- Ethereum’s ETH/BTC ratio hit 0.023278, its lowest since May 2020, marking an 8.7% drop in 48 hours.

- ETH’s total value locked (TVL) fell from $74 billion to $45.8 billion; price dropped 42.9% since December 2024.

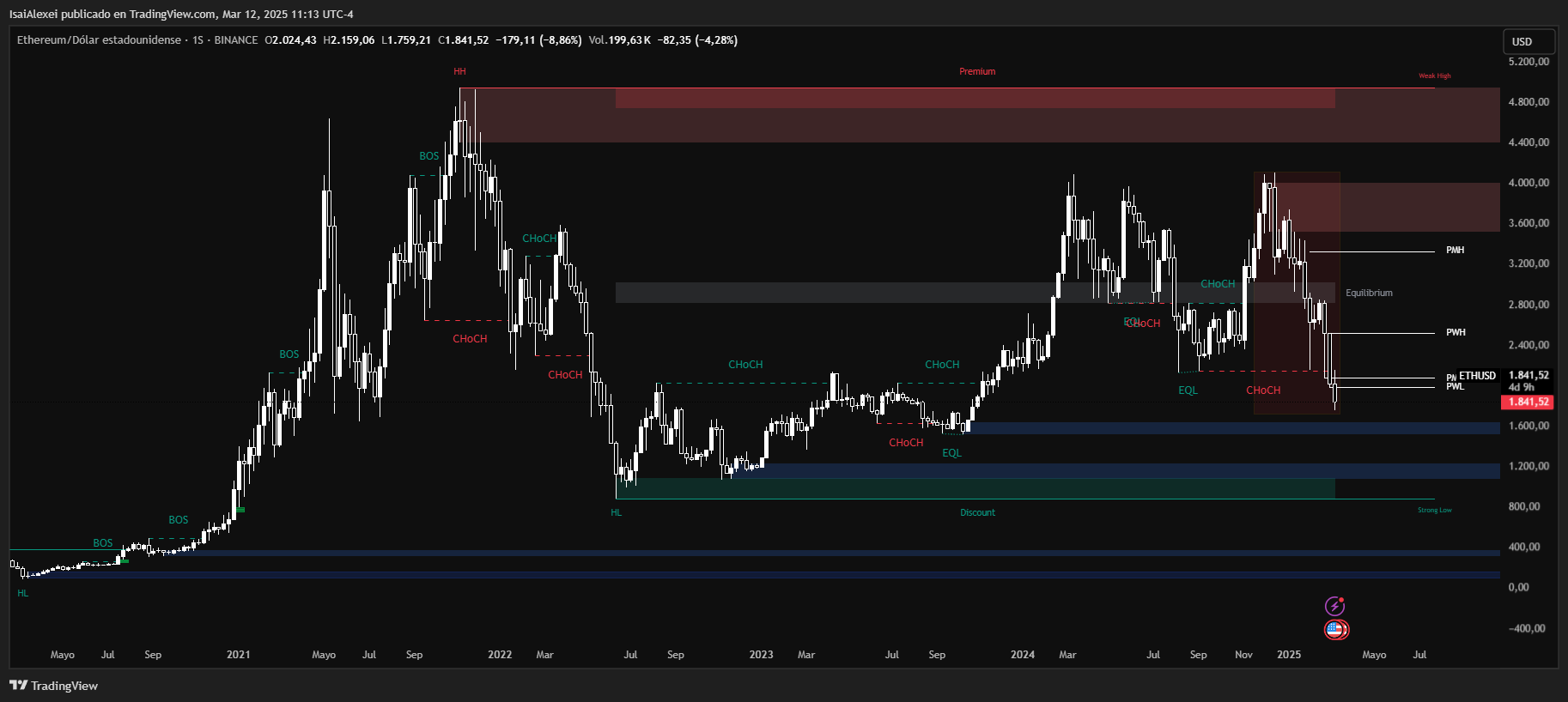

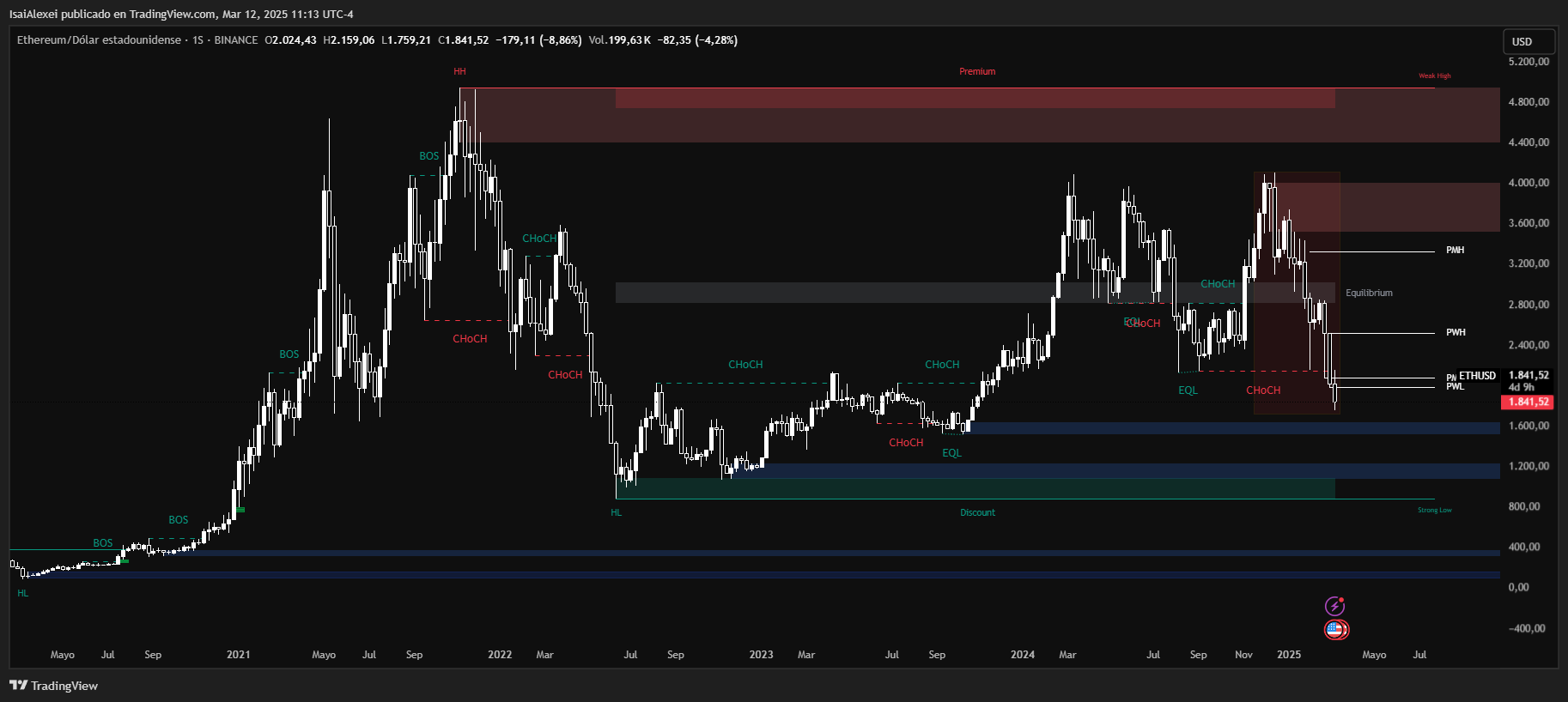

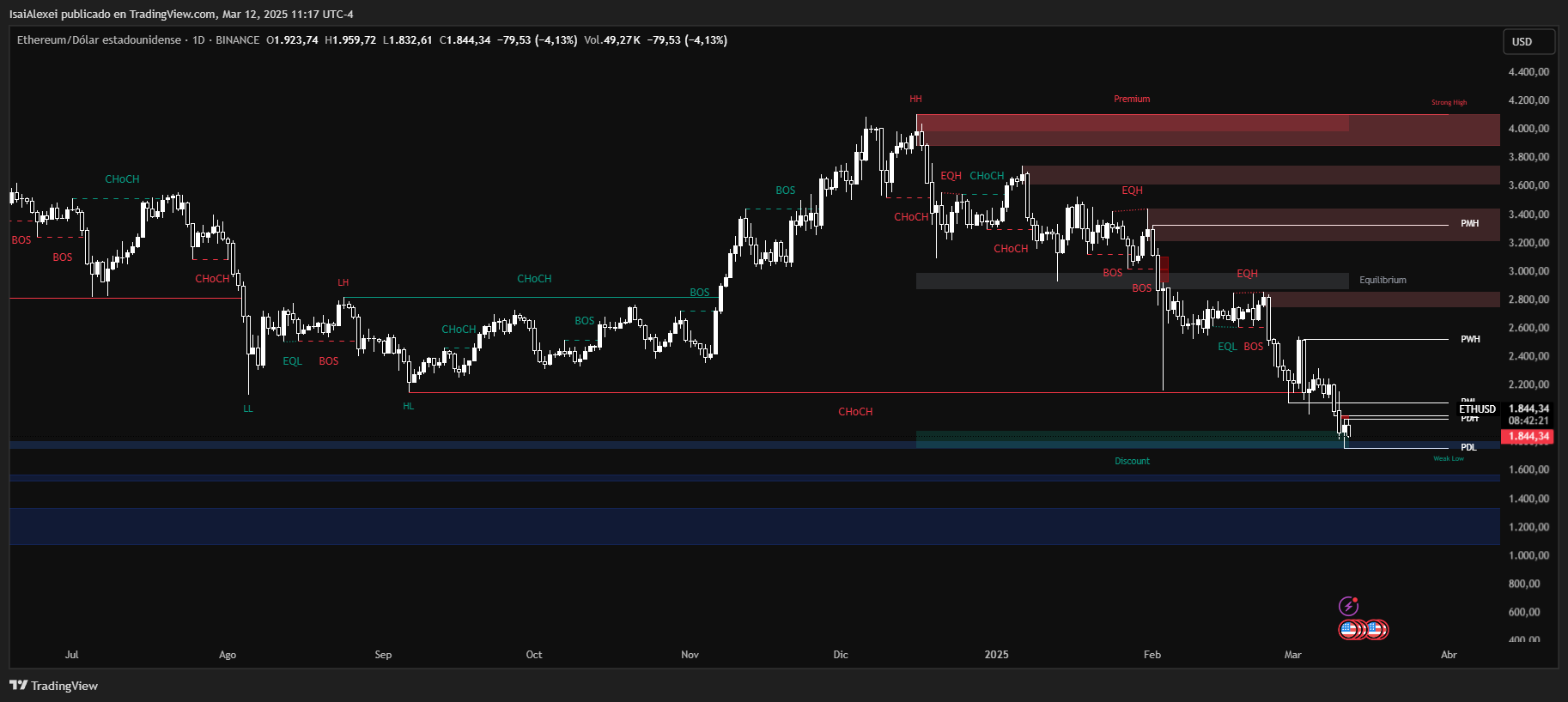

Ethereum (ETH) has reached its lowest valuation relative to Bitcoin (BTC) since May 2020, with the ETH/BTC exchange rate dropping to 0.023278, an 8.7% decline over 48 hours. Data from TradingView shows Ethereum’s total value locked (TVL) — the sum of assets held in its decentralized finance protocols — fell from $74 billion in December 2024 to $45.8 billion.

ETHNews reports ETH’s price fell 42.9% since December 2024, trading near $1,945. Broader cryptocurrency markets faced pressure due to macroeconomic uncertainty, including U.S. trade disputes with Canada, China, and Mexico. Solana and Binance Coin (BNB) saw losses of 35.6% and 23%, respectively.

BREAKING

: Ethereum$ETH falls to its lowest valuation relative to Bitcoin $BTC since May 2020 pic.twitter.com/3rTFuPygua

— Barchart (@Barchart) March 12, 2025

Liquidations across crypto markets exceeded $900 million in 24 hours, with $202 million from ETH long positions, according to TradingView. Ethereum’s price decline accelerated after losing the $2,000 support level, a threshold previously stabilizing sell-offs.

Stablecoin inflows into Ethereum-based protocols slowed, while decentralized exchange volumes dropped from $92 billion in December to $82 billion in February. Futures trading tied to ETH also declined from $31 billion to $18 billion in the same period.

The Ethereum Foundation, which manages ETH’s development, faced speculation after an unidentified wallet deposited 30,098 ETH into a MakerDAO vault. Developers Eric.eth and Sassal.eth denied the wallet belonged to the foundation.

This is fake. Again.

Feel free to reach out to press@ethereum.org for confirmation next time if this account has any (any) interest in accuracy.

— Joseph Schweitzer (jbs.eth)

(@JBSchweitzer) March 11, 2025

The foundation’s treasury, valued at $970.2 million in October 2024, holds 81.3% of its assets in ETH. This marks a 39% drop from $1.6 billion in March 2022.

To manage expenses, the foundation sold 4,266 ETH in 2024, generating $12.21 million at an average price of $2,795 per ETH. In January 2025, it allocated 50,000 ETH (worth $165 million) to Aave, a lending platform, to generate yield. ETHNews analysts suggest further ETH price declines could force the foundation to sell holdings at lower prices, risking liquidity challenges.

Ethereum’s revenue, derived from transaction fees, fell from $193 million in December to $26 million in February. Spot ETH exchange-traded funds (ETFs) recorded $176 million in outflows last month, signaling reduced institutional demand.

Market participants now monitor whether ETH’s price stabilizes or tests new support levels, which could influence the foundation’s financial strategy.

As of reporting, ETH trades near $1,945, while BTC holds above $85,000. The ETH/BTC pair’s decline reflects shifting investor preference toward Bitcoin during periods of heightened market uncertainty.

The post Ethereum’s ETH/BTC Ratio Crashes to 2020 Lows — What’s Next for Holders? appeared first on ETHNews.