- Binance Labs supports 46 projects, emphasizing DeFi, AI, Bitcoin ecosystem, gaming, ZK technologies, and real-world assets.

- The fund adopts a chain-agnostic strategy, investing in Solana, Ethereum, Telegram, and Layer 2 networks for broader impact.

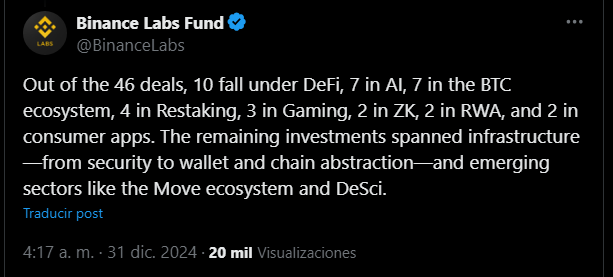

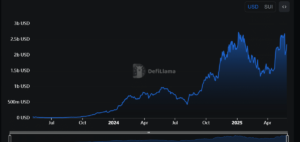

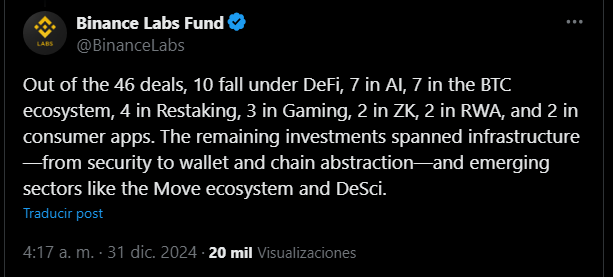

Binance Labs is positioning itself for 2025 by concentrating on investments that support long-term growth and sustainability. This year, the fund has backed 46 projects, dividing its attention between foundational infrastructure and consumer-facing applications.

At Binance Labs (soon to be rebranded), we’re laser-focused on fundamentals, aiming for long-term impact. Going into 2025 and beyond, we’ll continue to provide evergreen support to founders who share our vision of building for the long term.

As we conclude 2024, let’s review the…

— Binance Labs Fund (@BinanceLabs) December 31, 2024

The fund’s investments span several sectors, including decentralized finance (DeFi), artificial intelligence (AI), the Bitcoin ecosystem, restaking protocols, gaming, zero-knowledge (ZK) technologies, real-world assets (RWA), and consumer applications.

Binance Labs’ portfolio also demonstrates a chain-agnostic approach, incorporating projects from blockchain networks such as Solana, Ethereum, Telegram, and several Layer 2 solutions.

Approximately 20% of its investments stem from the BNB ecosystem, supported through the Most Valuable Builder (MVB) Program, underscoring Binance’s commitment to nurturing its internal ecosystem.

As the crypto industry enters 2025, sectors like gaming and ZK technologies are anticipated to shift from development to active production phases. Privacy solutions are also expected to gain traction, addressing increasing demands for secure and transparent digital interactions.

Meanwhile, intersections between blockchain, AI, and biotechnology hold potential for transformative applications that bridge these fields.

The regulatory landscape in the U.S. could evolve with the incoming administration, potentially creating a more favorable environment for institutional investment. This anticipated shift aligns with Binance Labs’ goals of supporting projects with strong teams, practical use cases, and sustainable business models.

Additionally, Binance Labs plans to expand its investments into secondary markets, allowing for greater flexibility and opportunities beyond traditional venture capital models. Under the renewed leadership of CZ, there’s a stronger emphasis on personal engagement with founders, ensuring direct support for promising projects.

The post Inside Binance Labs: 46 Crypto Projects Backed, What’s Next for 2025? appeared first on ETHNews.