- Bulls must reclaim $14.50 then $16.00 to reverse trend; oscillators and moving averages signal strong sell; short-term momentum.

- ETHNews views current drop as Elliott Wave 2 correction; potential rally emerges when correction finds support base; levels.

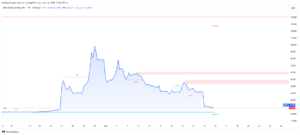

Chainlink (LINK) is trading at $13.17 USD, reflecting a sharp −5.79% drop on the day. Over the last week, LINK has increased slightly by +2.09%, but the broader trend remains decisively bearish: it is down −24.33% over the past month, −34.11% year-to-date, and −54.80% in the past six months.

This positions LINK as one of the altcoins under heavy corrective pressure, despite its strong long-term performance of +222.60% over five years.

Technically, LINK has failed to hold the key $15.30–$15.50 breakout zone, and momentum has sharply reversed. If the current decline extends, the next immediate support sits near $12.50, with a more significant demand level forming around $11.80–$12.00.

On the upside, bulls will need to reclaim $14.50 and eventually $16.00 to resume a bullish trend. Oscillators and moving averages currently flash strong sell signals, confirming short-term downside momentum.

The recent rejection is being viewed by ETHNews analysts as a “wave 2 correction” in a longer-term Elliott Wave structure, suggesting a potential rally could emerge from current levels once the correction finds a base.

The post LINK Loses $15 Breakout—Is $11.80 the Next Crash Zone? appeared first on ETHNews.