- TVL falls 3.26% ($50M outflow), DEX volume drops from $216M to $130M amid profit-taking.

- NFTs drive 109% transaction rise, but liquidity outflows challenge AVAX’s price recovery despite sector growth.

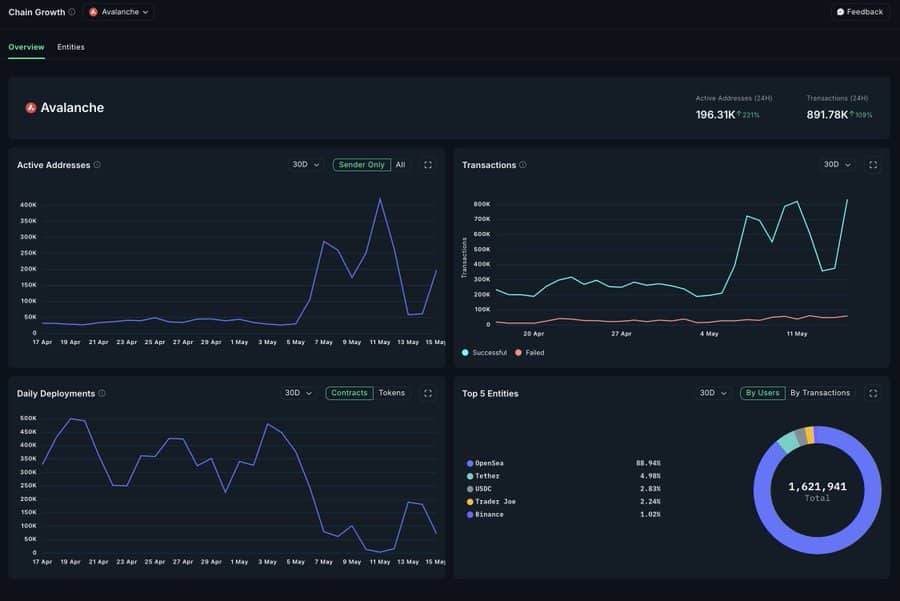

Avalanche (AVAX) traded at $23.66 at press time, down 1.13% over 24 hours, despite a sharp rise in network usage driven by non-fungible token (NFT) transactions. Data from Nansen reveals active addresses on Avalanche jumped 221%, while transaction counts increased 109%, signaling heightened investor engagement.

Approximately 90% of recent transactions linked to OpenSea, an NFT marketplace, according to ETHNews. This aligns with broader sector trends, as NFT applications posted 78% growth over the past month. Increased NFT activity suggests growing niche adoption, though its impact on AVAX’s price remains muted amid broader market conditions.

While user activity climbed, Avalanche’s total value locked (TVL) — a measure of assets deposited in its decentralized apps — fell 3.26% to $1.47 billion. Around $50 million in AVAX exited protocols, indicating profit-taking or reduced confidence. Decentralized exchange (DEX) volumes also dropped from $216 million to $130 million, reflecting weaker trading demand.

The surge in NFT-related transactions highlights Avalanche’s utility in digital collectibles, a sector gaining traction. However, declining liquidity and DEX activity suggest traders remain cautious. For AVAX to rebound, sustained NFT growth must offset outflows, converting user engagement into lasting value.

Avalanche (AVAX) – Price & Technical Analysis – May 17, 2025

AVAX is currently trading at $22.06, nearly flat on the day (-0.10%), after recently rebounding from support around the 20-day EMA ($22.78). While Avalanche is up +23.00% over the past 30 days, it remains underperforming over longer timeframes, showing -33.61% over 6 months and -35.31% year-to-date, confirming a recovery in progress rather than a confirmed breakout.

Technically, AVAX is attempting to form a base around $22–$23, with resistance building at $26.84, the level to watch for a bullish breakout.

A push above that threshold opens the door to $31.73 and $36, while a failure to hold above support may send price toward $20.57. Momentum is stabilizing, and the market awaits further confirmation of trend direction.

From a fundamental view, Avalanche remains an important smart contract Layer 1, with institutional activity increasing. Recent developments include the launch of SolvBTC.AVAX, a yield-bearing RWA-backed Bitcoin asset designed for institutional yield generation, and BlackRock’s sBUIDL integration with Euler on Avalanche, signaling significant DeFi traction.

The post AVAX Price Dips Despite Surge in NFT-Led On-Chain Activity appeared first on ETHNews.