- XRP’s 315% price rise vs. Bitcoin’s 35% growth drew retail and institutional investors via lower entry costs.

- XRP targets $3.80 ATH, $200B market cap; legal clarity and macro factors may aid challenge to ETH, BTC.

Over the past year, Ripple’s XRP has risen by 315%, surpassing Bitcoin and other leading cryptocurrencies in recent performance. Data from the past 60 days shows XRP as one of only three altcoins to achieve positive returns against Bitcoin, which saw an 8.39% decline during the same period.

Is an Altcoin Season on the Horizon?

The Altcoin Season Index recently hit its lowest level since June 2023, reflecting a weak performance of altcoins over the past 60 days. However, this could be seen as an opportunity, as many altcoins have dropped significantly more than… pic.twitter.com/njmKKF8po6

— Alphractal (@Alphractal) February 10, 2025

Between November 2024 and March 2025, XRP’s value increased steadily, while assets like Ethereum, Solana, and Dogecoin fell by 38%, 31%, and 48%, respectively, against Bitcoin. This contrast highlights XRP’s relative stability and growing investor interest.

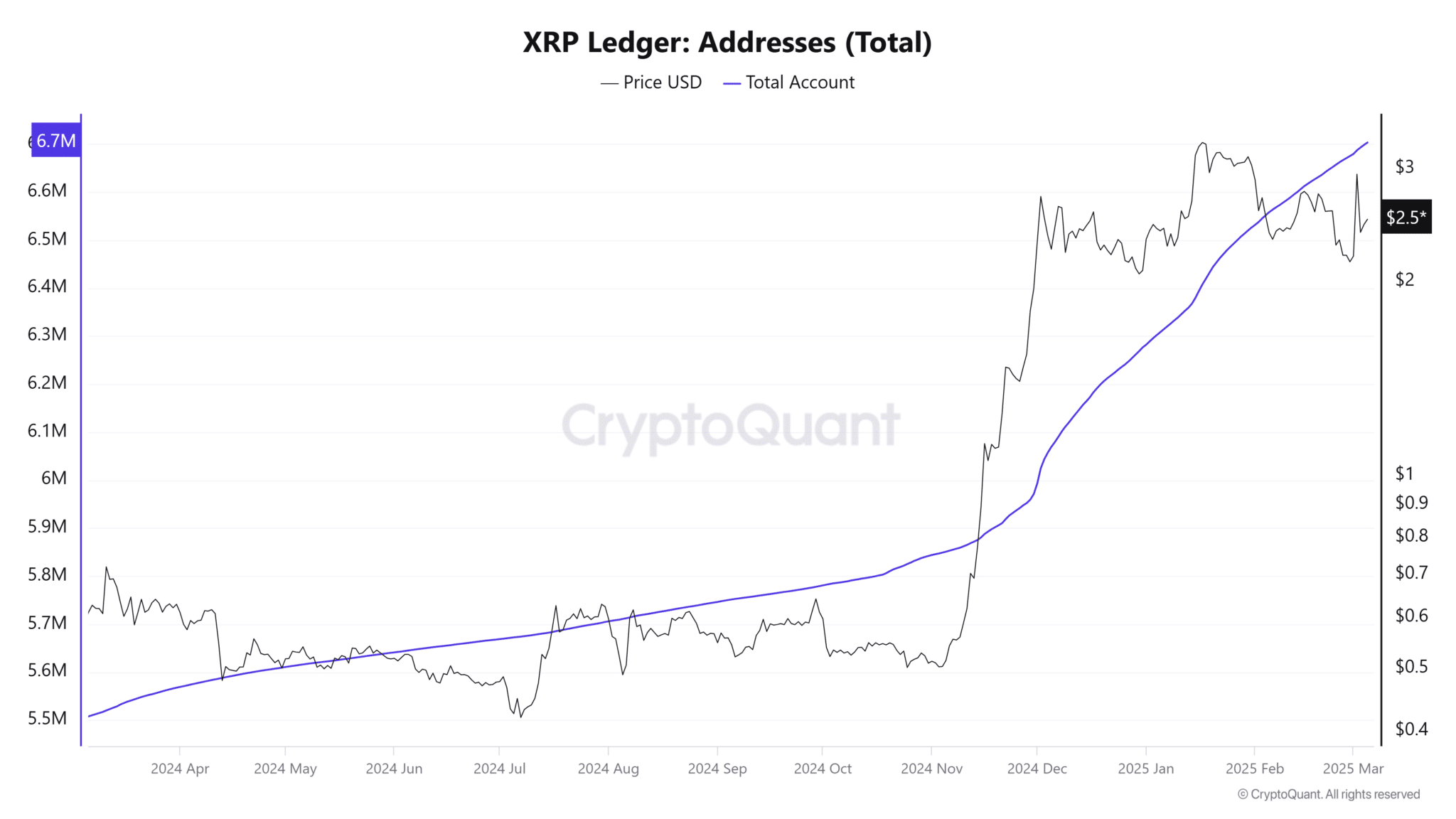

The XRP Ledger (XRPL) added 1.2 million new addresses over the past year, reaching 6.7 million total addresses. Bitcoin’s network, by comparison, grew by 100,000 addresses in the same timeframe. XRP’s circulating market value also expanded from 1.09% to 5% of the total crypto market, with its overall value rising from $23 billion to $188 billion.

XRP’s price increase of 315% in the past year outpaced Bitcoin’s 35% gain. ETHNews analysts attribute this growth to XRP’s lower entry cost compared to Bitcoin, attracting both individual and institutional investors. Bitcoin’s market value grew by 54.5% during this period, reflecting its entrenched position.

While overtaking Bitcoin remains unlikely in the short term, XRP’s trajectory suggests potential to challenge Ethereum’s market position. Legal developments and regulatory clarity could further bolster XRP’s adoption.

Immediate targets include surpassing its all-time high of $3.80 and reaching a $200 billion market value.

ETHNews traders note that macroeconomic factors and regulatory decisions will influence XRP’s ability to sustain its current pace. Achieving these goals may determine whether XRP narrows the gap with Bitcoin or stabilizes as a leading altcoin.

XRP is currently trading at $2.6065, reflecting a 4.26% increase on the day. Over the past week, it has surged 18.56%, though it’s still down 3.63% for the month. The long-term trend remains bullish, with a 400.90% gain over six months and an impressive 340.09% rise over the past year. Despite this, XRP has shown extreme volatility, recently spiking 50% to $3.00 before retracing to its current level.

From a technical perspective, XRP is experiencing a pullback phase after testing resistance near its all-time high (ATH) at $3.40. Current price action suggests a consolidation period, with a symmetrical triangle pattern forming, which could indicate a continuation of the previous uptrend if XRP breaks above key resistance levels.

Fibonacci retracement levels indicate support around $2.25-$2.50, with a critical buying zone at $1.90-$2.00 if a deeper correction occurs. Conversely, a breakout above $2.90-$3.00 could trigger another bullish leg toward $3.40+.

Market sentiment remains mixed. Oscillators are showing neutral momentum, while moving averages are tilted bullish, suggesting potential upside continuation. However, traders should be cautious of profit-taking and liquidity traps, especially given the recent news-driven volatility surrounding XRP’s inclusion in the rumored U.S. Crypto Reserve.

Large whale movements, such as a 95M XRP withdrawal from OKX, suggest accumulation by major investors, which could support price stability in the near term.

Overall, XRP remains in a bullish macro-trend, but short-term price action is likely to be volatile. Traders should watch key resistance at $2.90-$3.00 and support at $2.50-$2.25 for potential breakout or dip-buying opportunities.

The post XRP Outperforms Bitcoin and Major Altcoins Amid Market Shifts appeared first on ETHNews.