- President Trump’s executive order includes “strategic crypto reserve,” sparking debate among cryptocurrency enthusiasts.

- Despite political controversies, trading volumes for XRP remain stable at 23.66M, indicating sustained investor interest.

In recent developments in the cryptocurrency sector, XRP has demonstrated resistance despite political controversies. On January 23, President Donald Trump signed the executive order titled “Strengthening American Leadership in Digital Financial Technology”. This directive includes plans for a “strategic crypto reserve”, a concept that has stirred considerable debate within the cryptocurrency community.

Critics, particularly from the Bitcoin community, have voiced concerns that the language of the order should have specified a reserve solely for Bitcoin, thus excluding other digital currencies like XRP. These critics have accused Ripple, the company behind XRP, of using political influence to shape the executive order’s language in its favor.

The biggest obstacle for the Strategic Bitcoin Reserve is not the Fed, Treasury, banks, or Elizabeth Warren.

It’s Ripple/XRP. They are aggressively lobbying against the SBR by throwing around $millions at politicians, desperately trying to derail it.

They did the same to…

— Pierre Rochard (@BitcoinPierre) January 23, 2025

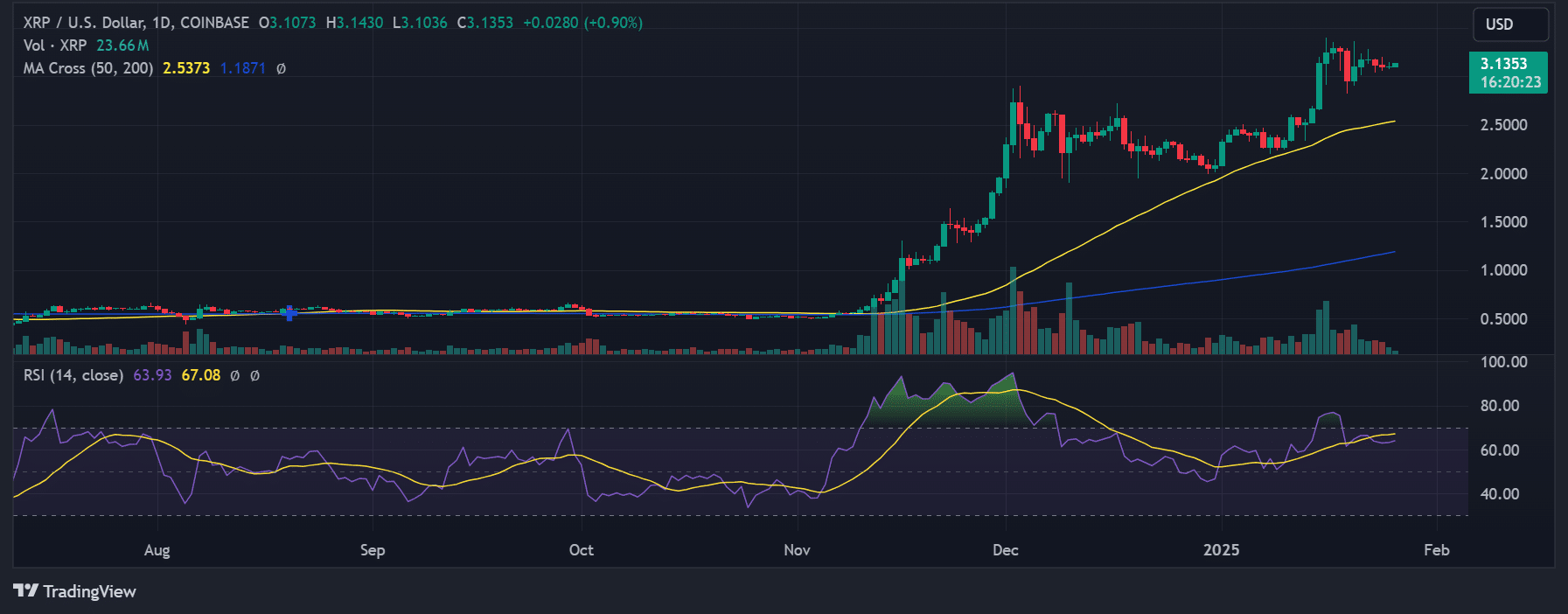

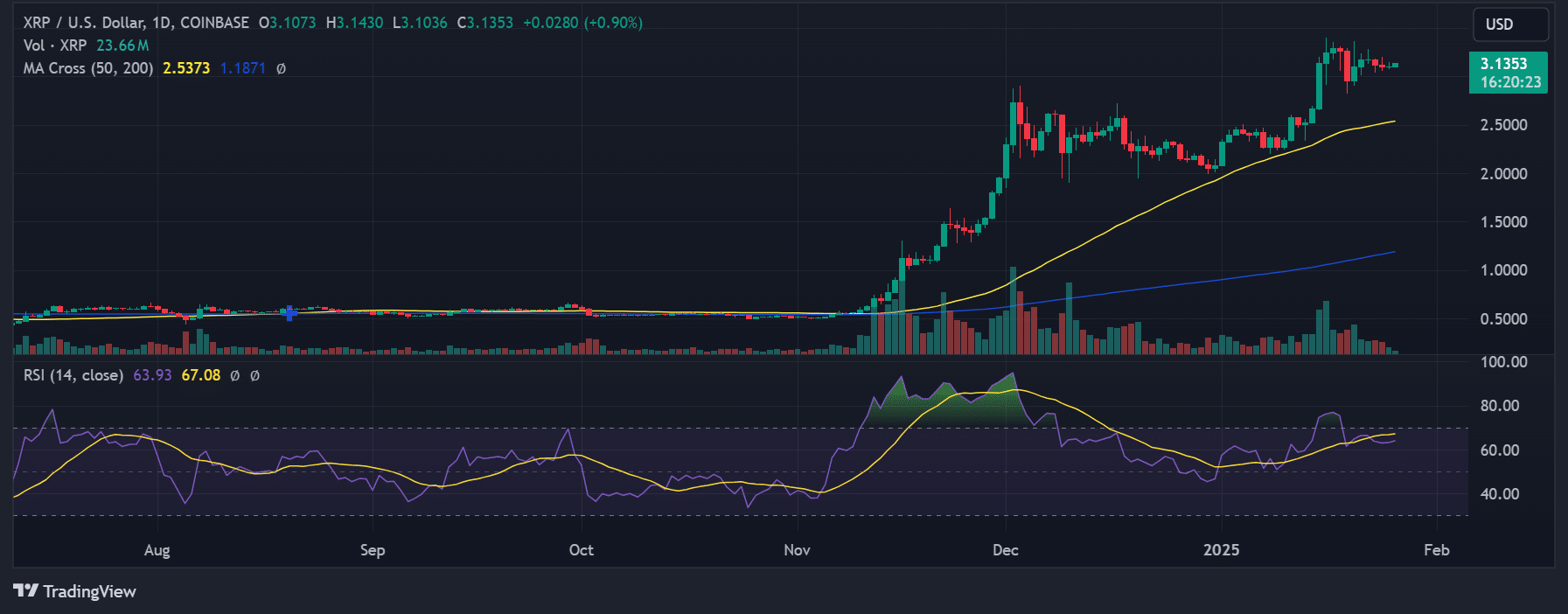

Despite these controversies, XRP’s market performance has remained robust. As of the latest data by ETHNews, the XRP/USD trading pair is priced at $3.1353, marking a 0.90% increase.

The currency exhibits a strong bullish pattern, as evidenced by the MA cross of the 50-day and 200-day moving averages, with values at 2.5373 and 1.1871, respectively. This indicates a sustained upward trajectory since November 2024.

The trading volume for XRP remains stable at 23.66M, reflecting continued investor interest amidst the political debate. The RSI, sitting at 63.93, shows moderate bullish momentum, suggesting that the asset is not overbought despite its recent gains.

I didn’t donate $12 million to Kamala or cost the GOP three additional Senate seats like Ripple did.

But I’m still gonna try to help @realDonaldTrump and team understand why XRP is the poster child for why we shouldn’t have a national crypto reserve.

Bitcoin Reserve or nothing.

— Ryan Selkis (d/acc)

(@twobitidiot) January 24, 2025

In the realm of market sentiment, the XRP Weighted Sentiment chart has shown significant stability. Although there were notable spikes in sentiment from mid to late November 2024, the overall mood has normalized, maintaining a neutral stance even in the face of ongoing debates.

Ripple is deliberately working against the US Bitcoin Strategic Reserve initiative, prioritizing their own interests over the well-being of the American people.

— NICO

(@BITVOLT) January 23, 2025

Amidst discussions of potential centralization, David Schwartz, Ripple’s CTO, has addressed concerns regarding the structure and governance of the XRP Ledger (XRPL). Contrary to claims of possible centralization, Schwartz has emphasized the decentralization of XRPL, which relies on a consensus algorithm rather than proof of work. This system, according to Schwartz, reduces the incentives for dishonest behavior and control, unlike the Bitcoin mining process.

For about the 400th time, for anyone who doesn’t understand what validators do:

XRPL actually has a consensus algorithm that actually reaches an agreed consensus. About every five seconds, every node participates in a process to decide how to resolve the double spend problem for…

— David “JoelKatz” Schwartz (@JoelKatz) January 26, 2025

As previously reported in ETHNews, Schwartz refuted claims regarding Ripple’s ability to manipulate the XRP supply or influence the ledger unilaterally. He stressed that any changes to the XRPL require consensus among validators, making it highly unlikely for Ripple or any single entity to enact significant alterations without broader agreement.

The post Decentralization and Governance: XRPL’s Role Under New Crypto Guidelines appeared first on ETHNews.