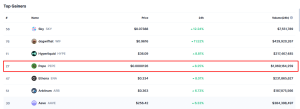

- Kamala Harris’s odds of winning the U.S. presidential election have reached a record high of 45% on the decentralized forecasting market Polymarket, altering perceptions in the cryptocurrency markets.

- Donald Trump’s chances have fallen to 54%, impacting investor strategies and potentially signaling a shift in regulatory approaches depending on the election outcome.

As the U.S. presidential race intensifies, decentralized platforms like Polymarket now show Democratic candidate Kamala Harris at a record-high 45% likelihood of victory. This significant uptick in her odds follows Joe Biden’s withdrawal from the race last month, citing concerns over his age, and endorsing Harris as his successor. The increase in Harris’s chances reflects not only the change in candidates but also her vigorous campaign efforts post-nomination.

On the other hand, incumbent Republican Donald Trump, previously leading in political markets, has seen his reelection odds dip to 54%. These dynamics are crucial as they directly influence market sentiment, particularly in sectors sensitive to regulatory changes, such as cryptocurrencies.

Regulatory Implications on Cryptocurrencies

The fluctuating odds also cast a spotlight on potential shifts in cryptocurrency regulations. The U.S. lacks a unified national regulation of crypto assets, but the number of holders and businesses in this sector has been climbing steadily. This market growth attracts increased scrutiny from the Securities and Exchange Commission (SEC), tasked with protecting investors and maintaining fair markets.

Cryptocurrency investors are particularly keen on the electoral outcome, as it could dictate the regulatory climate. Trump has been vocal about his support for cryptocurrencies, which has historically bolstered investor confidence. However, the possibility of a Harris presidency introduces uncertainty. Investors fear stricter regulations under a Democratic administration could pose challenges to the cryptocurrency markets.

Despite this, the robust funding within the cryptocurrency industry suggests a resilience that could weather potential regulatory storms. Some industry insiders even speculate that a Harris administration might foster further growth in the sector by maintaining or even enhancing the current regulatory frameworks. This ongoing uncertainty makes it essential for stakeholders to stay informed and adapt their strategies as the political landscape evolves.

In summary, as the U.S. presidential election draws nearer, the interaction between political developments and cryptocurrency market sentiments becomes increasingly intricate. Investors and industry observers must navigate these waters carefully, keeping a close eye on both electoral and regulatory shifts that could shape the market’s future.

The post Shifts in U.S. Presidential Odds Reshape Cryptocurrency Market Sentiments appeared first on ETHNews.