Contrary to popular belief, XRP was not originally designed for banks or cross-border payments. It was initially developed to disrupt financial middlemen and empower individuals with a decentralized finance system.

From Bitcoin Alternative to a Peer-to-Peer Payment Revolution

XRP Ledger (XRPL) was developed in 2011 by David Schwartz, Jed McCaleb, and Arthur Britto. Inspired by Bitcoin, the team sought to create a more efficient and scalable digital asset focused on payment use cases.

XRPL was designed to handle fast, low-cost transactions while addressing Bitcoin’s energy consumption and scalability issues. Their intention was to solve some of Bitcoin’s drawbacks by creating a system that supported peer-to-peer payments without relying on mainstream financial institutions.

By June 2012, the XRPL was operational, and subsequently that year Chris Larsen joined the team. Both of them founded OpenCoin in September 2012, which was later rebranded as Ripple Labs Inc.

Ripple’s initial mission was to create a decentralized payment system where individuals and businesses could transact directly, bypassing the high fees and delays associated with traditional financial networks like banks and PayPal.

The Banking Plan: Ripple’s Strategic Shift in 2014

In 2014, Ripple refocused its strategy to work with financial institutions, with the aim of democratizing financial services. The goal was to equip smaller banks with the tools to compete more effectively against established systems like SWIFT.

This transition aimed at equalizing the playing field within the finance sector, using XRPL’s strengths to improve payment infrastructures. Ripple’s focus on banking solutions positioned XRP as a bridge currency for cross-border payments, reducing liquidity requirements and transaction costs for banks and payment providers.

Despite this shift toward institutional partnerships, XRP and XRPL were still designed to promote decentralized finance.

XRPL was built to enable fast, low-cost transactions and to give users more control over their funds. Its decentralized exchange and tokenization features are designed to reduce dependency on centralized financial systems while increasing accessibility for individuals and businesses.

SEC Victory and Trump’s Crypto Push Inspire Market Surge

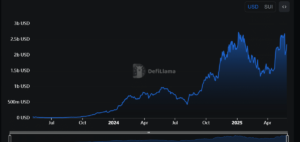

In March 2025, XRP experienced a major price surge after the U.S. Securities and Exchange Commission (SEC) dropped its long-standing lawsuit against Ripple, as previously reported by ETHNews.

The legal battle, which lasted over four years, had created uncertainty around XRP’s status as a security. The resolution drove a significant rebound in XRP’s value, with investor confidence increasing.

Additionally, the Trump administration announced plans to establish a strategic reserve of digital assets, including XRP. This plan reinforced positive market sentiment and fueled further momentum in XRP’s performance.

The post XRP’s Origins: Built to Disrupt, Not Serve, Financial Institutions appeared first on ETHNews.