- 21Shares files DOGE ETF with Nasdaq, building on House of Doge partnership amid SEC review of rival proposals.

- SEC evaluates DOGE ETFs; Grayscale leads, while Polymarket odds hit 67% and Bloomberg analysts forecast 75% approval.

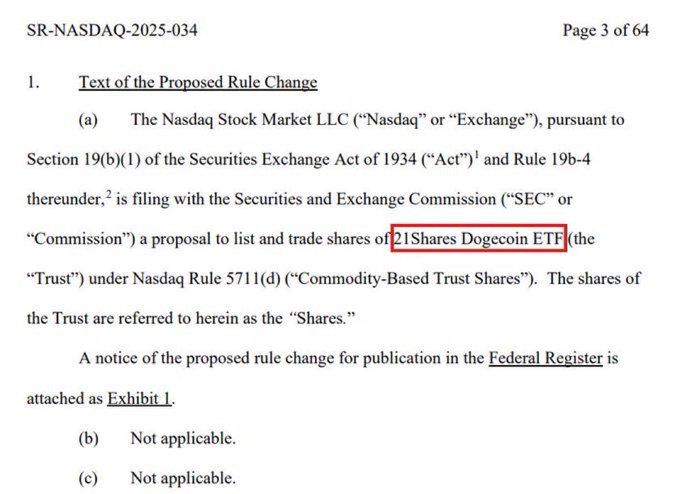

Asset manager 21Shares has filed for a Dogecoin ETF with Nasdaq, expanding its partnership with House of Doge to create regulated investment products tied to the meme cryptocurrency.

The filing follows similar proposals by Grayscale and Bitwise earlier this year, with Grayscale’s application reportedly advancing further in the U.S. Securities and Exchange Commission’s (SEC) review process.

Update: The SEC has acknowledged @Nasdaq‘s filing to list and trade shares of the @21Shares_US Dogecoin ETF, formally initiating the review process for this proposed investment vehicle. https://t.co/PsMlmLeJjC

— 21Shares US (@21shares_us) May 14, 2025

The SEC is evaluating multiple Dogecoin ETF applications, reflecting increased institutional interest in meme coins. Prediction platform Polymarket shows a 67% chance of approval by year-end, up from 55% last month. Bloomberg analysts assign a higher probability of 75%, citing regulatory shifts toward accommodating niche crypto assets.

Dogecoin’s adoption has risen globally, prompting traditional banks to integrate crypto services. Institutions are responding to client demand for digital asset access, with some offering custody or trading for Dogecoin. An ETF approval could amplify this trend, enabling investors to gain exposure without directly holding the asset.

A Dogecoin ETF might accelerate the token’s use in payments and remittances, leveraging its low fees and fast transactions. ETHNews analysts note that mainstream investment vehicles could challenge traditional banking models, particularly in regions with volatile currencies. However, Dogecoin’s price volatility and meme origins remain concerns for risk-averse investors.

The SEC’s decision hinges on market manipulation safeguards and custody solutions. Grayscale’s progress suggests regulators are engaging with applicants, but approval timelines remain uncertain.

If successful, Dogecoin would join Bitcoin and Ethereum as the third cryptocurrency with a U.S.-listed ETF, potentially reshaping perceptions of meme coins as legitimate assets.

Dogecoin (DOGE) – Technical & Market Analysis – May 13, 2025

Dogecoin (DOGE) is currently trading at $0.2225, down -4.44% on the day, following a brief rally that pushed it close to its key resistance level at $0.24. Despite the daily pullback, DOGE remains up +29.04% over the past 7 days and +40.07% over the last month, marking a powerful momentum reversal from earlier 2025 lows. Still, the token is down -29.59% year-to-date and -41.82% over the past six months, showing that this is a recovery in progress rather than a full bull breakout.

Technically, DOGE faces strong resistance at the $0.24–$0.26 zone, where several rejections occurred in the past week. A breakout above this region would likely send it toward $0.30–$0.34, while support is now found at $0.20.

On-chain data shows a 528% surge in active addresses, indicating revived interest and possible accumulation, especially after the announcement of a spot Dogecoin ETF filing by 21Shares.

Fundamentally, sentiment has been fueled by two key catalysts: Coinbase announcing support for cbDOGE, a wrapped version of DOGE on the Base network, and renewed social media momentum. The daily trading volume sits at $2.07 billion, with a market cap of $33.15 billion, making it the top-ranked meme coin in terms of capitalization.

The post DOGE ETF Approval Odds Soar to 75%: Why Bloomberg Analysts Say ‘Buy’ Now” appeared first on ETHNews.