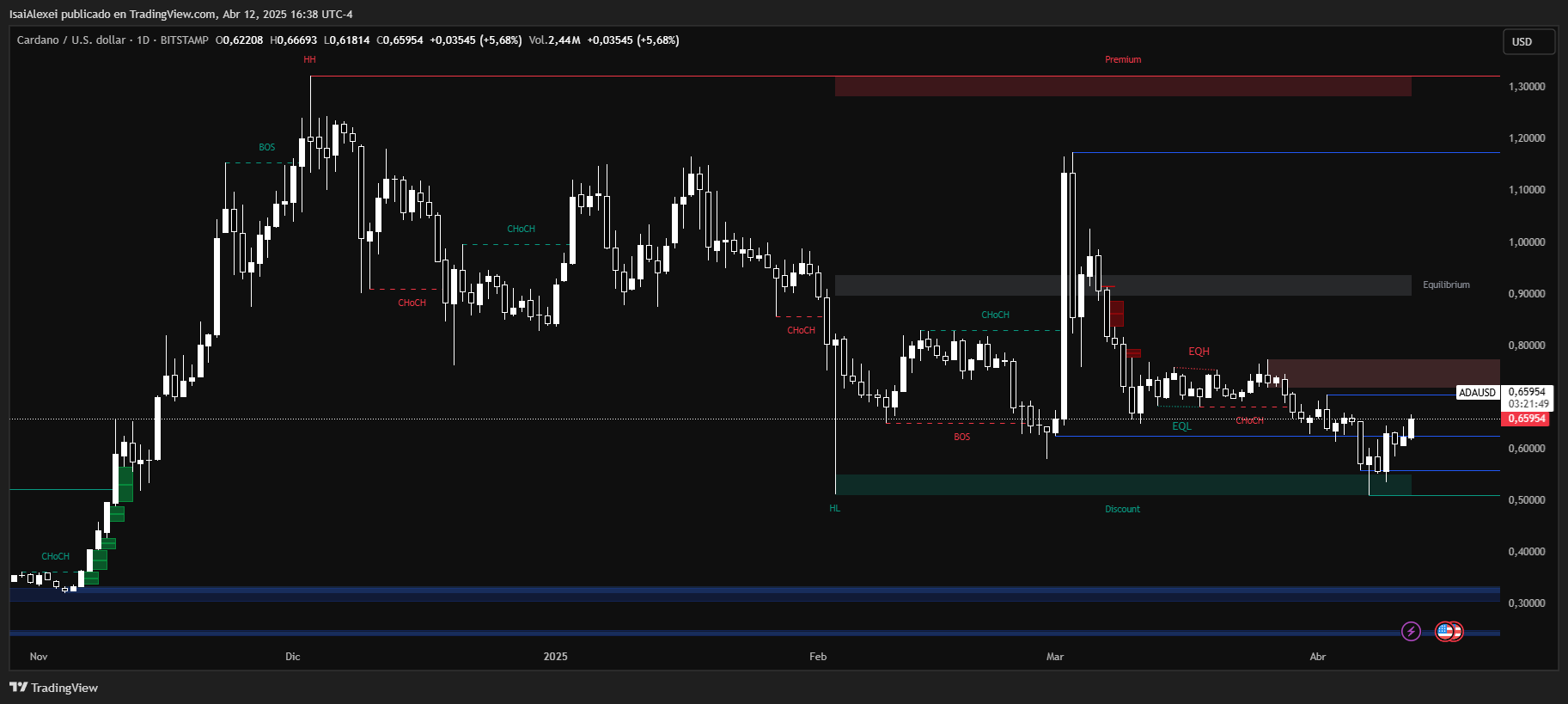

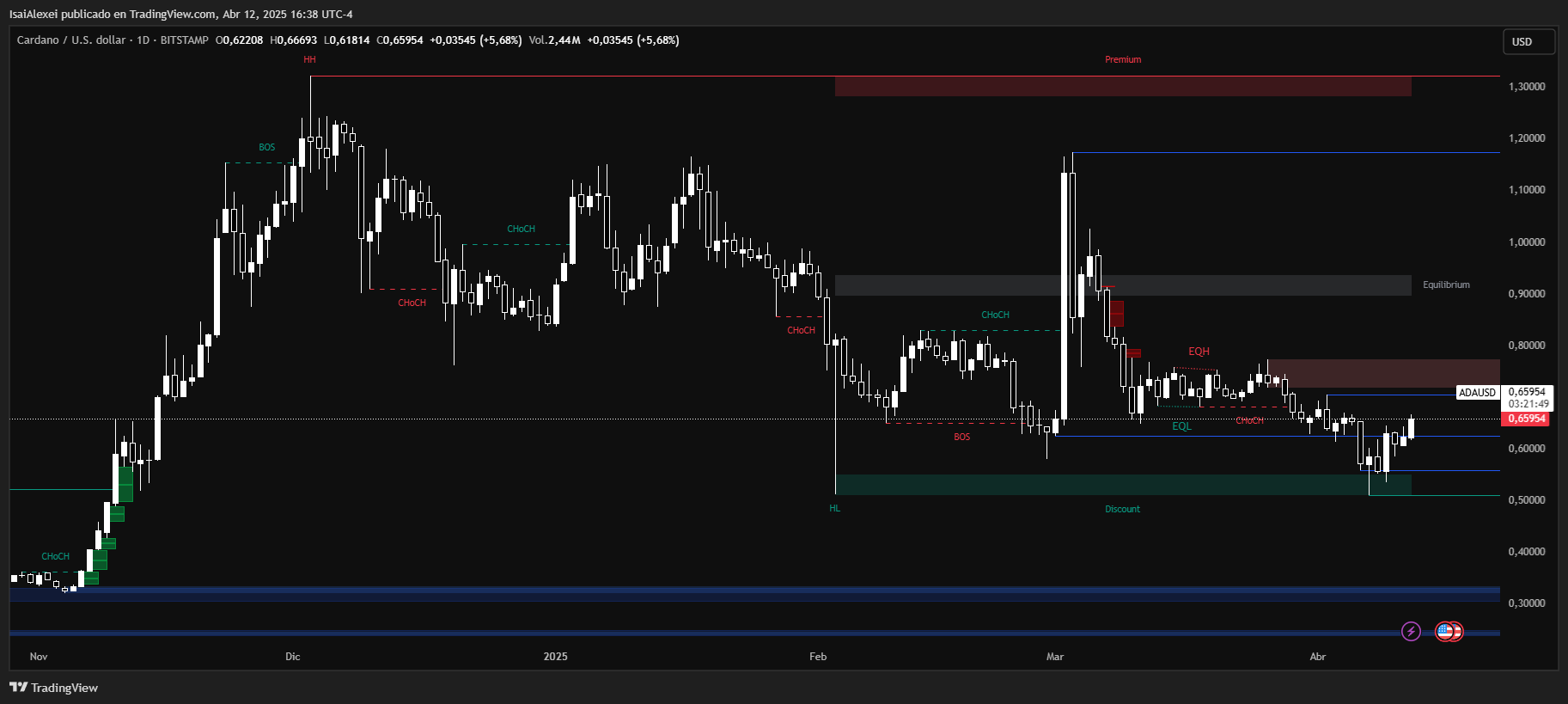

- Cardano reclaimed $0.62 and may reach $0.705 if it breaks through resistance between $0.69 and $0.71.

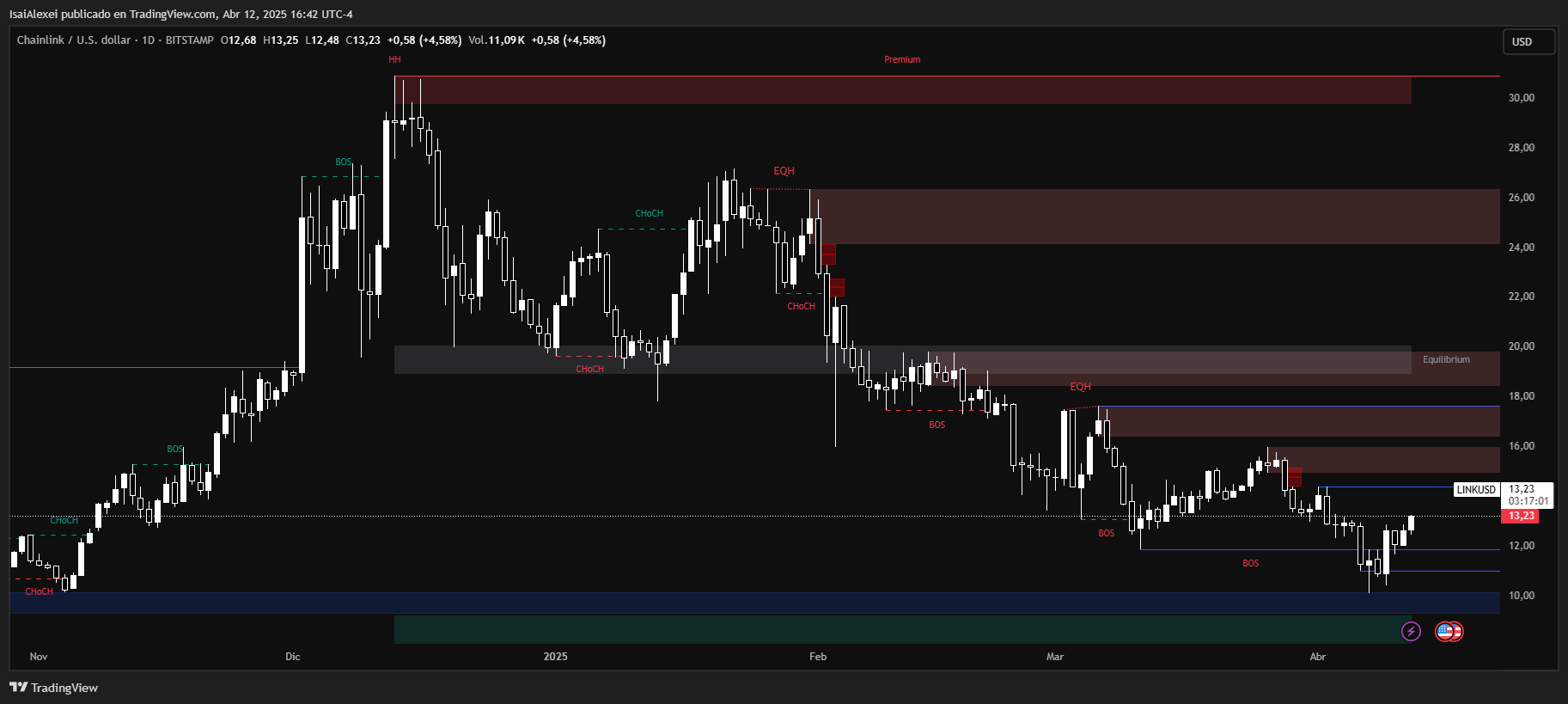

- Chainlink is testing $13.50; a breakout with volume could lead to $14.20 in the coming trading sessions.

- Avalanche bounced from $19 and is targeting $21.50 to confirm momentum toward the $22.75 projected level.

Three crypto—Cardano (ADA), Chainlink (LINK), and Avalanche (AVAX)—showed upward moves over the past 24 hours. Despite broader downward pressure through 2025, each token is approaching short-term resistance areas that may define their next directional steps.

Cardano is priced at $0.6565 after gaining 5.24% in a single trading session. Even with that move, ADA is still down 22.23% in 2025, although it remains 88.23% higher over the past six months. The asset recently recovered the $0.62 level, a zone now viewed as a potential short-term base. Analysts remain divided.

Traders consider the current range to align with a Wyckoff accumulation pattern, where steady buying below resistance may support a breakout.

Others point to the potential for a head-and-shoulders formation, which could trigger a deeper pullback if the neckline breaks. Momentum indicators, including RSI and MACD, are positioned between neutral and slightly bullish territory.

Volume has grown during the latest recovery, adding weight to a possible upward continuation. ADA is nearing resistance between $0.69 and $0.71. If price clears that range and holds, a move toward $0.705 is projected in the next four trading days, assuming support at $0.56 remains intact.

LINK is trading at $13.11, up 3.70% in 24 hours. However, the token remains under a broader downtrend, with a 34.38% loss year-to-date and 25.33% decline since last April. A recent recovery from the $12.50 support zone marks a brief attempt to reestablish upward pressure.

LINK is testing the lower end of a past downtrend channel, with key resistance set near $13.50. If LINK pushes through this range with rising volume, price targets extend to $14.20 and possibly $15.10.

Current RSI readings suggest mild bullish momentum, and a moderate volume increase supports the idea of accumulation. A failure to hold above $12.70 could bring a return to $11.58, where buyers have previously entered.

For the short term, LINK may reach $14.05 within the next four days, provided it sustains levels above $12.90 and breaks through $13.50 cleanly.

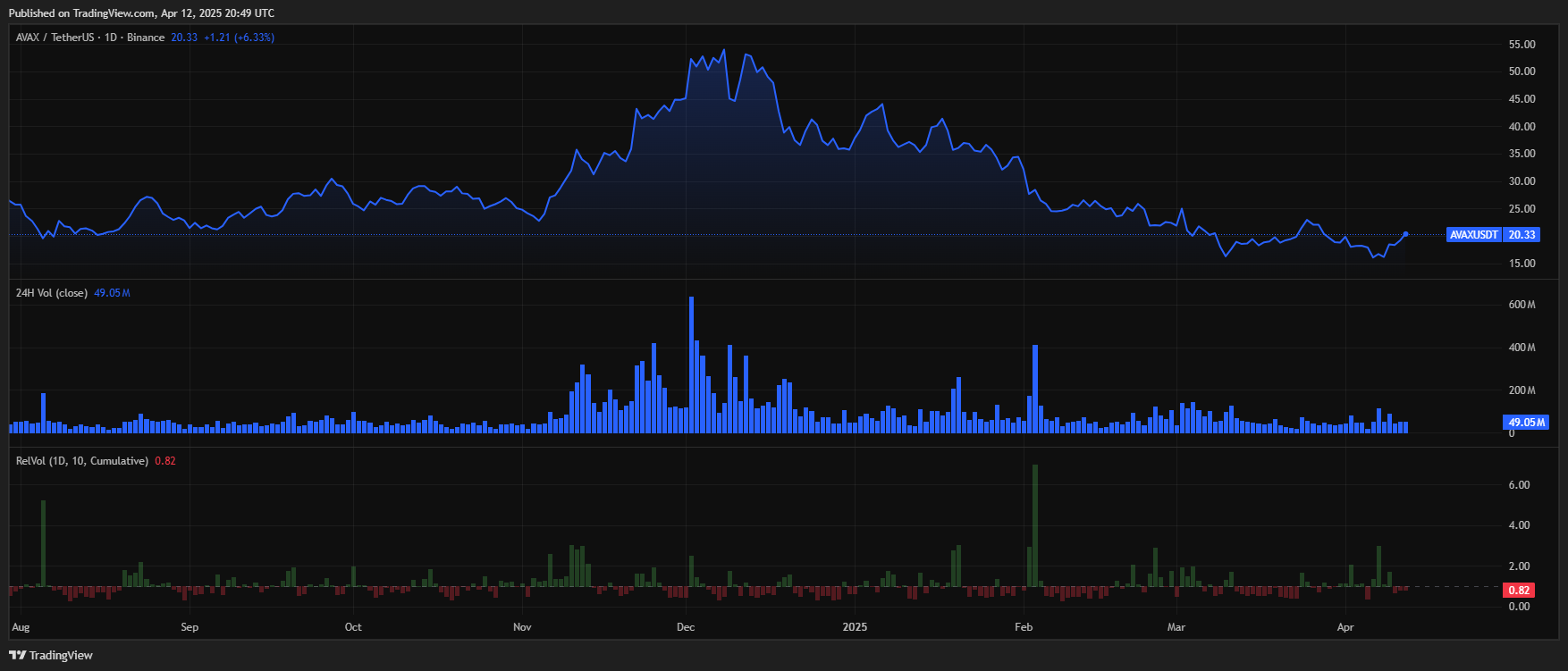

Avalanche is priced at $20.19 after gaining 5.60% on the day and 11.17% over the past week. Despite these recent moves, the token continues to reflect a downtrend with a 43.31% year-to-date decline and 56.11% drop over the past twelve months.

Recent price action shows AVAX bouncing from below $19, an area that acted as a key technical floor. It is now approaching resistance near $21.50, with another barrier at $24.00.

Volume has picked up in tandem with the price rise. RSI values are climbing, and early moving average crossovers on short timeframes support a short-term bullish stance.

A push past $21.50, with strong confirmation, could set up a rally toward $22.75 within 4 to 6 days. This depends on maintaining the $19.80 level as a floor. A drop below that could reactivate sellers, with targets between $17.00 and $16.00.

The current price behavior of ADA, LINK, and AVAX is driven by technical thresholds, short-term volume patterns, and recovery attempts from recent lows. These tokens, while recovering in the last 24 hours, remain under yearly losses.

Their short-term direction now depends on whether they can clear resistance zones and hold recently reclaimed support levels without reversal.

The post Cardano, Chainlink, and Avalanche: Traders Monitor Breakout Zones After Brief Daily Gains appeared first on ETHNews.