- SEC halted DeFi Development’s $1B Solana fundraise due to missing internal controls report, forcing withdrawal of Nasdaq filing.

- Solana price dropped 4.05% to $159.40; $423M SOL moved to exchanges, signaling increased investor caution recently.

The U.S. Securities and Exchange Commission stopped DeFi Development Corp.’s $1 billion fundraising effort. The regulatory body cited a missing internal controls report in the company’s financial disclosure.

DeFi Development, previously named Janover, aimed to use these funds primarily for Solana token acquisitions. The SEC declared the April 2025 Form S-3 registration noncompliant due to this omission. Consequently, the Nasdaq-listed firm withdrew its filing on June 11th.

Solana’s price dropped 4.05% to $159.40 following the news

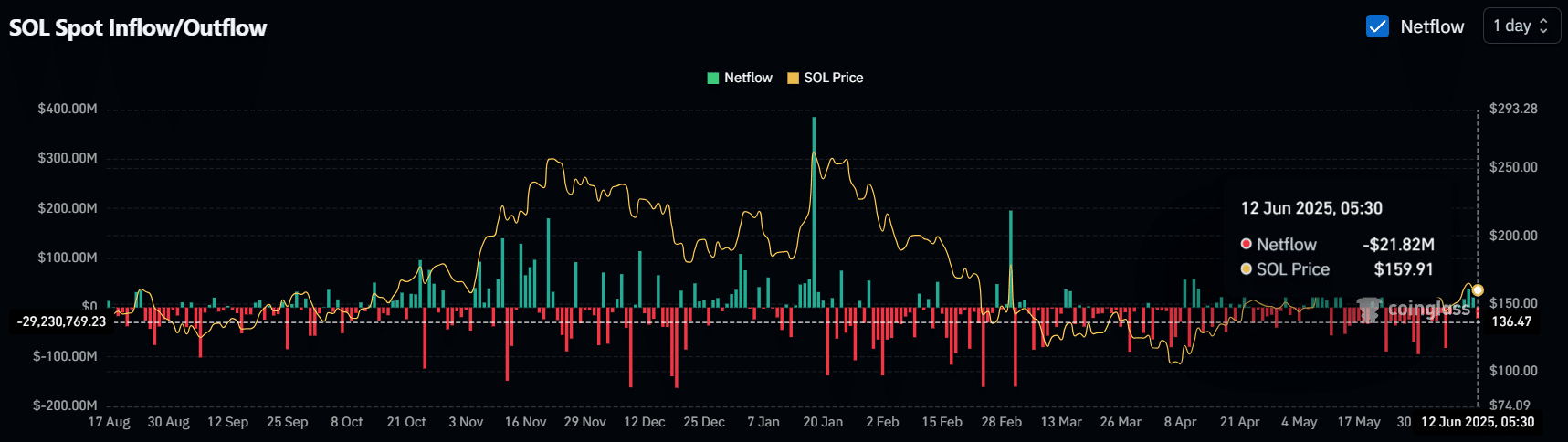

Glassnode data indicates 2.7 million SOL ($423 million) moved to exchanges in nine days. This movement suggests increased investor caution. However, blockchain activity reveals countervailing patterns.

Two new wallets withdrew 1,348,741 SOL ($219.99 million) from Coinbase Prime on June 12th. The entirety of these funds went into staking contracts. This action points to long-term positioning despite regulatory uncertainty. Exchange data further shows $21.82 million in SOL outflows during the past 24 hours.

Binance’s Long/Short Ratio reached 2.40, with 70.61% of traders holding long positions. This metric reveals prevailing bullish sentiment among active speculators. Technically, Solana faces a critical test at $156 support.

Holding this level could enable a 16% rebound toward $184. Failure may trigger extended losses.

Solana (SOL) is trading at $166 USD, showing a +4.74% gain over the last 24 hours and marking its sixth consecutive day of gains. This bullish momentum has pushed SOL above its 50-day simple moving average (SMA) at $161, setting up a potential run toward $200, provided it can also break through its 200-day SMA at $175.

The rally comes amid growing speculation around the approval of a spot Solana ETF, with analysts assigning a 90% probability of approval by late 2025. The U.S. SEC is actively reviewing proposals and is expected to comment within 30 days.

This narrative is helping fuel both institutional interest and retail enthusiasm, positioning SOL as a frontrunner among altcoins for the next major breakout.

The SEC recently halted plans by DeFi Development to fund Solana token purchases due to compliance gaps, specifically the absence of required internal controls documentation. While this has not derailed price action, it does signal that not all institutional exposure to SOL will move forward smoothly in the near term.

The post Solana Whales Stake $220M Despite SEC Fundraising Halt appeared first on ETHNews.