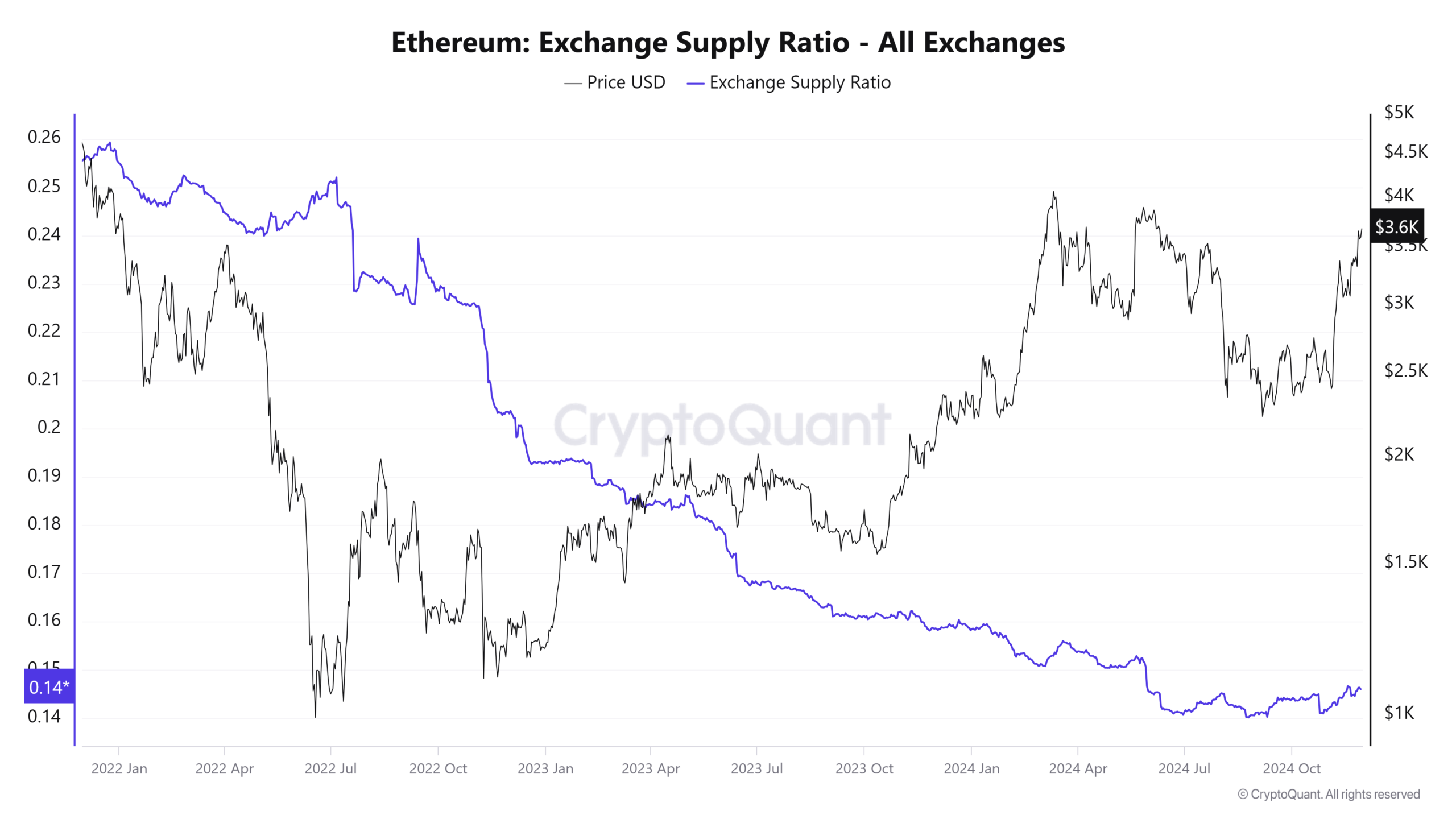

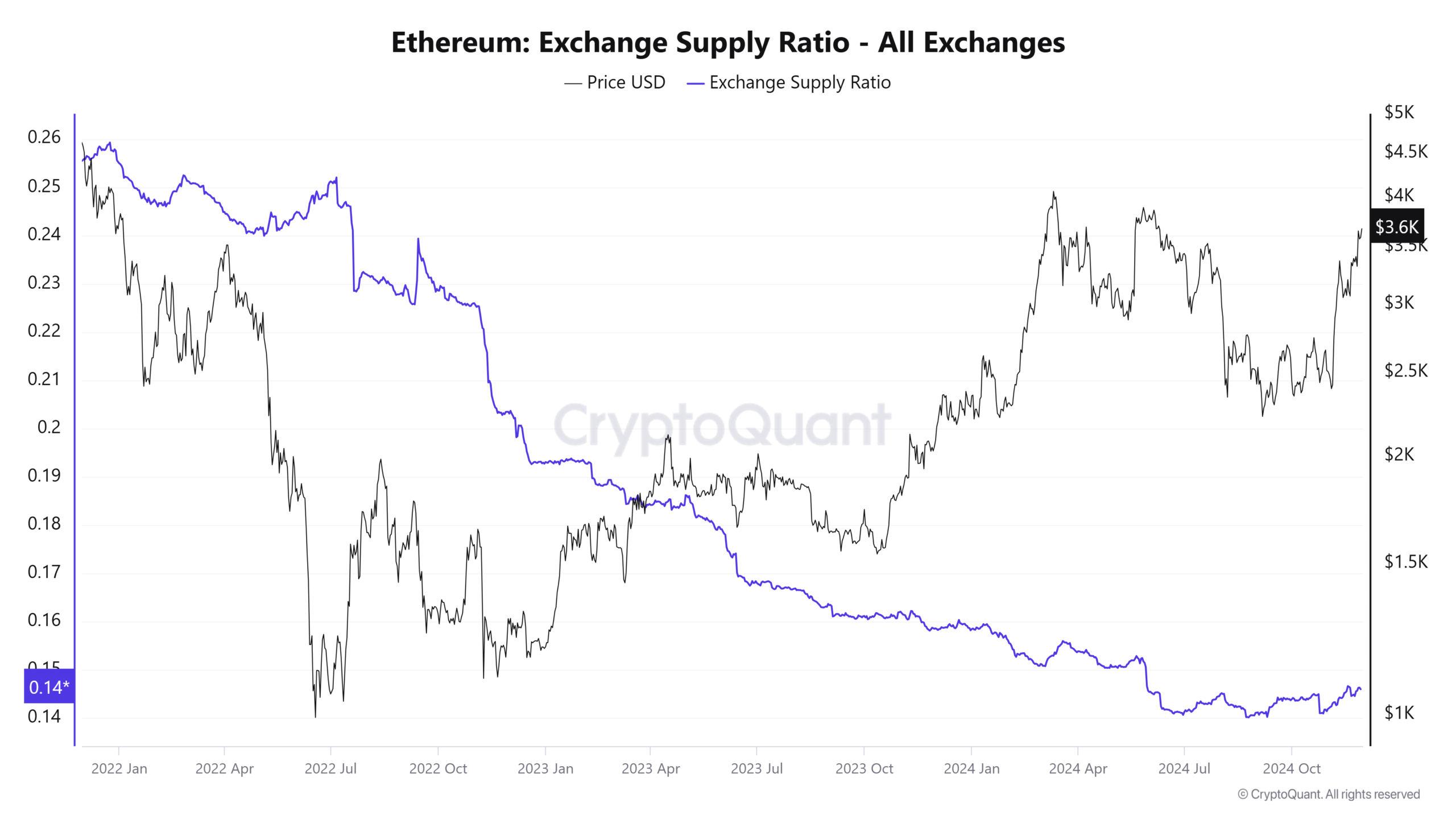

- An increase in the Ethereum Exchange Supply Ratio suggests more Ethereum is moved to exchanges, potentially for sale.

- A decrease in the ratio indicates withdrawals to private wallets, typically viewed as preparation for long-term holding.

- After peaking in 2020, the ratio has steadily declined, showing more holders are removing Ethereum from exchanges.

The Ethereum Exchange Supply Ratio, an indicator used to monitor the portion of Ethereum held in exchange reserves relative to its total circulating supply, offers insights into market behavior. This metric becomes particularly relevant when considering investor actions regarding their holdings on centralized exchanges.

An increase in the Exchange Supply Ratio indicates more Ethereum is being deposited into exchange wallets, which is typically associated with a preparation to sell, potentially leading to downward pressure on prices.

Conversely, a decrease in this ratio suggests that Ethereum is being withdrawn from exchanges to private wallets, an action often interpreted as preparation for long-term holding, which could be favorable for price stability or increases.

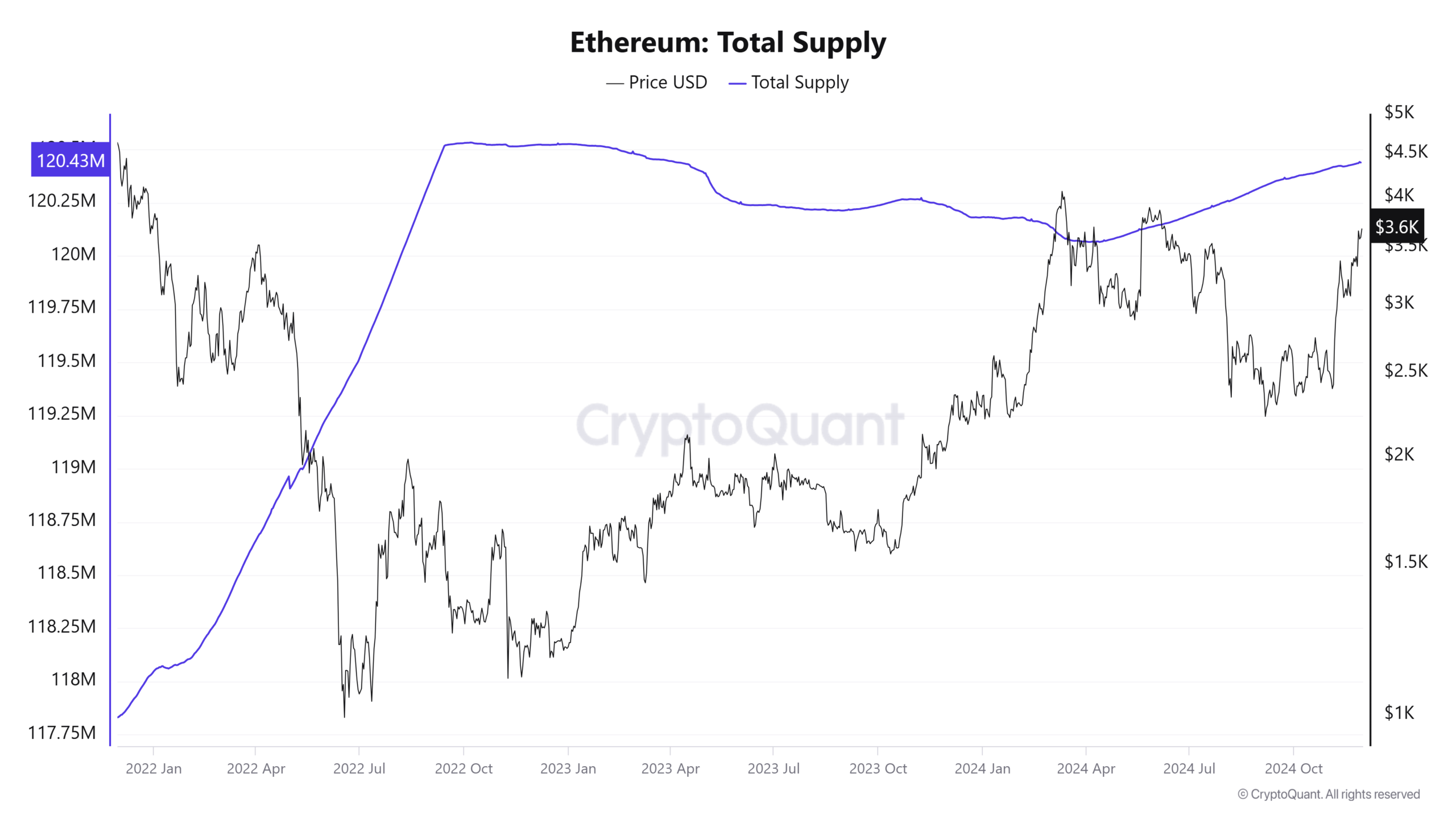

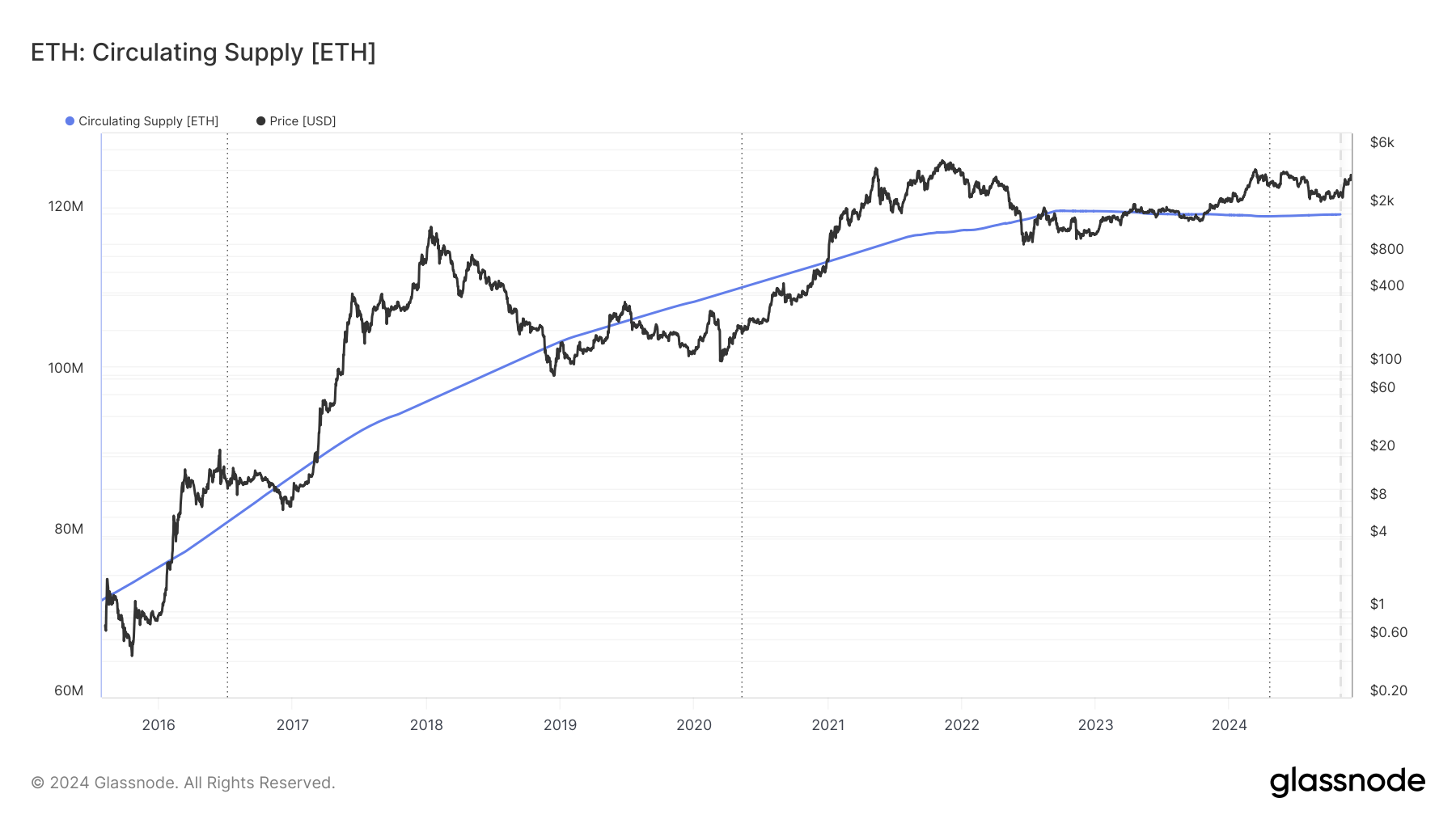

Recent analyses have shown that after reaching a high in 2020, where over 30% of Ethereum’s circulating supply was held in exchange reserves, there has been a noticeable decline.

Despite an increase in the total supply of Ethereum, the amount held in exchanges has reduced, suggesting that a larger share of Ethereum holders are choosing to withdraw their assets from exchanges.

Currently, the Ethereum Exchange Supply Ratio appears stable, with minimal fluctuations, reflecting a balance between incoming and outgoing flows on exchanges.

This stabilization occurs even as Ethereum’s price has seen increases, suggesting a balanced market sentiment with neither a strong selling or buying bias dominating.

The current state of the Exchange Supply Ratio might suggest sustainability in Ethereum’s price levels as long as this balance remains.

However, market observers suggest keeping a close watch on this ratio; a significant rise could indicate increased selling activity, potentially signaling that a market peak might be near.

Ethereum (ETH) is currently trading at $3,664.7 USD, reflecting a 1.96% increase over the last 24 hours. Over the past month, ETH has gained 37.89%, demonstrating robust growth and reinforcing its position as a key player in the cryptocurrency market. Year-to-date, Ethereum has risen by 60.59%, with a one-year gain of 78.49%.

The post Ethereum’s Supply: What the Exchange Supply Ratio Reveals appeared first on ETHNews.