- 21Shares’ Ethereum staking ETF filing sparks institutional demand, tightening ETH supply via staking incentives.

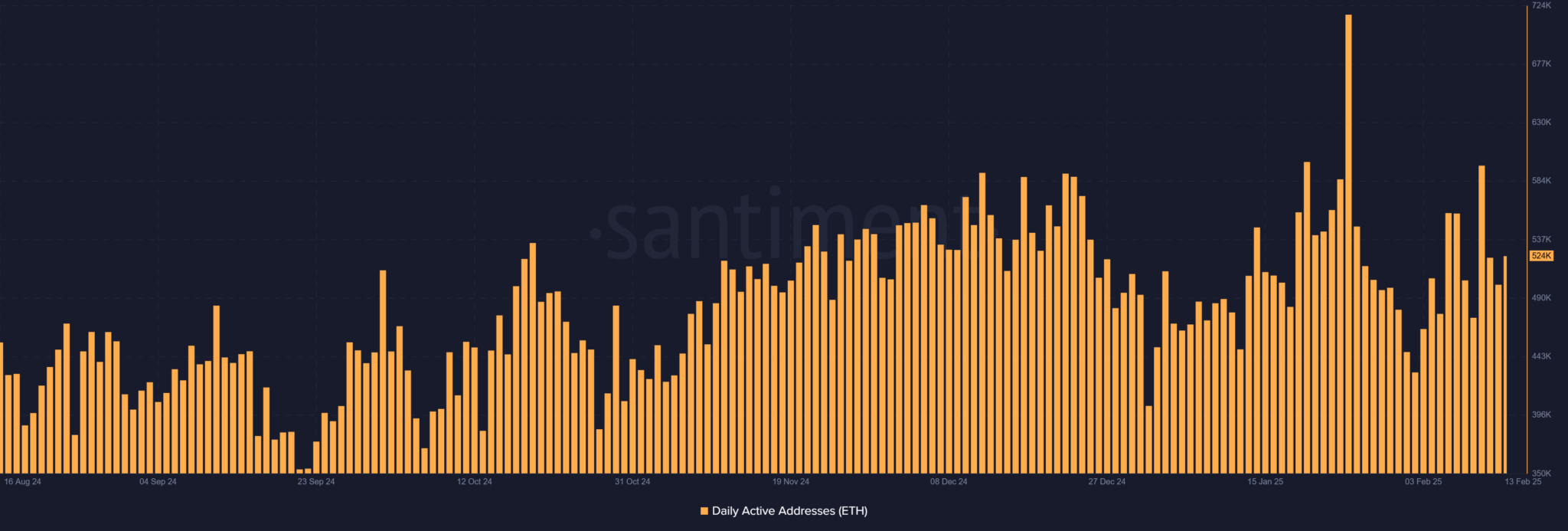

- Daily active addresses surpass 524,000, reflecting adoption strength and fueling ETH’s utility-driven price potential.

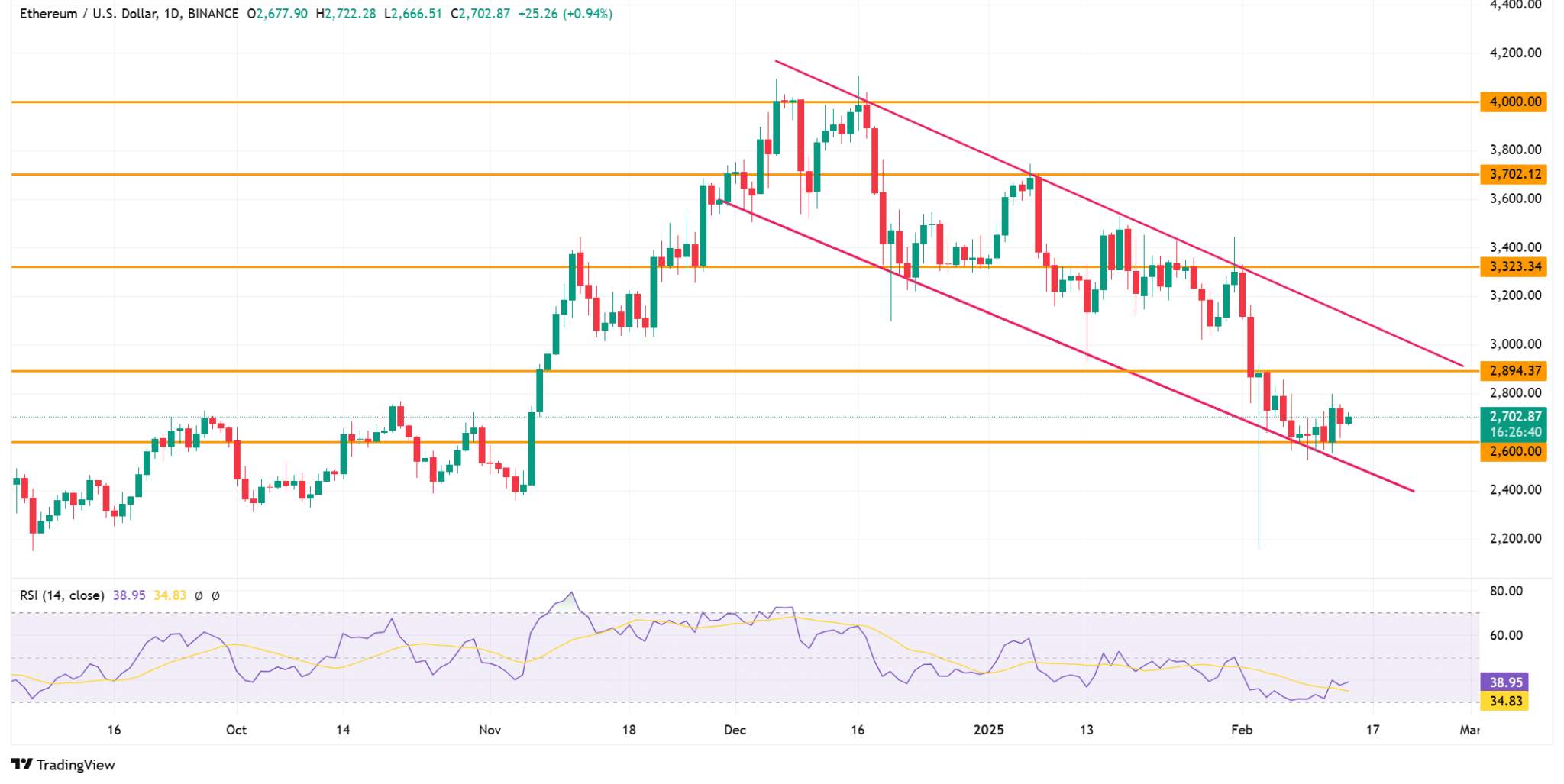

Ethereum holds steady above $2,600, with ETHNews analysts eyeing a potential climb to $3,200 or higher. As of the latest data, ETH trades at $2,702, up 0.67% in 24 hours. The asset’s ability to maintain this level raises questions about its capacity to breach higher resistance zones.

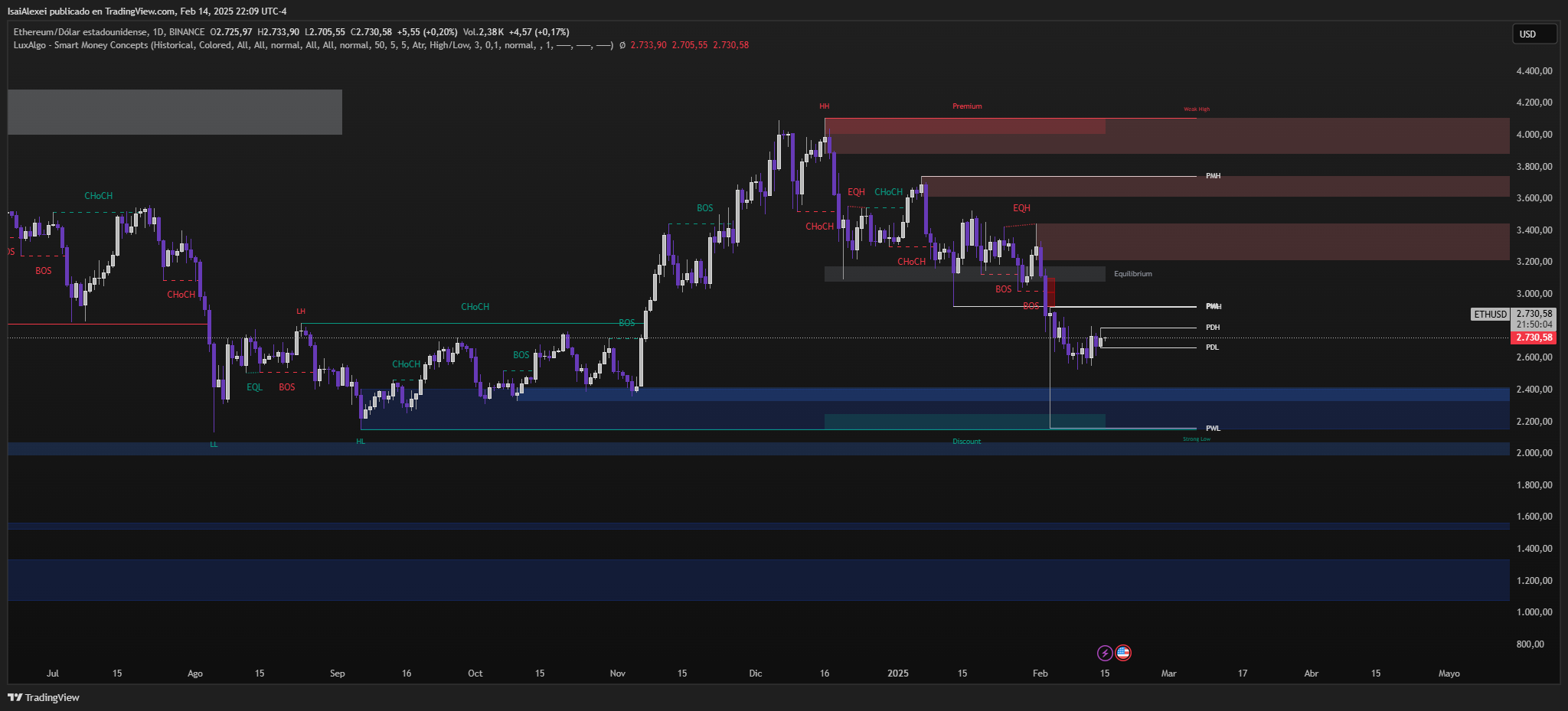

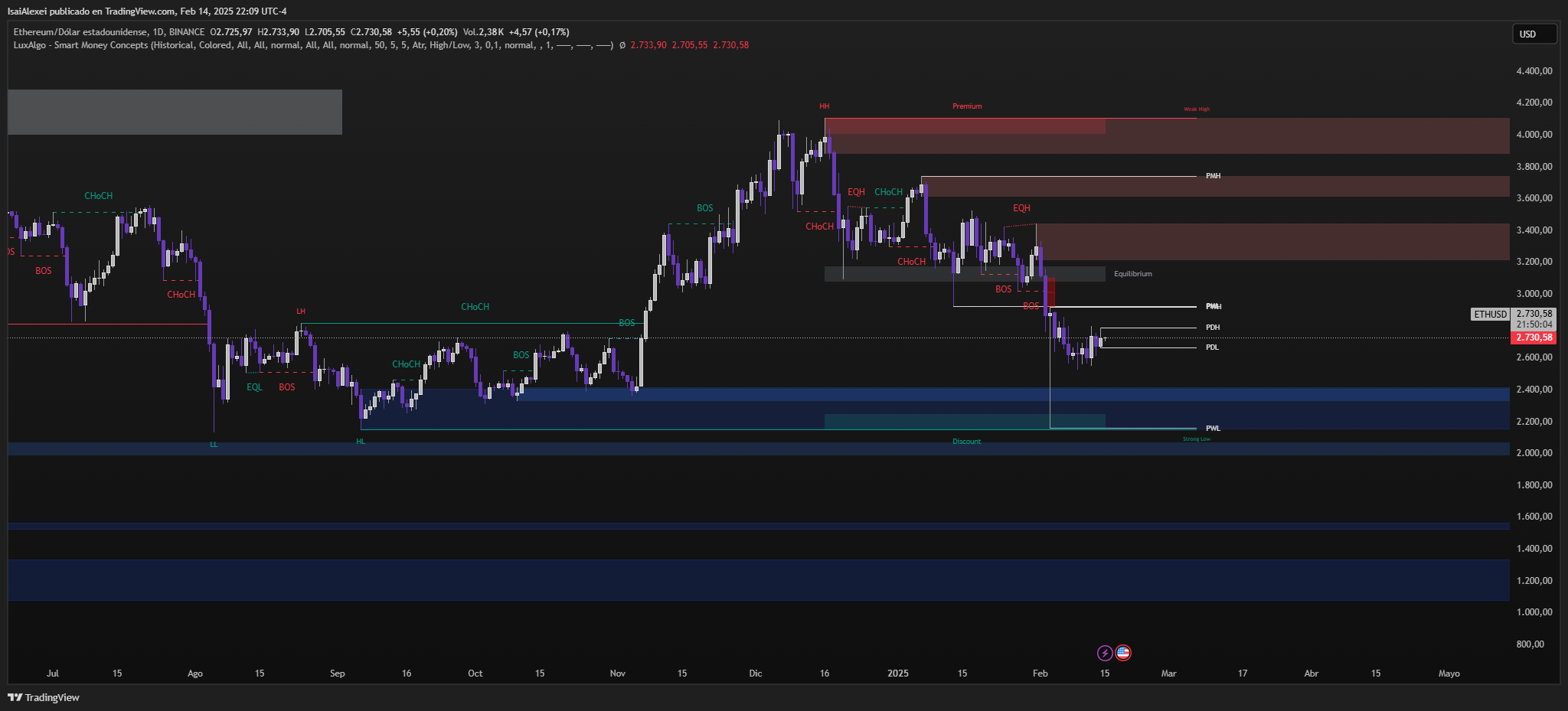

Technical indicators suggest cautious optimism. ETH currently trades within a defined price channel, facing immediate resistance near $2,800. A sustained break above this level could open a path toward $3,200, with $3,400 as a secondary target.

The Relative Strength Index (RSI) sits at 38.95, below overbought territory, hinting at room for upward movement. However, ETH must stay above critical support levels to avoid reversing recent gains.

Institutional involvement adds weight to bullish forecasts. Asset manager 21Shares recently filed for an Ethereum staking ETF, a development likely to attract institutional capital. Such products could tighten ETH supply by encouraging long-term holding through staking mechanisms.

While approval timelines remain uncertain, the filing underscores growing confidence in Ethereum’s infrastructure among traditional finance players.

Network activity reinforces ETH’s fundamentals

Daily active addresses consistently surpass 524,000, reflecting steady user engagement. This metric, often linked to adoption rates, signals ongoing demand for Ethereum’s decentralized applications. Higher usage typically correlates with increased ETH utility, a factor that historically supports price appreciation.

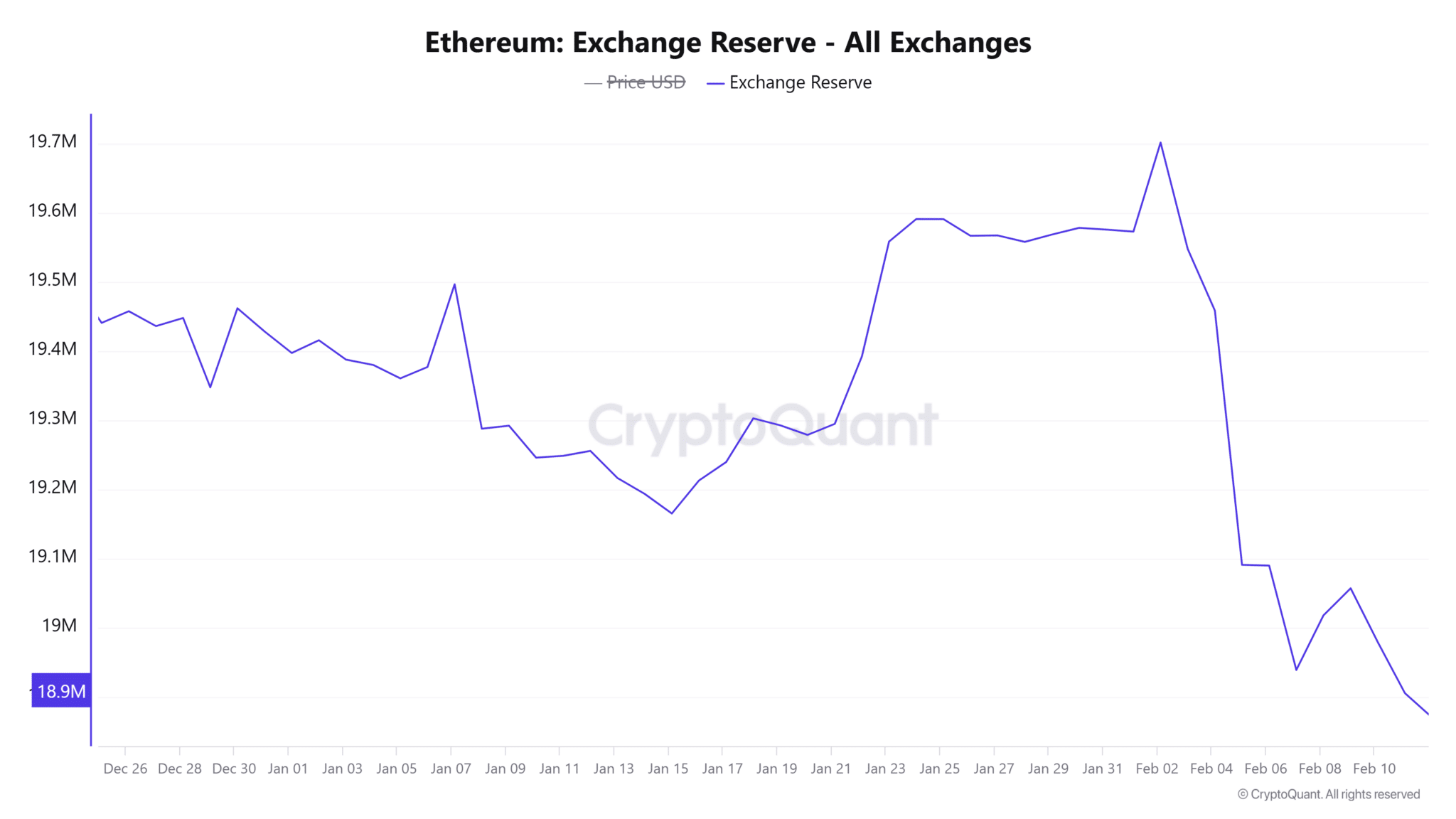

Exchange reserves present a mixed signal. ETH held on exchanges rose 0.02% to 18.88 million, suggesting some traders may be preparing to sell. While elevated reserves often precede volatility, the current increase remains marginal. ETHNews analysts note that unless reserves spike sharply, the broader upward trend could remain intact.

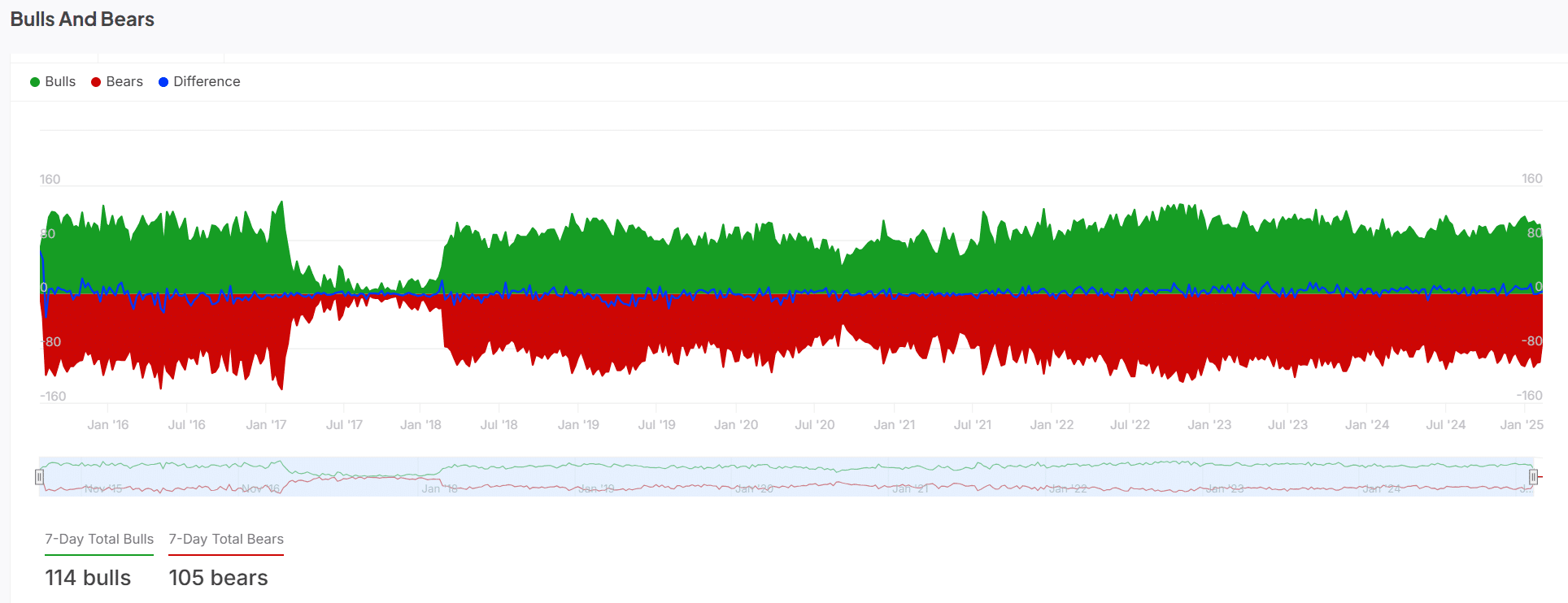

Market sentiment leans slightly bullish, with 114 bullish positions against 105 bearish ones. This balance indicates cautious optimism but also vulnerability to shifts. A sudden price drop could tip sentiment, though current support levels provide a buffer. For now, bulls appear to have a narrow edge, provided ETH maintains its current trajectory.

Ethereum’s path to $3,200 hinges on three factors: holding above $2,600, breaking resistance at $2,800, and sustaining institutional inflows. If these conditions align, the asset could test higher targets within weeks.

While exchange reserves and sentiment shifts pose risks, ETH’s technical and on-chain metrics suggest the odds favor gradual upward movement.

The post Ethereum Network Activity Signals Growth Amid Price Consolidation Phase appeared first on ETHNews.