- Fidelity’s OnChain initiative on Ethereum aims to enhance transparency in tracking U.S. Treasury investments with blockchain technology.

- Fidelity joins BlackRock and Franklin Templeton in tokenizing Treasury products, further expanding the $4.78B tokenized Treasury market.

Fidelity Investments has filed with the U.S. Securities and Exchange Commission (SEC) to launch a tokenized version of its US dollar money market fund, Fidelity Treasury Digital Fund (FYHXX), on the Ethereum blockchain.

This new initiative, OnChain, is set to bring greater transparency and tracking to the $80 million fund that holds U.S. Treasury bills. Scheduled to go live on May 30, OnChain aims to revolutionize how investors access and monitor Treasury investments using blockchain technology.

Fidelity’s OnChain offering will serve as a secondary ledger for tracking the FYHXX fund’s transactions. The Ethereum blockchain will record shared transactions daily, providing transparent tracking.

However, according to ETHNews, Fidelity clarified that the blockchain will not be the official record of ownership. Traditional book-entry records will continue to serve as the primary ownership ledger for the fund. The company said it would reconcile blockchain transactions with official records daily to maintain accuracy.

Expanding Blockchain Use in the Treasury Market

Fidelity’s move into the tokenization of Treasury products is part of a larger trend among asset managers adopting blockchain technology. Over the past few years, firms like BlackRock and Franklin Templeton have launched similar tokenized funds, signaling a growing interest in using blockchain to enhance efficiency in the Treasury market.

The tokenization of real-world assets (RWAs) allows for faster settlements and streamlined operations, addressing some of the traditional challenges of managing government bonds and credit instruments.

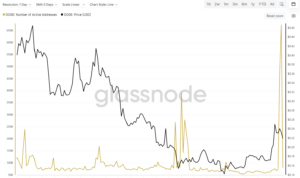

The RWA tokenization market for Treasury products is currently valued at $4.78 billion. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) holds the largest share, with $1.46 billion in assets. Ethereum remains the dominant blockchain for these tokenized assets, with over $3.3 billion worth of RWAs tokenized on the Ethereum network.

Fidelity’s Blockchain Ambitions

Fidelity is one of the largest asset managers globally, with $5.8 trillion in assets under management. The company’s entry into the Ethereum-powered Treasury space is a major move, positioning it as a key player in the tokenized Treasury market.

Although the OnChain initiative is still awaiting regulatory approval, Fidelity’s commitment to blockchain coincides with its general strategy to expand into digital asset markets, including launching spot Bitcoin and Ether exchange-traded funds (ETFs).

The company has also stated that it may extend the OnChain offering to other blockchains, displaying its ongoing interest in exploring diverse blockchain solutions for financial products.

As the market for tokenized U.S. Treasuries continues to grow, Fidelity’s entrance further intensifies the competition. BlackRock, which launched its tokenized T-bill fund in March 2022, has become the market leader with nearly $1.5 billion in assets. Franklin Templeton’s fund, the first to offer an on-chain money market product, currently holds $689 million in assets.

With the tokenized U.S. Treasury market growing nearly 500% over the past year, the space is poised for further expansion. As traditional financial institutions increasingly adopt blockchain technology, Fidelity’s OnChain initiative could be pivotal in shaping the future of Treasury market operations.

The post Fidelity Introduces Ethereum-Powered ‘OnChain’ Shares for Treasury Market appeared first on ETHNews.