- BlackRock CEO says the increasing U.S. debt could position digital assets like Bitcoin as alternative stores of value

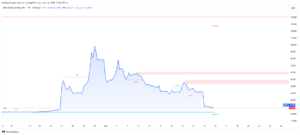

BlackRock CEO Larry Fink has warned that the U.S. dollar’s dominance as the global reserve currency could be at risk if the country fails to get its fiscal house in order—suggesting digital assets like Bitcoin could fill the void.

The comments came in Fink’s 2025 annual letter to shareholders, in which he pointed to increasing U.S. debt and deficits as serious threats to long-term monetary stability.

According to Fink, the national debt now exceeds 100% of United States GDP, while interest payments on that debt are projected to reach $952 billion in 2025.

He cautioned that, if current spending trends continue, the U.S. could hit the point where all federal revenue is consumed by mandatory spending and debt service as early as 2030—without room for discretionary programs or response to emergency.

“The erosion of faith in conventional financial systems and fiat currencies is no longer theoretical,” Fink wrote. “Investors are turning to alternatives like Bitcoin—not just as speculative assets, but as prospective hedges against long-term economic uncertainty.”

The remarks explain the growing institutional concern that prolonged fiscal imbalances could accelerate the adoption of decentralized financial infrastructure. While the U.S. dollar remains the major currency of the global monetary system, Fink’s comments point to a global shift in thinking about the potential of cryptocurrencies as parallel, if not competing, assets in the global financial order.

BlackRock Expands Digital Asset Strategy with Bitcoin and Tokenization

The shareholder letter also addressed BlackRock’s growing commitment to the digital asset ecosystem. In January, the firm launched the iShares Bitcoin Trust (IBIT), which has since amassed more than $50 billion in assets—making it the most successful ETF launch in history, as previously reported by ETHNews.

The success suggests global institutional acceptance of Bitcoin, especially as a long-term investment product.

Aside from Bitcoin, Fink also commented on the potential of asset tokenization—the digital representation of traditional financial instruments as tokens on a blockchain. He thought that tokenization could reshape the financial universe by making it more efficient, reducing costs, and opening up the capital markets to a global investor base.

BlackRock’s own tokenized fund, BUIDL, is reportedly among the largest of its kind and serves as a symbol of the firm’s strategic positioning in blockchain-based finance. “We are at the start of a technological revolution in finance,” Fink wrote. “The institutions that lead in digital assets and blockchain innovation will be the institutions that are leading global markets in five years.”

As the world watches America’s economy, Fink’s letter is both a challenge and a warning—one that serves to explain the growing legitimacy of Bitcoin as more than a speculative asset but as a major tool in global finance.

The post Larry Fink Flags Bitcoin as Potential Threat to Dollar’s Reserve Status Following U.S. Fiscal Woes appeared first on ETHNews.