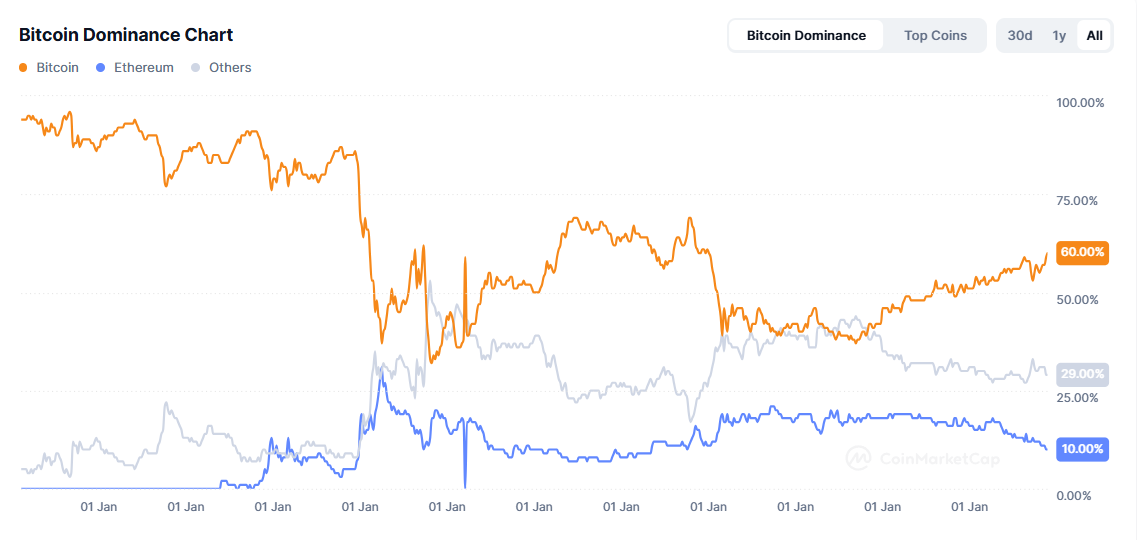

- Bitcoin dominance holds strong at 61.84%, signaling resilience amid broader market weakness and crypto volatility.

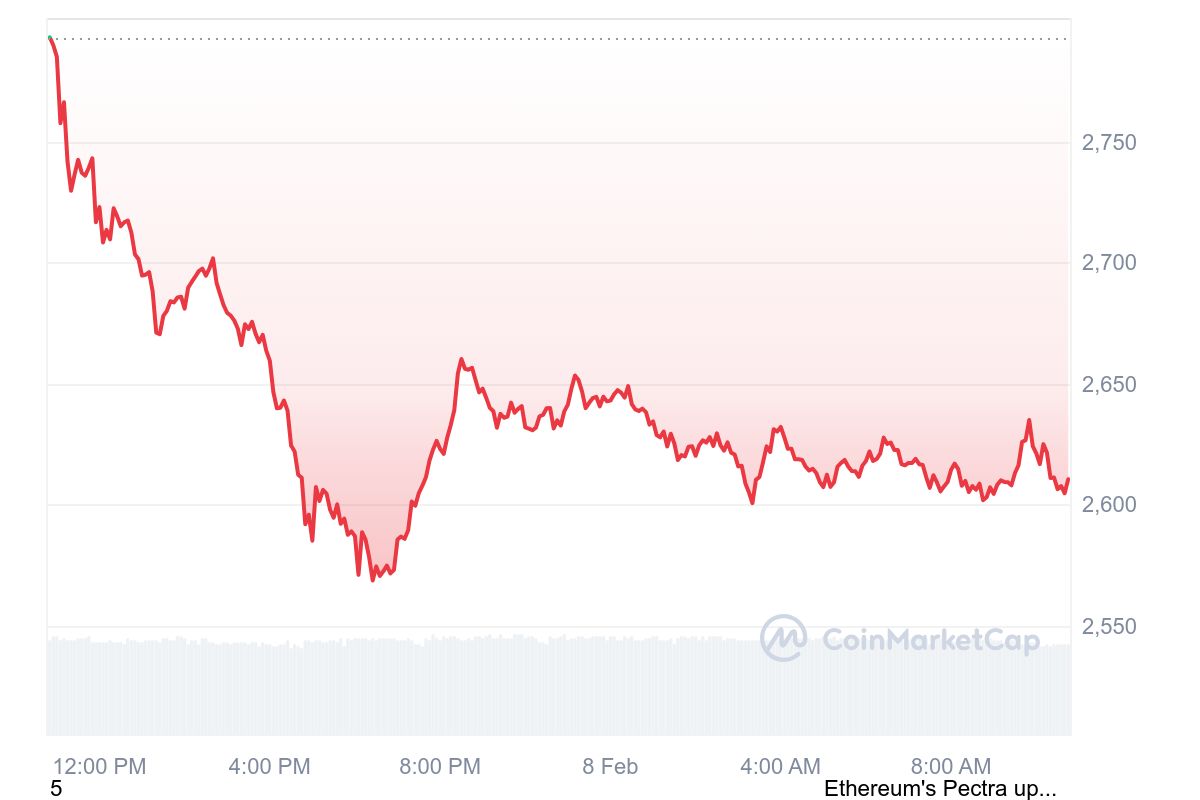

- Ethereum price drops sharply by 5% in 24 hours, reflecting heightened sensitivity to macroeconomic pressures.

The relationship between the stock market and cryptocurrency prices remains a topic of interest for investors. Analyst Bennett has recently shared insights on X, suggesting that the S&P 500’s performance could have implications for Bitcoin and Ethereum.

The analyst notes that the S&P 500 is having difficulty breaking through its range of highs, which might indicate trouble ahead for digital assets.

Analyst Bennett suggests the S&P 500 may fall to around 5,877 due to its current struggle at recent peak levels. This scenario could pose difficulties for high-risk investments such as cryptocurrencies. Past stock market fluctuations have often impacted crypto values, and this instance might mirror that trend.

A downturn in stocks typically prompts investors to decrease their involvement in volatile assets like Bitcoin and Ethereum.

Ethereum appears particularly vulnerable to these macroeconomic pressures. Over the past 24 hours, its price fell by 5%, trading at $2,623. This decline reflects broader market weakness and underscores Ethereum’s sensitivity to external factors.

The altcoin’s sharper fall compared to Bitcoin suggests traders are rotating out of riskier positions. Such behavior aligns with typical market patterns during periods of uncertainty.

Bitcoin, meanwhile, shows relative stability despite the downturn. Its price dropped by 2.4% in the same timeframe, settling at $96,313. Bitcoin’s dominance index remains strong at 61.84%, indicating that it continues to hold a firmer position than most altcoins.

For now, the S&P 500 remains a key indicator to watch. A confirmed drop to the 5,877 level could trigger further selling pressure across both traditional and crypto markets. Investors are likely to adjust their portfolios based on how equities behave in the coming days.

The interconnectedness of these markets highlights the importance of monitoring macro trends when assessing crypto price movements.

For instance, if the S&P 500 experiences a correction, it could lead to a reduction in investor appetite for high-risk assets, including digital currencies.

The post S&P 500 Warning: Is a Crypto Crash on the Horizon? appeared first on ETHNews.