- Binance, Bybit, and Bitget plan to launch liquid staking tokens on Solana, diversifying DeFi activities.

- New tokens like BBSOL, BGSOL, and BNSOL will allow users to earn returns while securing the blockchain.

Binance, the world’s largest cryptocurrency exchange by trading volume, is set to launch a liquid staking token (LST) on the Solana blockchain, aligning with other exchanges to tap into the expanding market.

This follows increased activity and interest within Solana’s liquid staking ecosystem, positioning major industry players to capitalize on emerging opportunities.

BNSOL

— Binance (@binance) August 29, 2024

On Thursday, Binance, Bybit, and Bitget hinted at plans to introduce new liquid staking tokens on Solana’s blockchain through cryptic announcements. Bybit’s token will be known as BBSOL, Bitget’s as BGSOL, and Binance will use BNSOL as the ticker for its LST.

“BBSOL will serve as a bridge between Bybit’s centralized exchange (CEX) and Web3 platforms, providing users with consistent and reliable rewards. By staking Solana (SOL) on Bybit Web3, users receive BBSOL tokens, unlocking a wealth of earning opportunities across Bybit’s CEX and Web3 products,” Bybit shared.

These tokens will allow holders to earn returns on their Solana (SOL) holdings while engaging in decentralized finance (DeFi) activities such as lending and borrowing, and concurrently contributing to the security of the blockchain through staking.

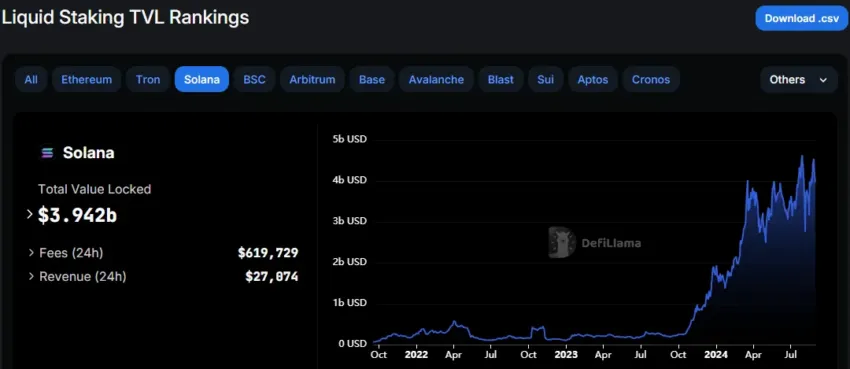

The liquid staking market for SOL has seen substantial growth in 2024, with its total value locked (TVL) more than doubling from $1.9 billion to $3.94 billion. Since its inception in 2021, this sector has shown robust growth, attracting a big number of traders.

Despite this impressive expansion, the $3.9 billion in TVL only represents 9.6% of the $42.5 billion locked across all liquid staking protocols. According to the latest ETHNews report, Ethereum continues to dominate the market, holding an 83% share.

Liquid staking protocols are increasingly popular because they merge contributions to network consensus security with financial flexibility, making them a compelling option for savvy investors looking to maximize returns.

Here’s why $CLOUD will no longer be :CLUD: @MaglDaron

1. #bnSOL – @binance ‘s LST, potentially adding $3B USD worth of $SOL in @sanctumso TVL. That’ll bring potentially a 55.48% increase in TVL, once native staked are converted to LSTs.

2. Other Exchange LST announcements… pic.twitter.com/ZFmbHglruS

— Jae Sik Choi (d/acc) (@0x_JaeThorn) August 29, 2024

For exchanges, launching LSTs creates a new revenue stream as these tokens enhance their product offerings. Stakers earn rewards, while exchanges earn fees.

For instance, Binance charges a 10% commission on Ethereum staking rewards with its BETH, the third-largest LST by market capitalization, which covers operational costs including hardware and network maintenance for validator nodes.

Furthermore, tokens like BNSOL, BBSOL, and BGSOL allow exchanges to keep Solana balances on their platforms, potentially increasing their control over transaction validation and network influence.

The post Could Solana’s New Staking Tokens End Ethereum’s Dominance? appeared first on ETHNews.