- Multicoin Capital’s SIMD-0228 might shift $SOL towards becoming a deflationary asset, boosting its market value.

- Adjustable ‘Smart Emissions’ based on staking levels could promote network security and economic stability.

A groundbreaking proposal submitted by executives from Multicoin Capital could redefine economic strategies on the Solana blockchain by potentially shifting $SOL towards becoming a deflationary asset.

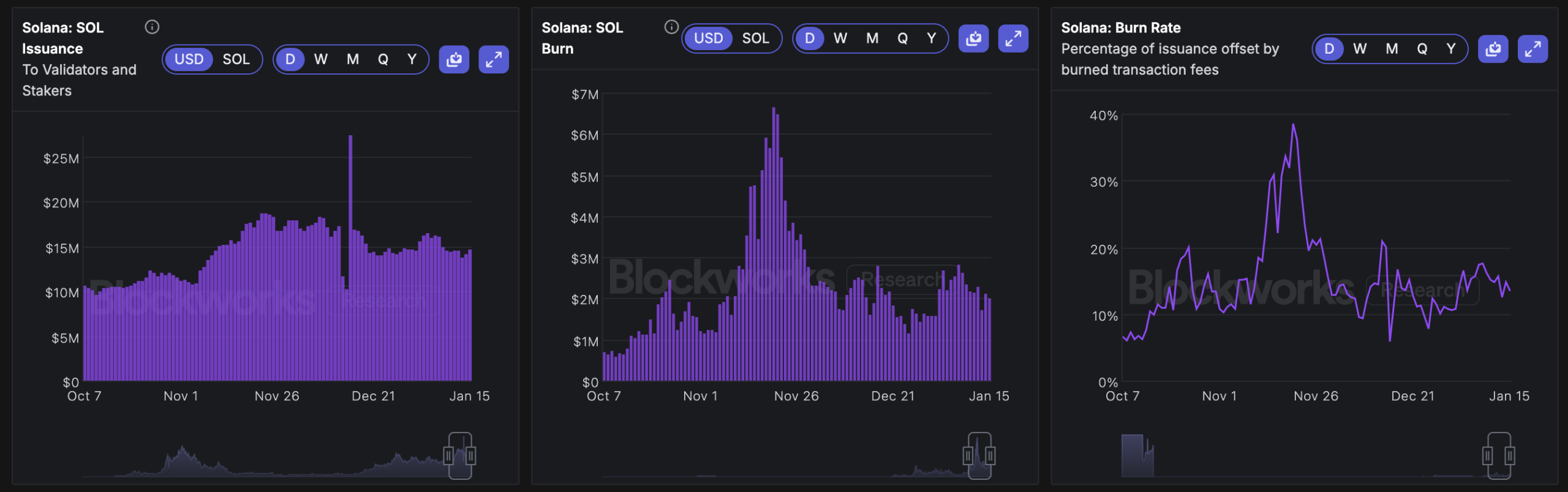

The proposal, identified as SIMD-0228, suggests a novel emission schedule aimed at optimizing blockchain economics while curbing the prevalent inflationary trends.

Today @kankanivishal and I released a Solana Improvement Proposal to reduce Solana inflation.

As Solana matures, stakers increasingly earn SOL through mechanisms like MEV. This income stream reduces the network’s historical exclusive reliance on token emissions to attract stake…

— Tushar Jain (@TusharJain_) January 16, 2025

Exploring SIMD-0228: A Paradigm Shift in Blockchain Economics

The initiative stems from an observed decrease in validators’ dependency on staking emissions, courtesy of Solana’s burgeoning economic activities and MEV rewards. This observation has catalyzed a reevaluation of the emission strategies to better align with the network’s current and future economic states.

Bullish SOL

• Lower inflation = less sell pressure from stakers.

• Smart emissions = dynamic, efficient issuance based on staking demand.

• MEV + fees now sustain validators → emissions no longer needed as much.

• Moves Solana towards sustainable tokenomics like ETH,… https://t.co/INT0tOqTjh— Omar Shakeeb | OSAZ |

(@Omar_Shakeeb) January 16, 2025

SIMD-0228 introduces a concept known as ‘Smart Emissions.’ This approach dynamically adjusts the emission rates based on the actual participation of stakers.

Specifically, the proposal details a mechanism where emission rates will escalate when the staked percentage of $SOL dips below 50%, aiming to enhance network security and incentivize staking.

“With the current staking participation rate of ~70%, the network would see a reduction of inflation of 1% p.a.” – SIMD-0228

Conversely, when over 50% of $SOL is staked, the emission rates will drop, fostering more sustainable economic conditions and supporting the utility of $SOL within DeFi ecosystems.

Solana (SOL) is currently trading at $220.09, reflecting a 5.27% increase in the last 24 hours. Its market capitalization stands at $107.09 billion, with a 24-hour trading volume of $5.27 billion, marking a 9.54% increase. The circulating supply is 486.6 million SOL, with no fixed maximum supply.

From a technical perspective, Solana is testing key resistance at $220 – $225. If it breaks above this range, the next upside targets could be $230 – $240. On the downside, critical support lies at $200 – $210, with further support at $180 if retracement occurs.

With growing institutional adoption, continuous ecosystem expansion, and strong technical fundamentals, Solana remains well-positioned for long-term growth. However, a sustained breakout above $225 is necessary to confirm continued bullish momentum.

The post Solana’s Governance Proposal: Pioneering Economic Shifts to Combat Token Inflation appeared first on ETHNews.