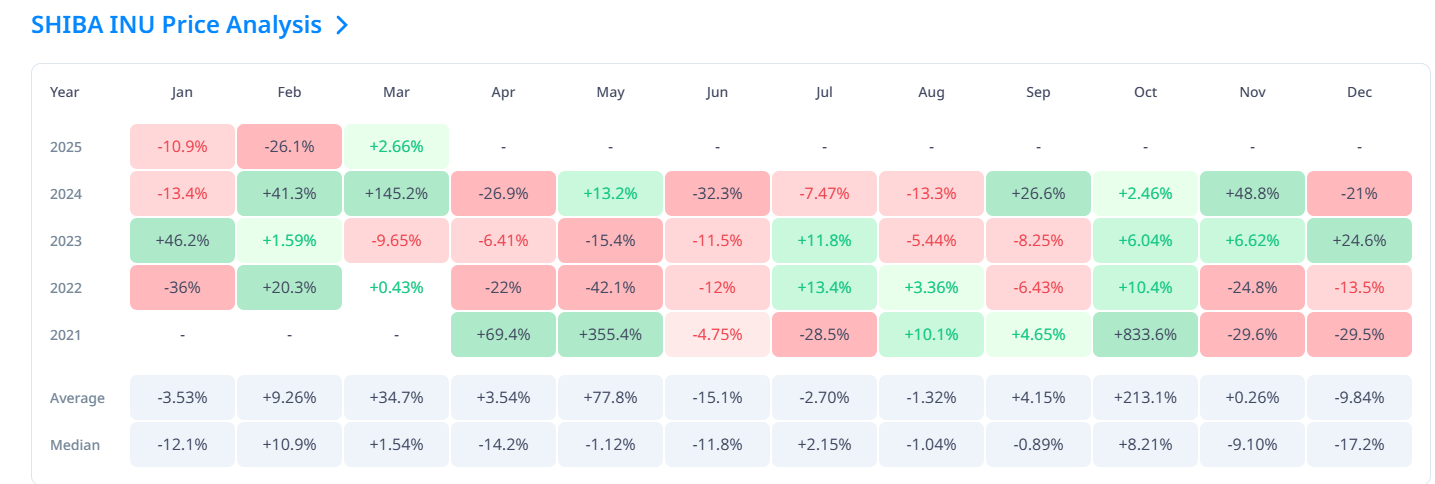

- Shiba Inu has dropped every April for the past three years, with a median return of minus 14.2 percent.

- Despite March gains, SHIB consistently faces April pullbacks, with even its best recent April showing a 6.41% loss.

As March closes, many Shiba Inu (SHIB) holders begin to look ahead with a familiar mix of optimism and hesitation. While first-quarter trading tends to build upward pressure for the token, April has repeatedly delivered losses, creating a recurring drop that investors have learned to track, if not fully understand.

Data from CryptoRank shows that April’s long-term average return for SHIB stands at 3.54%. At first glance, this may seem stable. But the median return tells a different story. Over the last three years, SHIB has logged an average drop of -14.2% each April. Even the least damaging April in that span saw the token fall 6.41%. These numbers suggest a structural trend, not just isolated pullbacks.

This performance pattern does not seem to generate much public discussion. While sentiment often lifts at the end of March, market behavior tends to shift quickly. That shift is not always tied to a clear event.

ETHNews analysts suggest that institutional investors may reduce positions following Q1 reports, draining liquidity from high-volatility tokens like SHIB. Others point to seasonal trends common across altcoins, where April becomes a month for correction.

Despite these recurring losses, few traders speak openly about them. Social sentiment often resets each spring, reinforcing the belief that this time might be different. Yet historical data continues to reflect the same cycle, now entering its fourth year.

There is still a chance for Shiba Inu to break the pattern. Crypto markets are unpredictable, and April is not guaranteed to repeat the past. However, the consistency of the drop raises doubts among long-term holders who rely on historical trends when making short-term decisions.

As April begins, SHIB enters a critical period. Past years suggest weakness during this month, but no asset is bound to its own history. Whether SHIB follows the same path or deviates from it, the next few weeks will test how much weight historical performance holds in one of crypto’s most reactive tokens.

As of March 26, 2025, Shiba Inu (SHIB) is trading at an exact live price of $0.00001434 USDT, showing a +0.91% increase on the day. Today’s intraday range fluctuated between a low of $0.00001392 and a high of $0.00001473, indicating moderate upward momentum as SHIB attempts to recover from its recent correction.

The 24-hour trading volume is approximately 1.66 trillion SHIB, signaling active participation despite overall market hesitation.

SHIB has performed positively over the past week, gaining +10.90%, and is also up +5.21% over the last month. However, the larger trend still reflects weakness, with a −32.25% drop year-to-date and a −53.15% loss over the past year.

The token continues to trade below its long-term moving averages and remains in a broader downtrend on higher timeframes, despite recent bullish moves on shorter-term charts.

Technically, SHIB has been moving inside a descending channel, and price is now near the upper boundary, suggesting an approaching breakout attempt. If bulls manage to push beyond $0.00001500, the next short-term target is $0.00001640.

However, failure to maintain current momentum could lead to a retest of support around $0.00001370 or even the lower demand zone near $0.00001250.

The RSI remains neutral, and the MACD is beginning to flatten after showing early signs of bullish crossover.

The post Shiba Inu heads into April with caution after three straight years of losses appeared first on ETHNews.