- Solana received a major institutional boost this week as Sol Strategies filed to raise up to $1 billion for direct investment, while DeFi Development Corp. became the first public company to adopt Solana-based liquid staking tokens

- These moves signal growing confidence in Solana’s staking infrastructure and its potential for broader institutional adoption.

Solana has once again starred in the institutional spotlight as the blockchain boasts two major publicly traded firms take a bold step to deepen their involvement in the blockchain’s ecosystem.

After institutional players such as Canary Capital, 21 Shares, Bitwise,and VanEck showing interest in a spot SOL ETF, this week, Canada-listed Sol Strategies and Nasdaq-listed DeFi Development Corp. (DFDV) both announced initiatives that could significantly expand institutional exposure to Solana, particularly around staking and token infrastructure.

On Tuesday, Sol Strategies filed a preliminary base shelf prospectus to raise up to $1 billion in securities, including equity and debt, to increase its investment in Solana. While there are no immediate plans to issue the securities, the filing grants the firm strategic flexibility to act quickly on market opportunities.

This latest move follows Sol Strategies’ earlier $500 million convertible note issuance, from which it has already deployed $20 million to purchase over 122,000 SOL tokens.

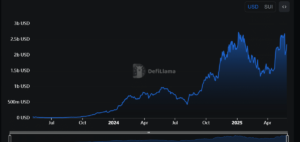

In a parallel development, DeFi Development Corp. became the first public company to adopt Solana-based liquid staking tokens (LSTs) through infrastructure provided by Sanctum, a prominent staking platform in the Solana ecosystem.

DFDV has introduced a new token, dfdvSOL, which allows users to stake their SOL tokens with the company’s validators while retaining the ability to use those assets in decentralized finance (DeFi) applications or redeem them at any time.

This approach to liquid staking addresses a key limitation of traditional staking: the inability to access staked tokens until the unbonding period ends. By using LSTs like dfdvSOL, users can maintain network security participation while keeping their capital liquid and productive in other DeFi protocols.

The dual announcements highly showcase a growing institutional confidence in Solana’s technical infrastucture, particularly its validator network and staking capabilities. With increased support from regulated, publicly traded entities, Solana may be entering a new era of adoption.

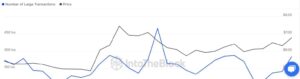

Meanwhile, SOL is at the time of press, swapping hands with $172.61 after a 0.86% and a 3.47% decline in the past 24 hours and week respectively. Additionally, the asset currently holds a $89.81B market cap after a 0.97% decline.

At this juncture, if more institutional players explore and invest in the blockchain’s staking architecture, Solana is positioning itself not only as a high-performance Layer 1 network but also as a legitimate institutional asset.

These developments may signal just the beginning of a wider wave of public-market interest in Solana’s rapidly expanding ecosystem, one that merges staking rewards, liquidity access, and institutional-grade investment strategies under one blockchain.

The post Solana Secures $1B Institutional Boost and Unveils First Public Liquid Staking Strategy appeared first on ETHNews.