- VeChain’s upgraded tokenomics introduce Staking NFTs, aiming to boost engagement and reward active participants.

- Despite these enhancements, VET’s price remains under pressure, trading at $0.0268 with a 13% weekly drop.

VeChain unveiled a major tokenomics update, “VeChain Renaissance,” which includes new staking mechanisms and rewards and aims to improve reward distribution and network engagement.

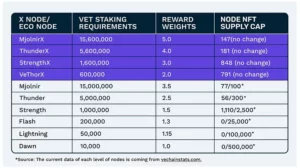

The major change is adding Staking NFT, a new active staking mechanism in which VET holders can be rewarded. In this system, staked VET tokens as Economic Nodes or X Nodes can now be pledged as collateral to create Delegator Staking NFT.

Subsequently, these NFTs can be assigned to Validator Nodes, which grant holders a portion of rewards for producing blocks. This system is set so that staking rewards go directly to contributors of network security.

Additionally, VTHO tokenomics themselves are being reformed. The traditional mechanism of manufacturing VTHO in a constant ratio compared to VET is being replaced by a mechanism in which rewards adjust depending on network usage.

This adjustment will reduce inflation and stimulate a mechanism of deflation, wherein more usage leads to more burning of VTHO. Inflation is expected to be reduced by 72.2% on launch, and in the long term, it is set to maintain between 0.6% and 2.9% based on staking levels.

New Economic Model for VeChainThor

The new releases have a bearing on the staking and governance of the VeChainThor blockchain. The staking limit for validators is now boosted from 25M VET to 600M VET, which allows for greater network contribution.

Conversely, Validators receive 30% of the block rewards, and delegates receive 70%. This adjustment aligns rewards and enhances efforts in decentralization.

To strengthen its network, VeChain is releasing a dynamic gas market, which is replacing a static pricing system with a demand-driven system.

This move will lead to more efficient transaction fees while increasing VTHO consumption. Users can now pay a priority fee (or tip) to expedite transactions, with 100% of these tips going to Staking Nodes as additional rewards.

Meanwhile, VeChain is in the process of developing its platform, VeBetter, which unifies environmental rewards on a platform utilizing the $B3TR token.

The program rewards users for using blockchain, which is an additional source of demand for VET and VTHO. The protocol is of the view that such mechanisms can drive long-term usage and value generation.

VeChain (VET) Struggles at $0.0268 Drops 13%

VET’s market performance is weak. The token is currently trading at $0.0268, reflecting a 13% drop over the past week. This decline aligns with the broader cryptocurrency market downturn.

While there is a short-term drop, market analysts perceive that VET is preparing for a major bounce. Crypto expert Matthew Dixon believes that VeChain’s current corrective action is a wave pattern, which is a precursor for upward momentum.

He views 0.043 as a potential target, considering VET is maintaining its support levels. If bullish momentum continues, the price can go even higher, which is a potential trend change.

Similarly, EGRAG CRYPTO indicates that VeChain is following historical patterns in its action. The token once underwent a 62% pullback before a large rally, and following along in its current trend, VET can potentially see explosive growth.

#VET – History Is Repeating Itself

1⃣Current Price Action

If we take the fractal from the last cycle and apply it to the current price action, we can see a familiar pattern emerging. #VET initially pumped and then retraced around 62%, much like in the previous cycle.… pic.twitter.com/eHCMSx8G3a— EGRAG CRYPTO (@egragcrypto) February 23, 2025

Still, wider market sentiment is destined to play a determinant role in affirming a breakout. Technical-wise, VET is facing major levels of resistance of around $0.03, a point it must regain for a stronger rebound.

If bulls breach this barrier, another major barrier is set between $0.035 and $0.04, which coincides with levels of Fibonacci retracement of historical rallies. Sustained trading above this band can signal a trend change, making traders more optimistic.

To the downside, VET support is now set at $0.025, which in the past has provided buyers with a cushion. If this support is lost, we can potentially see a steeper correction down towards $0.022-$0.023. In this scenario, VeChain’s fundamentals would have to drive new buying interest to prevent further declines.

The post VeChain (VET) Enhances Staking & NFT Utility—Bullish for VET Holders? appeared first on ETHNews.