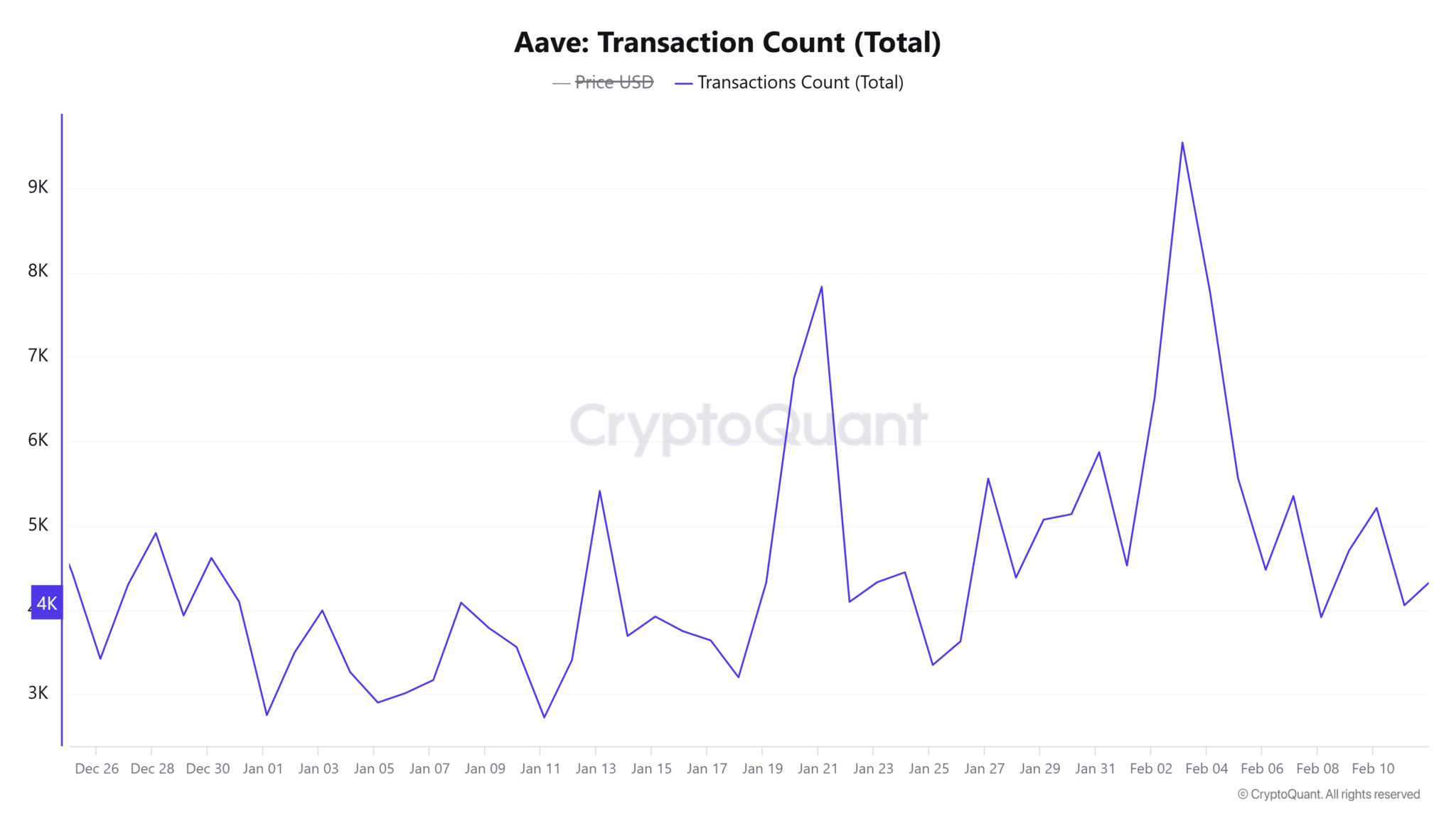

- Active addresses grow 1.5% to 113; transactions up 2% to 5,430, reflecting steady Aave protocol engagement.

- Market watches Bitcoin, Ethereum trends; AAVE’s breakout depends on resistance breaks, network growth, and macro conditions.

Aave (AAVE) has risen 5% in 24 hours, reaching $267.39, amid heightened derivatives activity and improving network metrics. Data from Coinglass shows a 24% jump in open interest to $290 million, reflecting increased trader participation.

ETHNews analysts note that such spikes often precede price volatility, though directional bias depends on broader market conditions.

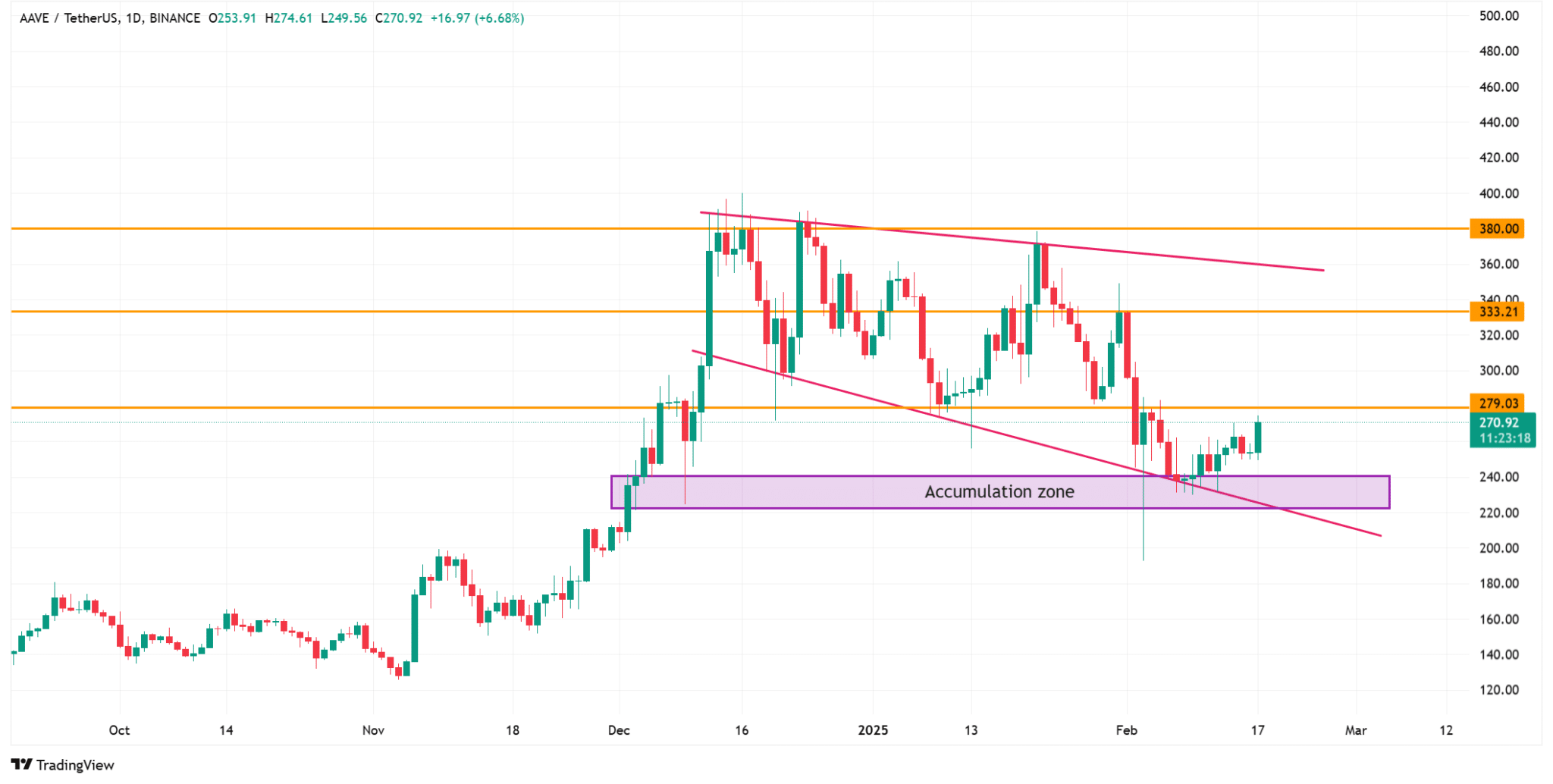

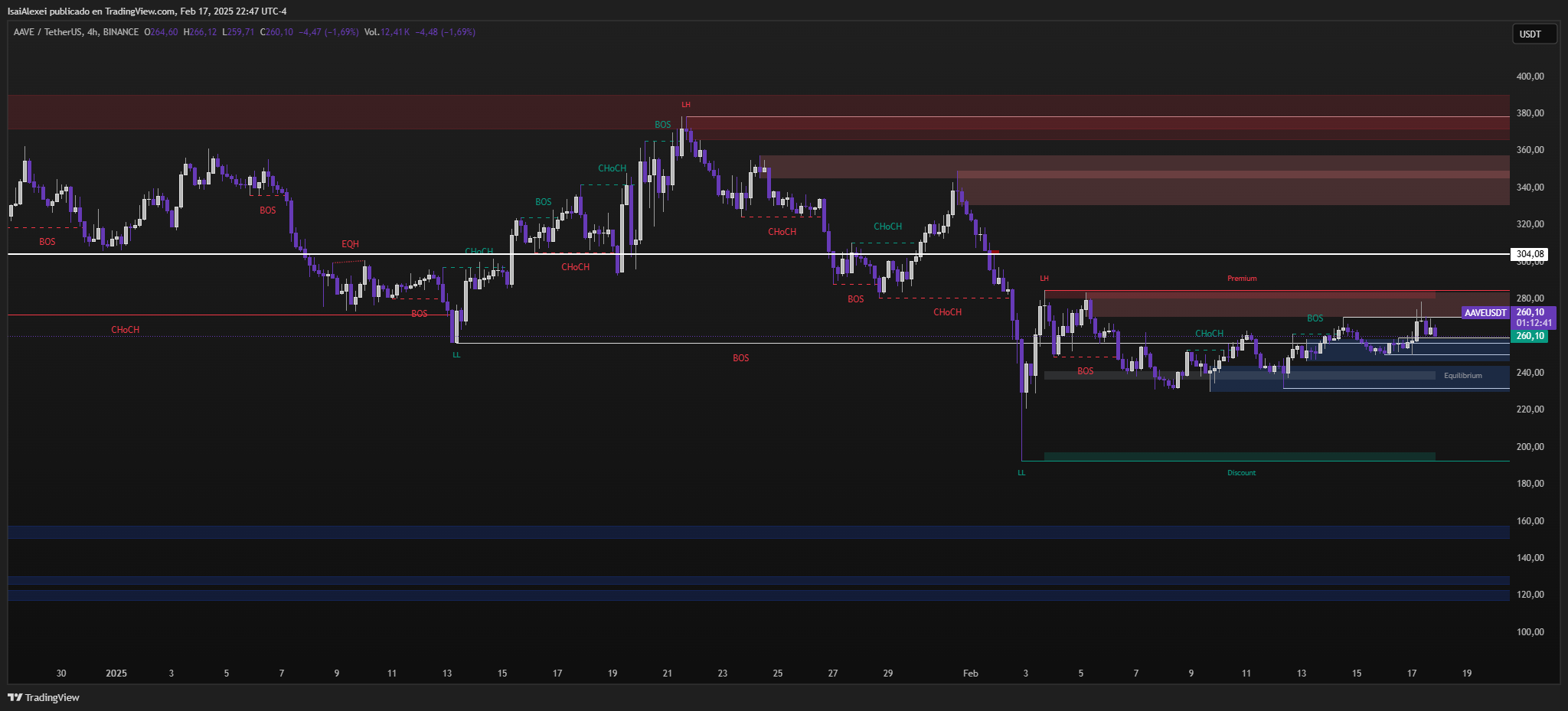

The token now approaches immediate resistance at $270, with subsequent hurdles at $279 and $333. A sustained close above $270 could signal bullish momentum, while failure may prolong consolidation.

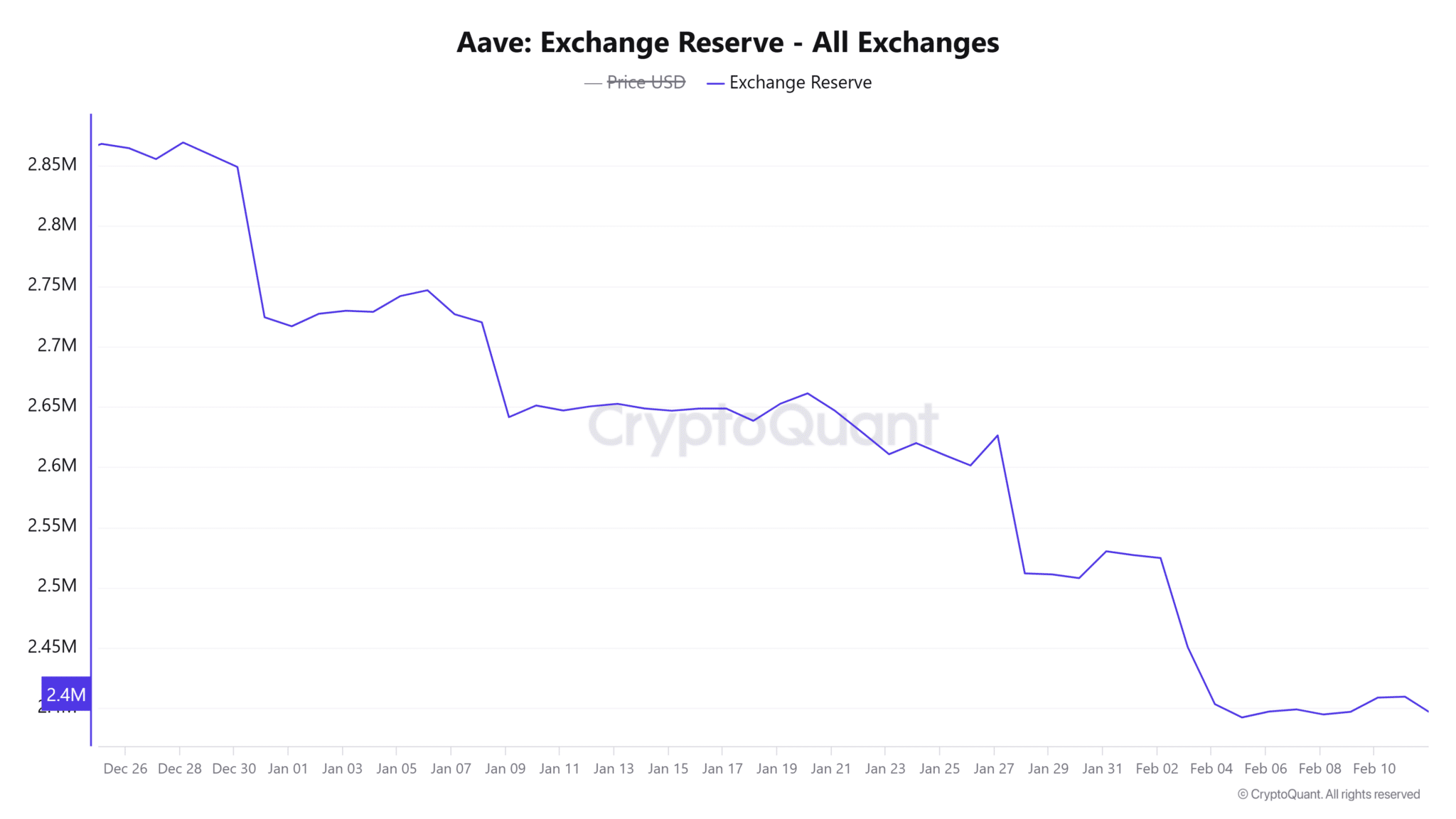

Exchange reserves dipped 0.06% to 2.39 million tokens, suggesting modestly reduced selling pressure. However, reserves remain a critical watchpoint, as inflows to trading platforms often correlate with downside risks.

Active addresses increased 1.5% to 113, while daily transactions rose 2% to 5,430. These upticks, though small, imply steady user engagement with Aave’s lending protocols. The platform’s total value locked stands at $19.6 billion, per DefiLlama, maintaining its position among top decentralized finance projects.

ETHNews market observers link AAVE’s recent performance to improving risk appetite in crypto markets. Bitcoin’s stabilization above $67,000 and Ethereum’s exchange supply have contributed to altcoin liquidity shifts. Yet macroeconomic factors, including interest rate uncertainty, temper overoptimism.

The token’s path hinges on two factors: derivatives market stability and resistance breaches. While rising open interest hints at trader conviction, excessive leverage could amplify corrections. Similarly, network growth must accelerate to justify sustained price gains beyond technical levels.

Aave’s governance token has trailed major peers year-to-date, gaining 32% compared to Ethereum’s 65% rise. This underperformance may attract contrarian bets if broader market conditions hold. Protocol upgrades, including cross-chain expansions and risk parameter adjustments, could further influence demand.

As AAVE tests key price zones, its ability to convert trader interest into decisive momentum remains unproven. The coming sessions will reveal whether current activity reflects speculative positioning or foundational shifts in user adoption.

For now, the token balances between technical promise and the gravitational pull of market-wide caution.

The post AAVE Tests Resistance as Trader Activity and Network Use Climb appeared first on ETHNews.