- Kiyosaki predicts Bitcoin could reach $200K this year, but warns fear of mistakes will hold many back.

- Kiyosaki urges investors to embrace risk with Bitcoin, seeing it as the greatest wealth opportunity in history.

Robert Kiyosaki, the bestselling author of Rich Dad Poor Dad, has long been a vocal advocate for Bitcoin, describing it as the “biggest opportunity” in history. Despite his optimism, he cautions that many people will miss out on Bitcoin’s potential rally due to the psychological barrier of the fear of making mistakes (FOMM).

Kiyosaki believes Bitcoin could soar to $200,000 by year-end but warns that hesitation and caution will keep many from making life-changing investments. His insights not only highlight Bitcoin’s potential but also the common mistakes investors make that prevent them from achieving financial success.

Bitcoin’s Impressive Potential and Kiyosaki’s Bold Prediction

Robert Kiyosaki has been unrelenting in endorsing Bitcoin as a game-changing financial asset. The financial commentator recently claimed that Bitcoin is “the biggest financial opportunity” in history.

According to Kiyosaki, Bitcoin’s potential far outweighs that of traditional investments like stocks and real estate. He has even suggested that it could surpass $200,000 by the end of the year, a staggering 130% increase from its current price.

Kiyosaki’s optimism is backed by his belief that Bitcoin represents a new form of wealth creation. He credits Bitcoin with helping him build his wealth and asserts that it will continue to rise as more people recognize its value.

However, he also points out that many investors, particularly those conditioned by traditional financial advice, are likely to miss out on this opportunity. Kiyosaki warns that these individuals will wait until BTC hits $200,000 to deem it “too expensive” to buy, ultimately missing the chance to invest at lower prices.

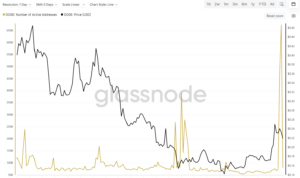

The cryptocurrency’s performance has remained relatively stable in recent weeks, with Bitcoin hovering between $80,000 and $87,500. However, the market has experienced volatility, with recent market manipulation and the upcoming U.S. tariffs adding uncertainty. These factors have kept Bitcoin’s price from breaking above $87,500 despite high optimism among long-term holders.

FOMM: The Psychological Barrier Holding Investors Back

One of Kiyosaki’s central arguments revolves around the psychological phenomenon known as the fear of making mistakes (FOMM). According to Kiyosaki, FOMM is the primary reason why many individuals avoid making high-reward investments like Bitcoin. This fear often leads people to be overly cautious, relying on outdated financial systems or traditional assets that promise slower, more predictable returns.

Kiyosaki likens FOMM to a baby learning to walk: “How does a baby learn to walk if they do not fall? They would never walk and crawl all their lives.” He believes that investing in Bitcoin is akin to taking the first steps toward financial freedom. Those unwilling to take calculated risks may never experience the wealth-building potential Bitcoin offers.

Additionally, Kiyosaki points to the influence of Wall Street and conventional financial education, which prioritize caution and discourage taking risks. According to Kiyosaki, these conservative attitudes are largely to blame for why many investors stay trapped in the middle or lower classes.

The Bigger Picture: Global Economic Risks and Bitcoin’s Role

Beyond Bitcoin’s price movements, Kiyosaki also warns of a looming global financial crisis, as ETHNews discussed earlier. He attributes the potential for a market collapse to governmental mismanagement, inflation, and the unsustainable U.S. national debt. In this context, he believes Bitcoin offers a haven for those seeking to protect their wealth from the weakening traditional financial system.

Kiyosaki urges his followers to diversify their investments by adding not only Bitcoin but also gold and silver to their portfolios. He views these assets as crucial protection against inflation and the devaluation of the U.S. dollar. With traditional monetary systems under increasing strain, Kiyosaki believes that BTC could be the key to securing financial freedom in uncertain times.

In his previous statements, Kiyosaki predicted Bitcoin could eventually hit $1 million per coin before the end of the decade. While some analysts have questioned whether Bitcoin’s current bull cycle is over, Kiyosaki maintains a long-term view, asserting that its value will continue to climb as more investors flock to it.

The post Bitcoin Rally to $200K? ‘Rich Dad Poor Dad’ Author Explains What Could Go Wrong appeared first on ETHNews.