- Ethereum’s price drops nearly 13% to sub-$1,900 as market reacts to erroneous Binance delisting rumors, causing investor anxiety.

- Binance introduced “Vote to List” and “Vote to Delist,” fueling speculation that Ethereum might be removed from trading.

Ethereum has experienced a steady drop in price over the past few days. After briefly trading around $2,100, it has since declined by almost 13%, placing many traders and investors on edge. The recent downturn coincides with rumors about Binance potentially removing Ethereum from its platform, a claim that the exchange’s former CEO, Changpeng Zhao (CZ), has firmly rejected.

Early confusion arose from new features introduced by Binance, known as “Vote to List” and “Vote to Delist.” These options allow the exchange’s users to choose which tokens remain on, or get added to, the marketplace. Shortly after these features went live, rumors circulated that Binance would delist Ethereum.

Whoever believes this deserves to be poor.

— CZ

BNB (@cz_binance) March 28, 2025

Many holders of ETH reacted strongly, fearing that such an action might weaken the coin’s value. CZ quickly responded on social media, stating that people who believed these rumors “deserve to be poor,” reflecting his confidence that Ethereum’s support on Binance remained unaffected.

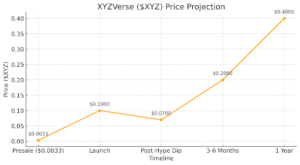

Even with CZ’s direct reassurance, Ethereum’s price continued its decline. It recently broke below the $1,900 level, prompting renewed caution among market participants. Some experts now warn that $1,750 could be tested if the selling pressure remains strong. A few pessimistic voices even consider a deeper slide toward $1,500, although that will likely depend on general market sentiment and global liquidity trends.

On the other side, certain traders are treating this correction as a chance to buy the dip. Should Ethereum stabilize in the mid-$1,500 range, buyers might step in and attempt to push the price closer to the $2,000 resistance level again. Although no one can predict short-term price actions with certainty, some see potential upside if confidence returns.

Ethereum’s Relative Strength Index (RSI) sits below 40, a level often interpreted as a sign of sellers dominating the market. However, oversold signals sometimes precede rebounds when trading volumes pick up.

Binance has announced the first batch of Vote to List results and will be listing Mubarak (MUBARAK), CZ’s Dog (BROCCOLI714), Tutorial (TUT), and Banana For Scale (BANANAS31) with Seed Tags applied.

More information

https://t.co/mmLtonzuEC pic.twitter.com/4xv6o6XHGn

— Binance (@binance) March 27, 2025

For now, observers remain watchful of further developments related to Binance’s listing practices. The exchange’s evolving policies, combined with market speculation, have added extra weight to Ethereum’s current trajectory.

The post ETH Slumps Below Key Level: Is $1,500 the Next Target for Sellers? appeared first on ETHNews.