- Cardano (ADA) whales dump $69 million, triggering fears of a price crash to $0.92 ahead of a December 6 token unlock.

- However, a resurgence of whale buying could ignite a rally, propelling ADA beyond the $1.33 resistance.

Cardano (ADA) is navigating a volatile market as large investors known as whales, have begun to take profits. While the recent price rally was impressive, the upcoming token unlock and potential selling pressure from whales could worsen the situation on ADA’s price momentum.

On Monday, December 2, Cardano’s large holders, also known as whales, exhibited a strong buying trend, with a netflow of 63.58 million ADA. However, according to data from IntoTheBlock, this positive momentum reversed sharply, as the netflow dropped to just 7.62 million ADA, This suggests that whales offloaded 55.96 million ADA, valued at approximately $69 million.

The sell-off is likely tied to the anticipated token unlock scheduled for December 6, which will release 18.53 million ADA worth $22.79 million into circulation. Token unlocks often increase market supply, potentially disrupting the delicate balance of supply and demand, and this event could heighten volatility for ADA.

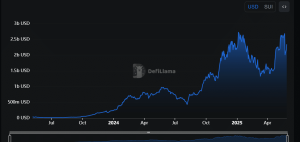

At the time of writing, ADA is swapping hands with $1.23 marking a 0.63% decline in the past 24 hours. On a broader scale, the digital asset has recorded a 22.60% and 268.91% surge in the past week and month respectively.

Additionally, with a 24 hour trading volume of $3.46B, the assets market cap has undergone a 0.75% decline stopping at $42.96B.

Looking at the asset’s technical analysis, Bollinger Bands on the daily chart have showcased heightened volatility, and the Relative Strength Index (RSI) confirms the asset is overextended, with a reading of 82.15representing well above the overbought threshold of 70.

These indicators suggest that ADA may face a price correction, potentially dropping to $0.92. This level is critical as it could signify a significant retracement after the recent rally.

However, the narrative isn’t entirely bearish. Should Cardano whales resume accumulation, the price could pivot and push higher, potentially testing the $1.33 resistance level. Renewed whale interest, coupled with strong market fundamentals, might reignite buying pressure, mitigating the impact of the token unlock.

The upcoming days are pivotal for ADA. The token unlock could lead to short-term turbulence, but it also presents an opportunity for investors looking to capitalize on price swings. Market participants should watch for any changes in whale behavior, as their actions are likely to dictate ADA’s trajectory.

If selling pressure persists, ADA could retrace further, with $0.92 serving as a key support level. Conversely, renewed interest from large holders could act as a catalyst, driving the price past $1.33 and sustaining Cardano’s bullish momentum.

For now, ADA remains under pressure, and all eyes are on the December 6 unlock and subsequent whale activity to determine its next move.

The post ADA Price Faces Pressure: Whale Activity Threatens $0.92, Recovery Hinges on $1.33 appeared first on ETHNews.