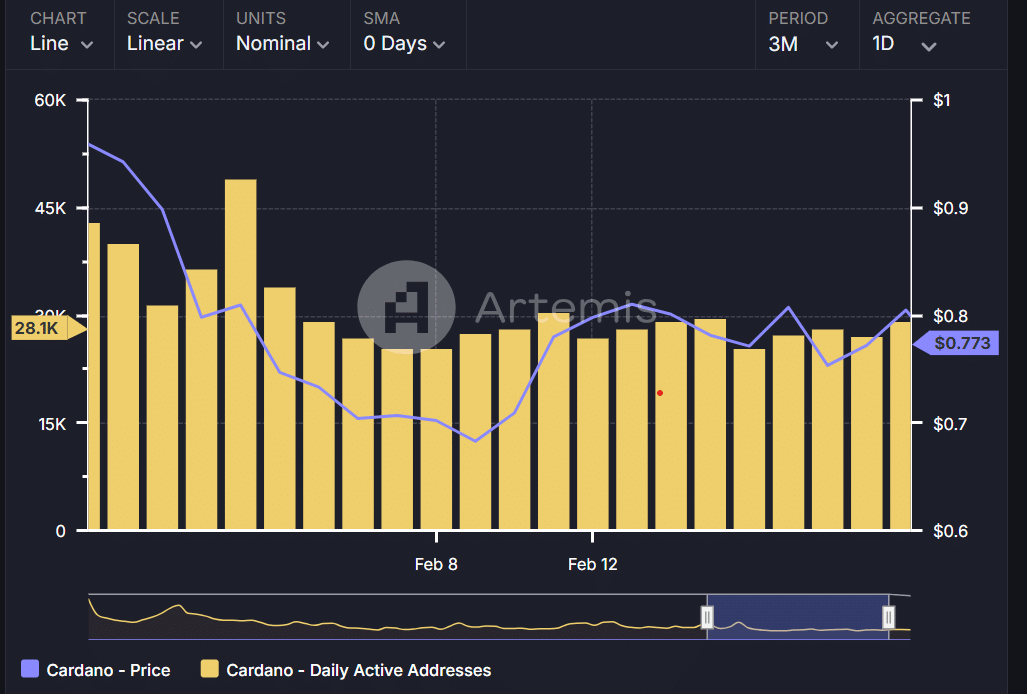

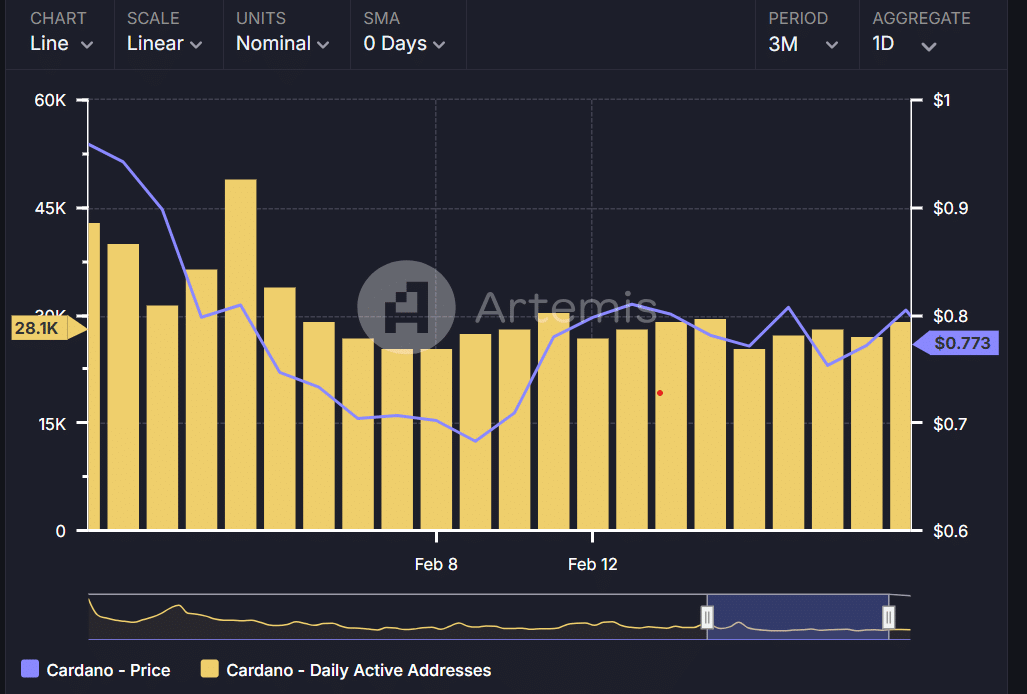

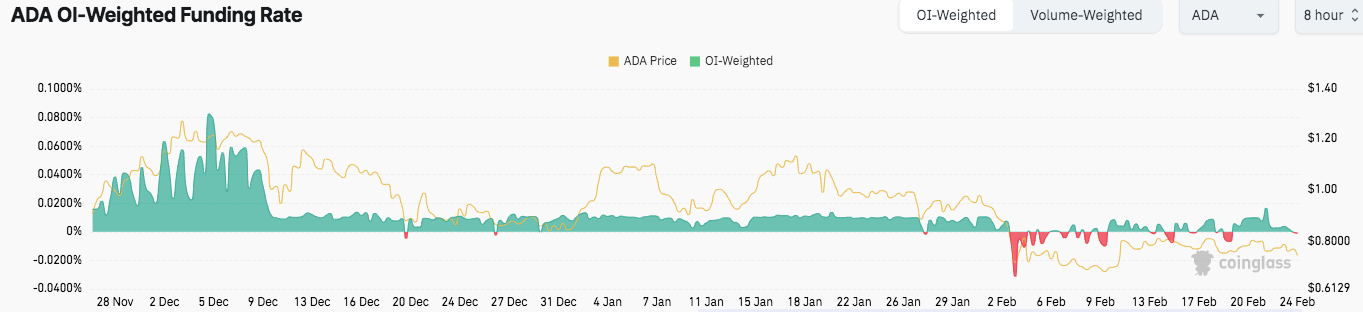

Additionally, the OI-Weighted Funding Rate chart for ADA displays this volatility, with fluctuations in the funding rate coinciding with the price shifts. Increased funding rate spikes signal changing sentiment, with investors adjusting positions amid price movement uncertainty.

Cardano’s Market Metrics and Volatility Indicators

As of press time, Cardano’s market cap stands was at $25.79 billion, recording a drop of 5.71%. However, the 24-hour trading volume has surged by 22.87%, reaching $611.37 million, suggesting growing market interest. The volume-to-market cap ratio is relatively low at 2.36%, indicating moderate trading activity compared to the market cap. ADA’s total supply is 44.99 billion, with 35.2 billion tokens in circulation.

Moreover, Cardano has fluctuated between $0.70 and $0.80 recently, with a notable dip around February 8. This was followed by a slight recovery, bringing the price closer to $0.773. These fluctuations indicate that the market remains volatile, with ADA’s price closely tracking the general market and network activity.

Technical Indicators Point to Potential Short-Term Volatility

Adding to this sentiment, technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) suggest that ADA may face bearish pressure in the short term. The current RSI value of 43.77 is below the neutral zone, indicating selling pressure. If the RSI moves further into the oversold region, this could point to a potential for further declines.

Meanwhile, the MACD also signals a bearish trend. The MACD line is currently positioned below the signal line, and the negative histogram values suggest that the downward momentum may persist. If ADA’s price continues to dip, the momentum could intensify, and a further price decline might follow.

The post Cardano Recovery Accelerates—ADA Aims for This Key Price Level appeared first on ETHNews.