- Ripple and SEC near settlement on XRP case with $125 million penalty; outcome could drive near-term price direction.

- A close above $2.34 on strong volume would reverse trend; failure below $2.10 risks drop toward $1.80–$1.90 zone.

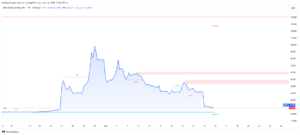

XRP (Ripple) is trading at $2.127 USD, reflecting a −2.88% drop on the day amid broad market weakness. Over the past week, XRP has risen +1.46%, but is still down −17.72% this month, showing how recent macro and legal uncertainty have impacted the asset.

Despite this short-term pullback, XRP maintains a strong +2.26% year-to-date performance, and a remarkable +332.72% gain over the past year, confirming its long-term bullish trend.

The technical picture indicates XRP is trading below its recent peak of $2.34, where sellers reasserted control. Indicators show bearish divergence in RSI and a red daily candle pushing toward the lower Bollinger Band, suggesting continued downside pressure. If the $2.10 support breaks, the next key zone lies around $1.98, which has served as a consolidation base during earlier accumulation phases.

On the fundamental front, Ripple and the SEC are reportedly close to a settlement agreement involving a $125 million penalty, expected to be finalized in the coming days. The outcome could significantly influence XRP’s short-term trajectory. Additionally, broader geopolitical tensions—like Israeli airstrikes on Iran—have triggered risk-off sentiment in crypto, contributing to XRP’s recent retreat from $2.30+ levels.

Looking ahead, XRP remains structurally bullish in the long term, but vulnerable in the short term if broader crypto markets continue to correct. A confirmed reclaim of $2.34 with volume would be bullish, while failure to hold $2.10 could lead to deeper retracement toward the $1.80–$1.90 zone.

The post SEC Deal Worth $125M Looms—Will XRP Soar or Sink on Settlement News? appeared first on ETHNews.