- Dogecoin active addresses hit 650K, a 6-month high, signaling retail speculation amid $0.226 price consolidation.

- NUPL metric shows most DOGE holders profitable; resistance at $0.30 risks profit-taking and potential sell-offs.

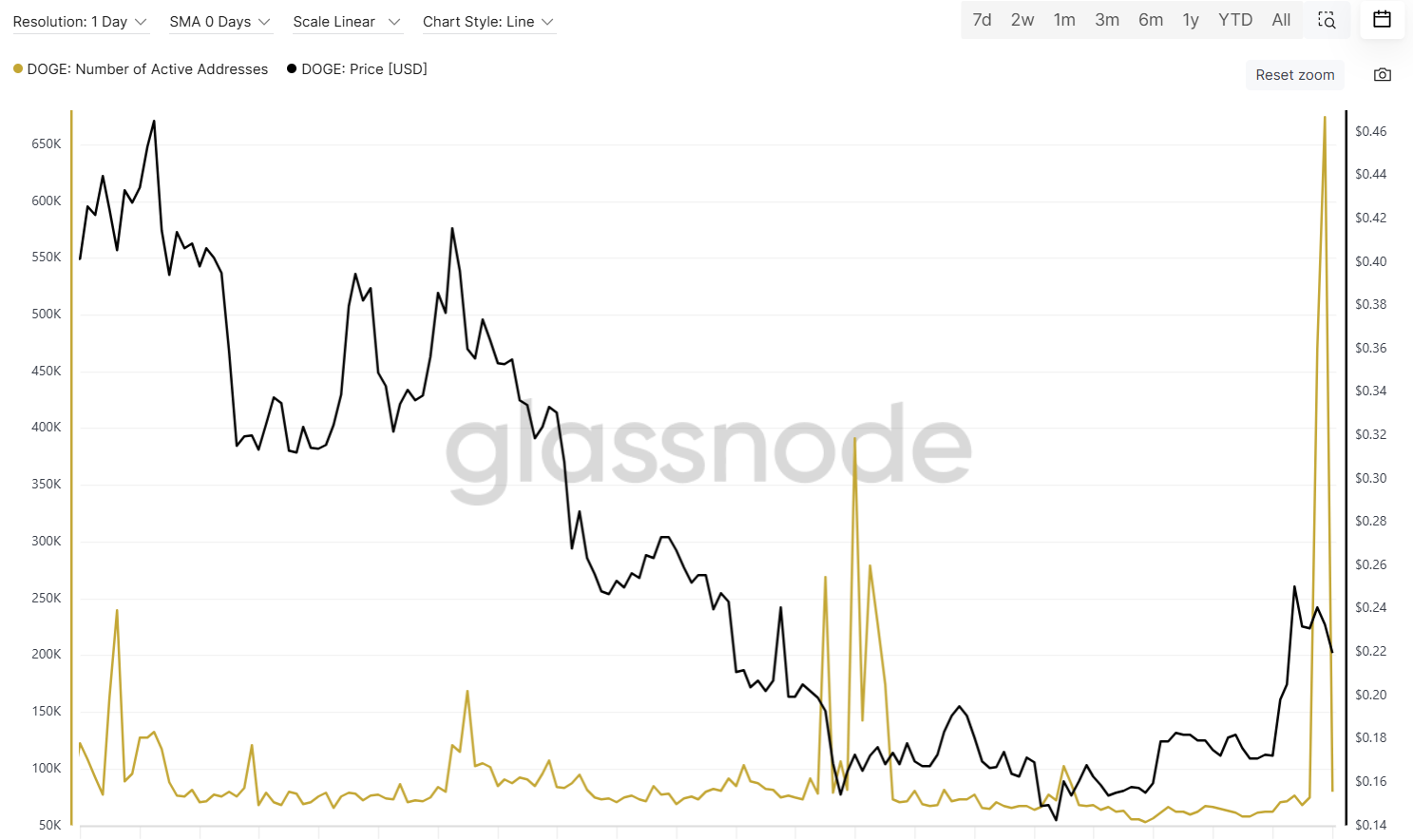

Dogecoin (DOGE) has recorded its highest number of active addresses in six months, with over 650,000 wallets transacting this week. The uptick, last seen in November 2024, coincides with renewed retail interest and speculative trading. Despite bullish technical signals, on-chain data suggests caution as profit-taking risks loom.

The surge in active addresses aligns with DOGE’s recent price climb to $0.226, though the token remains below its 2025 peak of $0.41. The Net Unrealized Profit/Loss (NUPL) metric, which tracks investor profitability, entered the “Optimism” zone, indicating most holders are in profit. Historically, such conditions precede selling pressure if prices stall near resistance.

On-chain data shows acquisition costs and realized profits nearing levels last observed in February, a period followed by a 30% price correction. This pattern raises questions about whether current holders will secure gains or hold for higher targets.

DOGE faces immediate resistance at $0.30, a level it has not consistently held since January. A breakout above this threshold could propel the token toward $0.36–$0.41, according to technical analysts. Support rests at $0.20, with a breakdown risking a retest of the long-term trendline near $0.145.

The Moving Average Convergence Divergence (MACD) indicator flashes bullish, while the Relative Strength Index (RSI) at 62 suggests room for upward movement before overbought conditions emerge.

However, trading volume, which exceeded $5 billion during the rally, has not been matched by growth in decentralized finance (DeFi) activity. Dogecoin’s DeFi total value locked (TVL) remains under $5 million, highlighting a disconnect between speculative trading and network utility.

The disparity between Dogecoin’s price action and its DeFi metrics underscores its reliance on sentiment rather than functional use cases. While social media buzz and celebrity endorsements often drive DOGE rallies, the lack of ecosystem development raises sustainability concerns.

ETHNews analysts note that without expanded utility—such as adoption in payments or DeFi protocols—Dogecoin’s price may struggle to maintain gains during market downturns. For now, traders focus on technical patterns and broader crypto trends, particularly Bitcoin’s stability above $100,000, which could influence altcoin momentum.

Dogecoin (DOGE) – Updated Price & Technical Analysis – May 13, 2025

Dogecoin is currently trading at $0.2284, up +4.13% on the day, continuing a strong multi-week rally that reflects renewed interest in meme coins and retail-driven momentum. Over the last 7 days, DOGE is up +15.08%, and over the past 30 days, it has surged +48.54%, confirming a breakout structure from previous consolidation phases. However, the asset is still down -27.70% year-to-date and -37.41% over the last 6 months, showing it is still recovering from prior highs.

Technically, DOGE recently hit a local high of $0.2597, before encountering resistance in the $0.24–$0.26 range. It is currently consolidating just below this zone, suggesting potential for another breakout if buying pressure continues.

Key support lies around $0.20, and a close above $0.26 could open the path toward the mid-$0.30s. ETHNews analysts have noted a bull flag formation and highlighted DOGE’s recent break above its 1W MA50, signaling strength similar to previous major rallies.

On-chain and social data show a sharp increase in activity

Coinbase’s recent announcement of cbDOGE integration has fueled interest, while active addresses on Dogecoin have spiked over 528%, hinting at broader retail re-entry. Despite lacking a capped supply or smart contract functionality, DOGE’s memetic power and visibility—especially through Elon Musk—continue to drive speculative demand.

The post DOGE’s $5B Volume vs. $5M Utility: The Speculative Bubble No One’s Talking About appeared first on ETHNews.