- US firm says NY judge froze $57.6M USDC; Argentine victims credit their Buenos Aires court order.

- Dispute follows collapse of “libra” token, once backed by Argentina’s Milei amid fraud and bribery allegations.

At the center of a legal tug-of-war, two versions conflict over who ordered the freeze of $57.6 million in USDC held in two digital wallets. Burwick Law, a US firm focusing on token disputes, said a judge in the Southern District of New York issued the freeze last week. However, Argentine victims claim they obtained a court order in Buenos Aires that prompted US authorities to act.

At Burwick Law’s office in New York, attorney Tim Treanor posted an update on social media explaining that a federal judge signed a temporary restraining order. Meanwhile, in Buenos Aires, Martín Romeo insisted that he and other plaintiffs filed a request with Argentinian courts back on April 13. He said Judge María Servini sent an official request to US law enforcement, which led Circle to block the funds. Romeo promised to share documents this Thursday to prove his version.

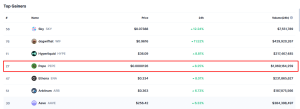

The frozen wallets still hold USDC but can move other assets like SOL and meme tokens. Yet, freezing does not equal recovering. Data expert Fernando Molina pointed out that the money remains out of reach until a court decision or settlement, and that any transaction involving those wallets now requires special approval.

Since February, token “libra” grabbed headlines when Argentina’s president, Javier Milei, publicly backed it. At launch, the token was meant to help small businesses and startups. For example, promoters said the token could provide fast, low-cost transfers for merchants. Consequently, its market value climbed past $2 billion.

However, once large holders withdrew liquidity, the token lost more than 90 percent of its price. After that plunge, Milei withdrew his support and said he never intended to promote investments in the project.

In Argentina, local lawyers filed fraud charges against Milei. In addition, Hayden Davis, CEO of Kelsier Ventures, claimed he paid Milei’s sister to secure the president’s endorsement. Therefore, critics argue the token’s collapse served as a scheme to benefit insiders.

Investigations continue on both sides of the border

Circle, one of the main issuers of USDC, has held the funds in place while courts sort out the conflicting orders. As of now, no party has recovered the frozen assets. Romero and his co-plaintiffs await confirmation from US authorities on the Argentinian request. On the other side, Burwick Law stands by its claim that the Southern District of New York took action first.

In the coming days, documents from Judge Servini’s office should clarify whether Argentinian courts or a New York judge prompted the freeze. Until then, owners of the frozen wallets remain unable to move their USDC, even if they hold other tokens. Overall, this case highlights the complexity of cross-border crypto disputes. In effect, it shows that conflicting legal systems can halt millions without clear resolution.

The post Libra Debacle Deepens: Milei’s Endorsed Token Triggers $57M USDC Freeze appeared first on ETHNews.