- Collaboration bridges TradFi and DeFi, aiming to tackle liquidity fragmentation and high costs in tokenized markets.

- Chainlink’s cross-chain tech ensures secure, automated settlements, reducing risks and enabling institutional-grade DeFi transactions.

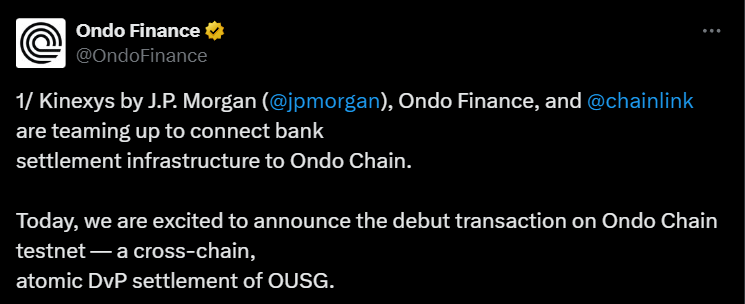

Kinexys, a J.P. Morgan subsidiary, partnered with Ondo Finance and Chainlink to complete a cross-chain settlement of tokenized assets on Ondo Chain’s testnet. The transaction involved Ondo’s tokenized U.S. Treasury product (OUSG) and utilized Chainlink’s infrastructure to synchronize transfers across blockchains.

This marks the first use of Ondo Chain’s system, designed to bridge traditional banking and decentralized finance (DeFi) through compliant, institutional-grade solutions.

The transaction tested a Delivery-versus-Payment (DvP) mechanism, ensuring asset transfers finalize only when both payment and delivery conditions are met. Chainlink’s cross-chain technology coordinated the exchange, reducing counterparty risk and automating compliance checks. Ondo Chain, built to support real-world asset (RWA) tokenization, combines public blockchain accessibility with controls for institutional requirements like audits and permissions.

Kinexys processed over $1.5 trillion in transactions since its launch, averaging $2 billion daily. Its integration with Ondo Chain expands its settlement capabilities beyond private networks, addressing fragmented liquidity and high costs in tokenized markets.

Implications for TradFi and DeFi Integration

The collaboration signals growing institutional interest in merging traditional finance systems with blockchain efficiency. By enabling cross-chain DvP settlements, the partners aim to reduce operational friction for assets like bonds, equities, and commodities. Ondo Chain’s design allows institutions to tokenize RWAs while adhering to regulatory standards, a hurdle that has slowed broader adoption.

Chainlink’s role as a middleware layer ensures secure data transmission between blockchains and banking systems. This reduces reliance on centralized intermediaries, a core DeFi principle, while maintaining the oversight required for regulated markets.

Nathan Allman, founder of Ondo Finance, stated the test demonstrates scalable solutions for merging TradFi and DeFi.

“This isn’t just a technical step—it’s a shift in how institutions can interact with blockchain” he said.

Sergey Nazarov, co-founder of Chainlink, emphasized the importance of secure cross-chain infrastructure.

“Institutions need guarantees that transactions execute exactly as programmed, without exposure to exploits or defaults,” he noted.

Nelli Zaltsman of Kinexys highlighted the platform’s growth, citing a tenfold annual increase in payment transactions.

“Collaborating with public chains like Ondo allows us to meet client demand for faster, cheaper settlements without compromising compliance,” she added.

Ondo Chain’s hybrid model—balancing transparency with institutional controls—could attract firms hesitant to adopt fully public networks. For DeFi, integration with entities like Kinexys offers access to deeper liquidity and regulated asset pools.

Scalability and regulatory alignment remain hurdles. While the test proves technical viability, mass adoption requires clearer guidelines on token ownership, taxation, and cross-jurisdictional enforcement.

Additionally, competing platforms from firms like Swift or Avalanche aim to solve similar problems, intensifying the race for institutional blockchain dominance.

ONDO Finance – Price & Technical Analysis – May 2025

ONDO is currently trading at $1.07, marking a +6.5% daily gain and a +23.5% increase over the past 7 days, confirming its strong position in the RWA (Real World Asset) tokenization trend.

Over the last month, ONDO has grown +19.6%, and year-over-year it’s up +42.3%, establishing itself as one of the leading performers in the DeFi and RWA sectors. The token’s market cap is $3.38 billion, with a 24-hour trading volume of $628 million, indicating robust and rising demand.

From a technical perspective, ONDO is now approaching a key breakout zone above $1.09, with clear bullish momentum. The token is up over 1,150% from its all-time low, though it remains 51.8% below its all-time high of $2.14, suggesting significant upside potential if momentum continues.

If ONDO breaks and holds above the $1.10 level, the next targets are $1.22 and $1.30. Support lies around $1.00, which previously acted as resistance and now flips to a strong demand zone.

Fundamentally, ONDO is gaining attention due to major developments in the tokenized treasury and yield-bearing asset space. The protocol allows users to access fixed-yield loans backed by crypto-assets in a permissionless and risk-isolated environment.

Notably, ONDO recently participated in a JPMorgan-led real-world asset (RWA) settlement pilot alongside Chainlink, showcasing institutional-level interest and potential integration.

Additionally, ONDO’s TVL exceeds $1.18 billion, with a fully diluted valuation (FDV) of over $10.7 billion, reinforcing its future growth trajectory.

Chainlink (LINK) – Price & Technical Analysis – May 2025

Chainlink (LINK) is currently trading at $16.94, showing a -2.61% daily decline, following a major breakout week. Over the last 7 days, LINK is up +22.55%, and over the past month, it has gained +34.18%, highlighting a strong upward momentum.

Despite this rally, LINK is still down -15.20% year-to-date, suggesting there’s more room for recovery from its prior bear cycle. On a yearly view, LINK is up +26.5%, and remains one of the top infrastructure plays in the blockchain space.

Technically, LINK is consolidating just below the critical $17.50 resistance level, having recently reclaimed support at $15.30, which has now flipped bullish. If LINK closes above $17.50 on strong volume, it could set up a move toward the $20.00–$21.40 zone.

Indicators are neutral to slightly bullish; RSI is cooling off after approaching overbought levels earlier this week. A drop below $15.30 would invalidate the current bullish setup and shift the trend toward $13.80 support.

The post J.P. Morgan’s Kinexys, Ondo Finance, and Chainlink Execute First Cross-Chain Settlement on Ondo Chain appeared first on ETHNews.