- Miners offloading Bitcoin at high prices to cover costs and lock in profits, putting pressure on BTC value.

- BTC resilience shown as dip-buying counters miner sell-off, suggesting potential for hitting new all-time highs.

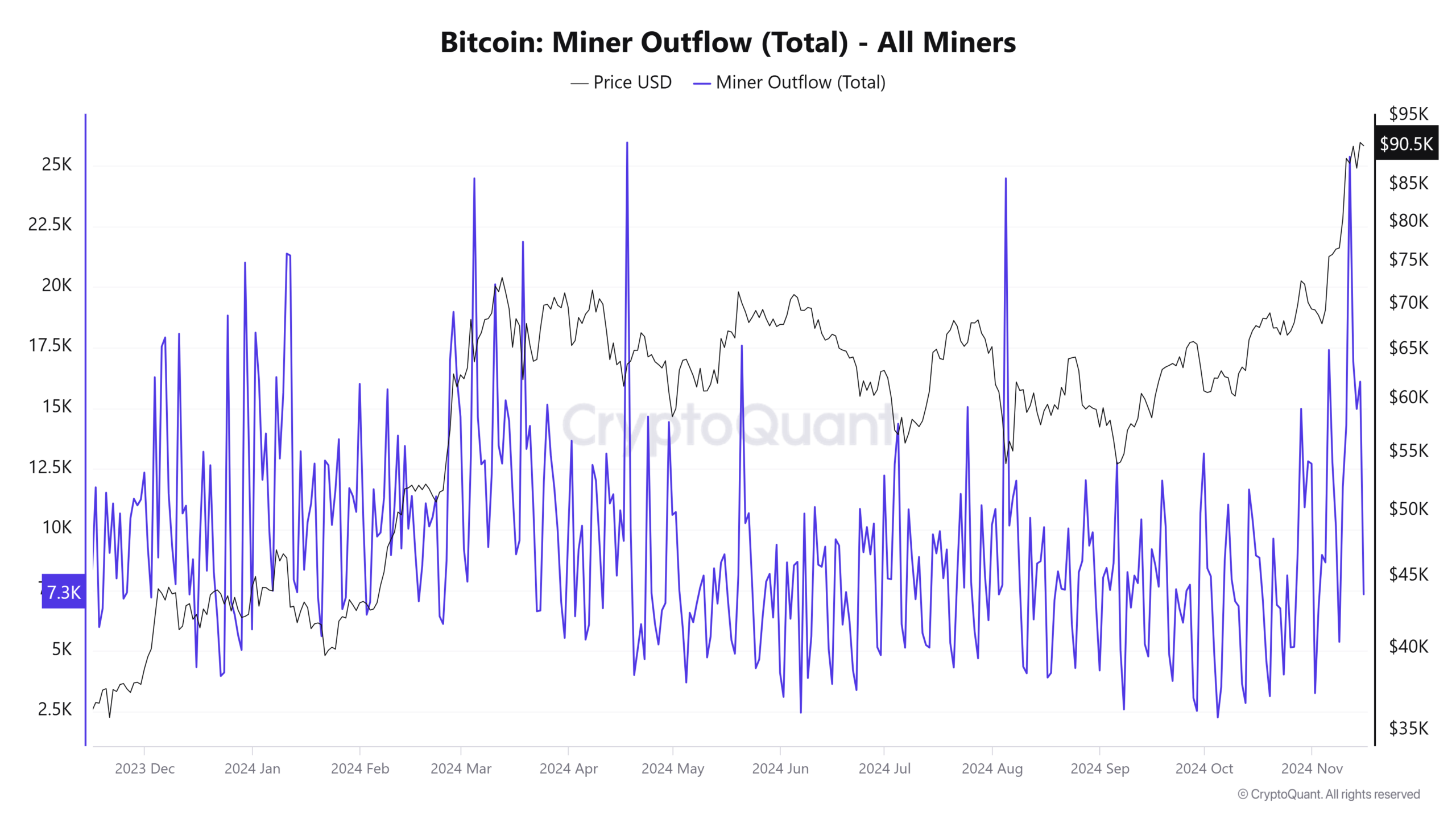

Bitcoin has encountered significant selling pressure from miners aiming to cover costs and secure profits.

Currently, as Bitcoin approaches the $93,000 threshold, the selling by miners has introduced a slight volatility, yet the resilience of bull market participants has been evident, with Bitcoin rebounding to near its all-time high of $91,389.

A miner with 2,000 $BTC($180M) woke up after being dormant for over 14 years and transferred all 2,000 $BTC out today.

This miner earned 2,000 $BTC through mining in 2010 and has held it ever since!https://t.co/PBny3oXw2R pic.twitter.com/Kddhh3YvMY

— Lookonchain (@lookonchain) November 15, 2024

This interplay between miner activity and market liquidity underscores a pivotal moment for Bitcoin. The recent halving event has decreased miner rewards to 3.125 BTC, compounding the financial pressures on miners and prompting them to liquidate part of their holdings to sustain operations.

This surge in selling, particularly noticeable when Bitcoin reaches new highs, poses potential setbacks for its ascent beyond $93,000.

Recent Behavior:

In late October and early November, Bitcoin’s price surged to approximately $90,500 USD. At the same time, there are significant spikes in miner outflow, suggesting that miners are capitalizing on the price rally to take profits.

This pattern indicates potential increased selling pressure if the outflow spikes persist, which could signal a possible price pullback.

Support and Resistance Levels:

- The current price is near a major resistance zone around $90,000 – $95,000 USD. The heightened miner outflow suggests that there could be strong selling pressure at this level, acting as a resistance.

- If a correction occurs, key support levels to watch are $80,000 USD and then $70,000 USD, based on previous price action and inflection points in miner outflow spikes.

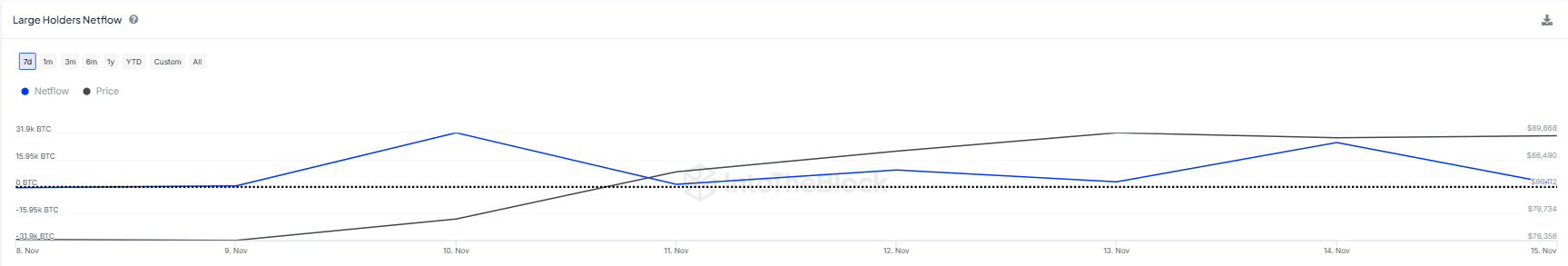

Despite these challenges, the market has seen an influx of liquidity, notably from the issuance of new USDT tokens by Tether’s treasury, suggesting a robust demand for Bitcoin.

This demand is further magnified by speculative interests around big developments such as potential U.S. Federal Reserve rate cuts and the increased flow of capital into Bitcoin ETFs.

These factors collectively help cushion the market against deeper corrections but have yet to prevent minor pullbacks influenced by ongoing miner sales.

The critical question now is whether the market can sustain this bullish momentum amid continuous selling by miners. A concerted effort to purchase dips effectively could propel Bitcoin to surpass its current highs and aim for the elusive $100,000 mark.

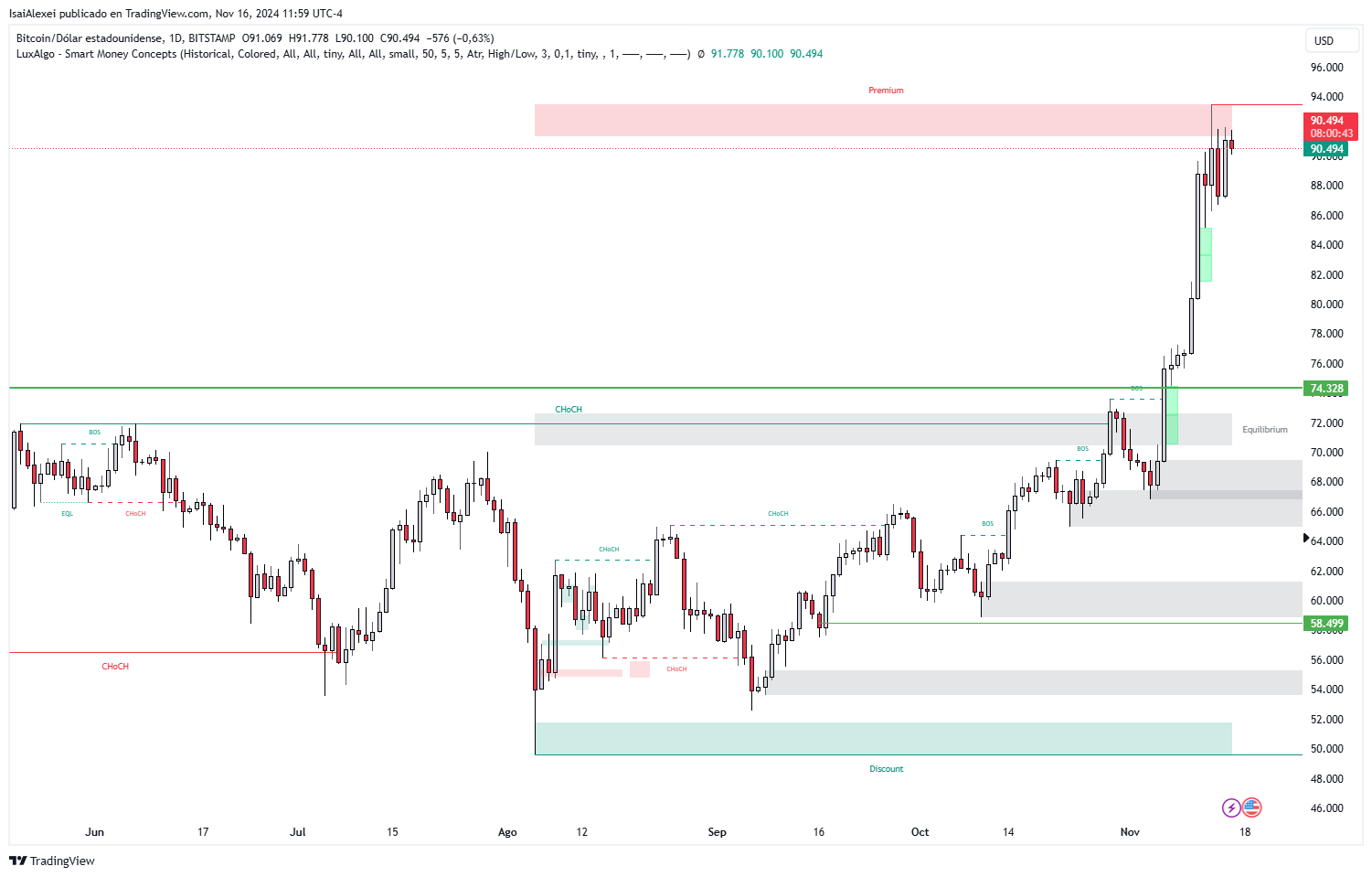

The current price of Bitcoin (BTC) is $90,409 USD, showing a slight decrease of 0.73% today.

- Key Observations:

Price Trend: Despite today’s minor pullback, Bitcoin has seen strong growth with a weekly gain of 18.13% and a monthly rise of 33.77%. Year-to-date, BTC has increased by 114.01%, reflecting significant bullish momentum. - Market Capitalization: The market cap of Bitcoin is $1.79 trillion USD, with a 24-hour trading volume of $62.81 billion USD, indicating high liquidity and active participation from traders.

Technical Analysis

Bitcoin is currently facing resistance near $91,000 USD. A successful breakout above this level could push the price towards the psychological milestone of $100,000 USD. However, if the resistance holds, a retracement towards the support zone around $85,000 USD is possible.

The post Anticipating Bitcoin’s Next Move: Factors Driving the Push Towards $100K appeared first on ETHNews.