- Solana is showing signs of a bullish breakout similar to its September 2024 rally, fueled by a surge in meme coin activity and strong technical indicators.

- Now the cryptocurrency is eyeing a golden cross between $190 and $200, which means further upward movement appears likely.

Solana is on the verge of a significant breakout. This uptrend has been backed by a powerful technical pattern, the same signal in September 2024 that triggered a remarkable 70% surge in SOL’s market price within two months.

Notably, the 21- day exponential moving average (EMA) is nearing a bullish crossover above the 200-day EMA.

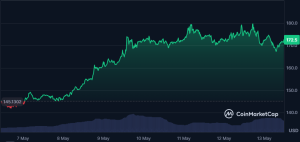

Currently, SOL is swapping hands with $172.60, which marks a 19.59% surge from last weeks market price. Notably, the token’s market cap stands at a strong $89.65B.

Digging deeper, the Solana ecosystem as a whole has oozed out nothing other than explosive price surges that have been highly driven by meme coin resurgence across the broader crypto market.

Tokens like Pudgy Penguins (PENGU), Bonk (BONK), Fartcoin (FARTCOIN), and Popcat (POPCAT) have more than doubled in value over the past month. This has brought the combined market cap to an impressive $14.7 billion, now representing more than 20% of the total meme coin market.

This meme-fueled frenzy has also translated into real growth across Solana’s DeFi landscape. The Solana network now boasts a 16.9% year-to-date increase in its total value locked (TVL), climbing from 45.15 million SOL to 52.78 million SOL.

Decentralized exchange (DEX) trading volumes have surged to $22.8 billion weekly. It goes without saying that these levels have not been seen since mid-February.

It is evident that investor interest in Solana-based including SOL have gone a notch up.

Another factor thats working in favor of the September 2024- like trend is the bullish market sentiment as showcased by data from Coinmarketcap.

Just a month ago, the Fear and Greed Index lingered at a fearful 15. Now, it’s at a solid 73, signaling “Greed” and reflecting a dramatic shift in trader psychology.

Adding fuel to this bullish fire is a weakened U.S. economy in Q1, which raises the likelihood of Federal Reserve rate cuts—typically bullish for risk assets like crypto.

The $180 short-term price target for SOL was technically achieved following a bounce off the 21-day EMA in late April. Further bullish signals are emerging as SOL eyes a golden cross in the $190–$200 area.

Reinforcing this positive outlook, the Relative Strength Index (RSI) is now overbought, and the Moving Average Convergence Divergence (MACD) histogram has been in a positive trend for five consecutive days.

If this golden crossover materializes and mirrors the September 2024 setup, SOL could be on track for another massive leg up. The next short-term target is $212, a key resistance zone from earlier in the year. However, with sentiment and volume both on Solana’s side, a climb to $300 in the coming months is well within reach.

For now, the 21-day and 200-day EMAs serve as critical support levels. A pullback toward these could offer a buying opportunity for latecomers. Though there have been setbacks including unstaked 187,600 Solana (SOL) tokens on May 12 by Alameda Research.

The post Solana’s Bullish Crossover Mirrors September 2024 – Can SOL Replicate 70% Gains in May 2025? appeared first on ETHNews.