- Ethereum’s L1 activity lags post-Pectra, but L2 networks surge 50% to 13M users, driven by Base and Arbitrum adoption.

- ETH’s realized cap jumps $3.8B as exchange supply hits 10-year low (4.9%), signaling accumulation and reduced sell pressure.

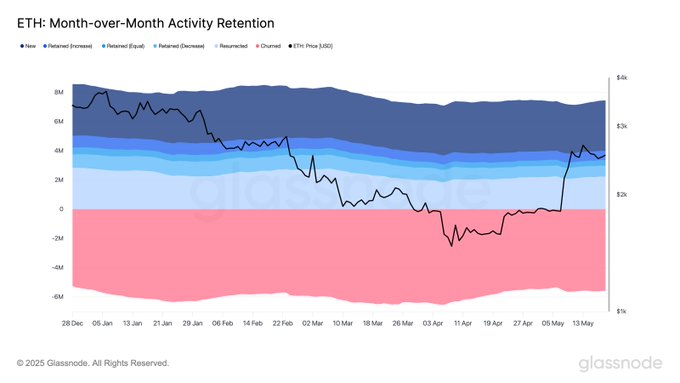

Ethereum’s network activity has shown mixed signals since the Pectra upgrade in May 2025. While the upgrade introduced technical improvements, it failed to attract new or returning users to the Ethereum mainnet (Layer 1).

#Ethereum’s Pectra upgrade hasn’t translated into a spike in network engagement just yet. Since the upgrade, the average new and resurrected addresses are down in comparison to YTD values (–1.8% and –8.4% respectively) – but churn is notably lower as well (–8.5%). pic.twitter.com/AHctRm2oLY

— glassnode (@glassnode) May 20, 2025

Data from Glassnode indicates new and resurrected addresses dropped 1.8% and 8.4%, respectively, compared to year-to-date averages.

However, existing users are engaging longer, with the churn rate—the rate at which users stop interacting—falling 8.5%.

Layer-2 Networks Rebound, Driving Usage Surge

In contrast to stagnant Layer 1 activity, Ethereum’s Layer-2 networks like Base, Arbitrum One, and OP Mainnet saw active addresses jump nearly 50% in May, from 8.7 million to 13 million. This rebound suggests developers and users are prioritizing scalability and lower fees offered by L2 solutions, even as the mainnet grapples with slower adoption.

Despite sluggish on-chain activity, Ethereum’s realized cap—a measure of the total capital stored in the asset—rose by $3.8 billion post-upgrade, breaking a downward trend from Q1 2025. This metric, which values each ETH token at the price it last moved, indicates renewed investor accumulation.

Exchange reserves have also plummeted to a 10-year low, with less than 4.9% of ETH’s supply available on trading platforms. Approximately 15.3 million ETH have moved to long-term storage, reducing immediate sell pressure and setting the stage for potential price gains if demand rises.

Options market data reveals a preference for bullish bets, with the 25 Delta Skew for one-week and one-month contracts at -3.5% and -4%, respectively. Negative skew values reflect higher demand for call options (bets on price increases) over puts (bets on declines). However, profit-taking from Q2’s price recovery could temporarily dampen momentum. Ethereum trades at $2,500 at publication, 60% below its current cycle high of $4,000.

Contradictions Define Ethereum’s Path Forward

Ethereum’s ecosystem faces a split reality: Layer-2 adoption thrives, Layer-1 stagnates, and investors accumulate despite short-term sell risks. The decline in exchange liquidity, coupled with bullish derivatives positioning, suggests mid-term upside potential. Yet, the network must reconcile its technical upgrades with tangible user growth to sustain momentum.

Ethereum (ETH) – Real-Time Price & Market Analysis – May 21, 2025

Ethereum (ETH) is currently trading at $2,574.00, showing a +1.96% gain today, continuing its steady climb after a sharp rally earlier in the month. Over the past 30 days, ETH has surged +62.39%, though it remains -22.61% year-to-date and -23.27% in the last 6 months, highlighting the ongoing recovery phase after last year’s correction. ETH now holds a market cap of $311.34 billion with 24-hour trading volume at $22.57 billion, showing strong trader engagement.

From a technical perspective, ETH’s 12-hour chart has formed a Golden Cross, often seen as a bullish long-term signal, with analysts eyeing potential upside targets toward $3,000–$4,000.

However, on the daily chart, there’s evidence of lower lows forming, which introduces the risk of a drop to $2,350 if buyers lose momentum. The price is hovering above a critical support zone at $2,530, and a daily close above $2,600 could confirm a breakout toward the next resistance near $2,746.

Fundamentally, Ethereum is benefiting from a mix of reduced exchange supply and institutional accumulation. Notably, ETH reserves on centralized exchanges have fallen to just 4.9% — the lowest in over a decade — with over 1 million ETH withdrawn this month, suggesting that whales are moving assets into cold storage or staking.

Open interest in ETH futures contracts also hit an all-time high today at 20.1 million ETH, signaling increasing institutional leverage and speculative appetite. This surge follows recent capital inflows of $3.8 billion into Ethereum-focused vehicles, largely attributed to the bullish momentum post-Pectra upgrade and ETF speculation.

The post Ethereum’s Post-Upgrade Activity Shows Diverging Trends as Investors Accumulate appeared first on ETHNews.