- Arizona governor blocks crypto reserve bill, creating regulatory uncertainty as Bitcoin faces $1.2B sell-wall near $98,000.

- A $1.2B sell order stalls Bitcoin’s climb to $100K, despite institutional buys from firms like Twenty One Capital.

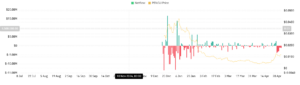

Bitcoin’s price stalled near $98,000 on May 3, 2025, as a $1.2 billion sell order created resistance. Concurrently, Arizona’s governor vetoed a proposed bill allowing state reserves to hold cryptocurrencies, introducing fresh regulatory uncertainty. These developments have heightened market tension, delaying Bitcoin’s potential push toward $100,000.

Arizona’s Crypto Bill Blockade

Arizona’s governor rejected legislation permitting state reserves to allocate funds to crypto assets. The decision reflects ongoing debates over integrating cryptocurrencies into public financial systems. While the governor did not elaborate on the veto, ETHNews analysts link it to caution over market volatility and oversight gaps.

A $1.2 billion Bitcoin sell order, placed near $98,000, has slowed upward momentum. Such large sell orders often indicate profit-taking or hedging by institutional players. Despite steady demand from firms like Twenty One Capital, Bitcoin’s price has struggled to stabilize. Trading volumes dipped 8% in 24 hours, reflecting hesitancy among retail investors.

The Arizona veto amplifies concerns about inconsistent crypto policies across U.S. states. Investors are reassessing exposure to Bitcoin, with some shifting toward stablecoins or commodities. Derivatives data shows a rise in short positions, suggesting bets on further price declines. Market sentiment indices, however, remain neutral, indicating no broad panic.

Security Concerns Highlighted by Bybit Incident

Bybit CEO Ben Zhou recently addressed a platform hack, resolving the breach without customer losses. The event underscored the importance of security protocols in maintaining trust. Exchanges are now prioritizing audits and multi-signature wallets to mitigate risks, a trend likely to influence investor confidence amid regulatory flux.

Bitcoin’s ability to breach $98,000 hinges on absorbing the sell-wall, which requires sustained buying pressure. Regulatory clarity, particularly in states like Arizona, could alleviate market hesitancy. ETHNews analysts note that Bitcoin’s long-term trajectory remains tied to institutional adoption and legislative developments.

Bitcoin (BTC) is currently trading at $96,516 USD, with a recent short-term pullback of -0.49% as it consolidates after a significant rally. Technical indicators suggest a neutral momentum overall, although a “golden cross” pattern on the daily chart signals continued long-term bullishness. In the past month alone, BTC has gained nearly 17%, and over 63% in the last year, suggesting strong performance in broader timeframes.

Short-term traders are eyeing potential corrections down to the $91,000–$94,000 support zone before BTC possibly targets the psychological barrier of $100,000. ETHNews analysts have noted that if Bitcoin reaches around $99.9K, long-term holders may begin to take profits, which could trigger a temporary retracement. Still, sentiment remains bullish with mid-term projections aiming as high as $106,000 if support levels hold.

My exact forecast: BTC will hit $102,800 within the next 7–10 days, barring major macroeconomic disruptions or regulatory shocks.

The post Bitcoin Faces $1.2 Billion Sell-Wall Amid Regulatory Setback in Arizona appeared first on ETHNews.