- Miner Position Index (MPI) fell to -0.027, signaling reduced selling; exchange transfers plunged from 21,000 BTC to 3,300 BTC.

- Puell Multiple holds at 1.1, indicating miners view current prices as unfavorable for large-scale Bitcoin sales.

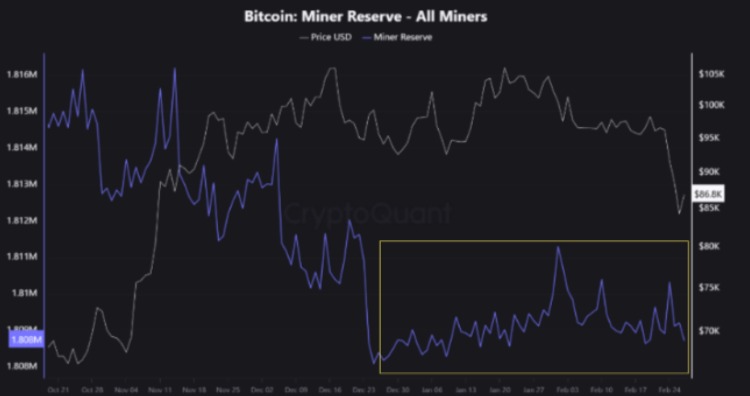

Bitcoin (BTC) fell 7.58% this week, hitting a four-month low of $79,060 before stabilizing near $79,526. Despite the decline, blockchain data shows miners have not accelerated BTC sales, opting to retain reserves accumulated since December 2024.

ETHNews analytics and platform CryptoQuant reports miner reserves—BTC held in mining wallets—remained steady during the downturn. The Miner Position Index (MPI), measuring sell activity against historical averages, dropped to -0.027, signaling reduced selling urgency.

Miner-to-exchange transfers fell from 21,000 BTC to 3,300 BTC over four days, aligning with Bitcoin’s steepest losses.

The Puell Multiple, tracking mining revenue against annual averages, holds at 1.1, suggesting miners view current prices as suboptimal for large-scale selling.

This contrasts with past cycles where miners sold reserves during price peaks to fund operations or secure profits.

ETHNews analysts note that restrained miner selling could ease downward pressure, potentially aiding Bitcoin’s recovery. However, BTC must reclaim $86,000 to establish a sustained rebound. Short-term support lies near $76,800, a level last tested in October 2024.

While miners’ discipline offers a glimmer of stability, broader market sentiment remains the key driver. Their resolve to hold reserves—a rare show of collective patience—adds a thread of resilience to Bitcoin’s otherwise frayed price narrative.

Bitcoin is currently trading at $82,888 USD, showing a 0.77% decrease in the past 24 hours. Over the past week, the price has dropped 13.64%, and in the last month, it has fallen by 18.23%. Despite this recent decline, Bitcoin has increased by 32.60% over the past year.

The price of Bitcoin reached a peak of $109,356 USD on January 20, 2025, but has since experienced a significant drop of over 26%, falling to its current price. The market sell-off has been triggered by negative sentiment and a broader market correction.

The post Bitcoin Miners Retain Holdings Despite Price Drop to 4-Month Low, Reducing Sell Pressure appeared first on ETHNews.