- A Digital Commercial Paper, managed by Guggenheim Treasury Services, is now live on Ripple’s XRP Ledger, marking a significant institutional adoption.

- This development, leveraging the XRPL, could substantially boost XRP’s utility and support a bullish outlook for the token.

A significant step for digital assets in traditional finance has just been taken: a Digital Commercial Paper (DCP), a type of fixed-income asset, has been launched on Ripple’s XRP Ledger (XRPL), a public blockchain.

This marks the first native issuance of digital commercial paper on the XRPL, with administration by Guggenheim Treasury Services and tokenisation and management by Zeconomy. This move signals increased institutional adoption of the XRPL, potentially opening new avenues for its use and hinting at a surge in the XRP token’s value.

Modernising Commercial Paper with XRPL

A total of $280 million in Digital Commercial Paper is now being brought onto the XRP Ledger, aiming to modernise the issuance, trading, and integration of commercial paper within global treasury and liquidity ecosystems.

These digital instruments are fully backed by U.S. Treasury Securities that align with their maturities, offering customizable terms of up to 397 days. Due to the strength of this collateral, Moody’s has assigned the DCP a Prime-1 credit rating, which is the highest available for short-term debt.

Investor protection is ensured through issuance by Guggenheim Treasury Services via Great Bridge Capital Company, a bankruptcy-remote special purpose vehicle (SPV). Once issued, the commercial paper is tokenised and managed on the Zeconomy platform.

Giacinto Cosenza, CEO of Zeconomy, highlighted that the platform delivers “institutional-grade modules and a powerful toolkit that brings corporations and traditional finance participants together to solve real-world problems onchain.”

The XRP Ledger enhances this offering with its robust infrastructure for institutional treasury operations and cross-border payments. Since launching in 2012, the XRPL has processed over 3.3 billion transactions without any downtime or security failures, supporting over six million active wallets via a decentralised network of 200+ validators.

Markus Infanger, Senior Vice President at RippleX, remarked that the launch of the DCP on XRPL represents a significant step forward.

Ripple plans to invest in the Digital Commercial Paper, reinforcing its commitment to expanding institutional Real-World Assets (RWAs) on the XRP Ledger. A joint report by Ripple and BCG projects RWA market growth from $600 million in 2025 to $18.9 trillion by 2033. Currently, DCP investments are limited to Qualified Institutional Buyers and Qualified Purchasers.

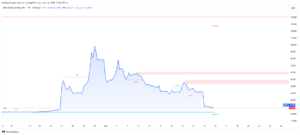

XRP’s Price Holds

The near-term XRP trends remain contingent on legal developments and ETF-related headlines. A break above $2.35 could open the door to retesting resistance at $2.50 and the May 12 high of $2.6553.

A sustained move through $2.6553 may bring $3 and the record high of $3.5505 into play. Conversely, a drop below the 50-day Exponential Moving Average (EMA) could expose the 200-day EMA and the $1.9299 support level. XRP is currently trading at $2.23, down 3.25% in the last 24 hours.

The post Ripple’s Legal Victory Echoes: XRP Adoption Surges with New Guggenheim Partnership appeared first on ETHNews.