- Grayscale Investments has filed a 19b-4 form with the U.S SEC to list a Hedera (HBAR) ETF, aiming to provide investors exposure to HBAR.

- Following Grayscale’s HBAR ETF filing, HBAR recorded a 9% surge with investors eyeing more gains once the ETF gains SEC recognition.

American Asset manager giant Grayscale Investment has officially filed for a 19b-4 form with the United States Securities and Exchange Commission to list a Hedera ETF. Notably, this filing was made via Nasdaq Stock Market LLC.

This marks yet another move from the asset manager giant in bringing institutional money into the cryptocurrency market.

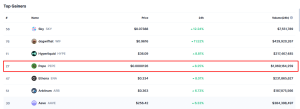

Following the listing, HBAR quickly reacted to the new development surge by a noble 9%. At the time of writing, Hedera’s native token is swapping hands with $0.2282, marking a 25.19% surge in the past week with a $9.54B market cap.

According to the filing, the Grayscale Hedera ETF aims to track the underlying price of HBAR. If approved, this ETF will allow institutional and retail investors to gain exposure to HBAR without the need to hold or manage the asset directly.

A 19b-4 filing is a fundamental component in the approval process for an ETF product. If given the green light, the Hedera ETF will trade on the Nasdaq exchange, similar to Grayscale’s other crypto-based funds.

Speculation points to Coinbase Custody as the probable custodian for the fund, though key operational details remain classified.

In a historical perspective, its important to note that this is not the first HBAR ETF filing to hit the U.S SEC desks. As we earlier mentioned, Canary capitals has also pushed for an HBAR ETF with the regulators. This is a step forward for the growing institutional/retail interest in the Hedera ecosystem.

Grayscale’s Expanding ETF Strategy

Grayscale has invested heavily in being at the forefront of crypto trusts and ETF developments. Its recent filing joins other major cryptocurrencies, including Cardano (ADA), Solana (SOL), and XRP, that are still on regulators ‘ desks.

The company’s confidence in securing these approvals stems from its legal victory against the SEC, which led to a reassessment of Bitcoin ETF applications. This legal win contributed to the eventual approval of spot Bitcoin ETFs in January 2024, followed by Ethereum ETFs shortly thereafter.

Having established a commanding position in the crypto ETF landscape, Grayscale possesses an upper hand in championing the launch of further altcoin ETFs.

Broader Crypto ETF Trends

Amidst Grayscale’s efforts, the SEC is facing a wave of crypto ETF applications. Beyond Bitcoin and Ethereum, firms like Tuttle Capital have filed for Dogecoin (DOGE) ETFs.

Additionally, proposals for memecoin ETFs, such as those related to TRUMP, MELANIA, and BONK, are still under consideration, though their approval has been hindered by the unclear regulatory nature of cryptocurrencies.

While Bloomberg has issued approval odds for ETFs based on XRP, Solana, and Litecoin, the likelihood of memecoin-based ETFs gaining traction remains low.

The post Grayscale Files 19b-4 for Hedera ETF – HBAR Price Surge Incoming? appeared first on ETHNews.