- SUI has hit a record $14.8B in DEX volume and rising TVL, yet its price remains stuck below key resistance amid weakening momentum and cautious trader sentiment.

- With a $206M token unlock set for June 2, the altcoin faces heightened risk of a pullback if bulls fail to push past the $3.87–$4.13 range.

Despite hitting a record $14.8 billion in decentralized exchange (DEX) volume in May 2025—nearly four times its historical monthly average—Sui (SUI) is struggling to reflect this growth in its market price.

While high DEX volume typically signals surging interest and precedes bullish price action, SUI remains locked under the key resistance zone between $3.87 and $4.13, raising concerns about its short-term trajectory, especially with a looming token unlock in June.

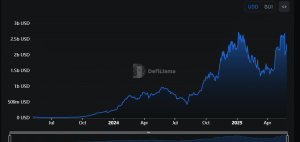

SUI’s growing ecosystem offers bullish fundamentals. Its Total Value Locked (TVL) has surged to $2.346 billion, up 7.69% in just 24 hours, highlighting robust capital inflows into its DeFi protocols. Additionally, a modest $1.31 million net spot inflow indicates that long-term holders may be quietly accumulating.

However, traders remain cautious. Open Interest has declined 2.83% to $1.79 billion, reflecting reduced speculative appetite. This aligns with weakening MACD momentum and fading histogram bars, suggesting traders are waiting for a confirmed breakout before committing.

Currently, SUI is trading at $3.69, up nearly 4% on the day, but still below heavy resistance. Price action has been range-bound for weeks, unable to break through the $3.87 threshold.

Compounding this, liquidation heatmaps from CoinGlass show dense clusters between $3.6 and $3.87. These zones act like landmines for bulls—triggering defensive selling or forced liquidations before a breakout can occur.

If SUI can decisively breach the $3.87 level, a short squeeze could propel it rapidly toward $4.97, the next key Fibonacci target. However, failure to do so might invite a sharp pullback to $3.57 or even $3.12. The MACD’s waning momentum and the RSI’s neutral-but-declining posture reinforce this precarious balance between optimism and risk.

June’s $3.2 Billion Token Unlock Wave Sparks Sell-Off Concerns

Adding further pressure is June’s token unlock calendar, which is expected to flood the market with over $3.2 billion worth of tokens. Specifically, SUI will unlock 58.35 million tokens worth $206 million on June 2, over $70 million of which is allocated to Series B investors. Given these investors’ early entry and profit potential, a sell-off post-unlock is a credible threat.

Zooming out, the Total2 crypto market cap (excluding Bitcoin) hovers near the 0.382 Fibonacci retracement level at $1.25 trillion, showing signs of stalling. A breakdown below the $1.21 trillion support could amplify market-wide weakness, further dragging down altcoins like SUI.

While SUI’s on-chain growth is undeniable, price action has yet to reflect it. With heavy resistance, technical warning signs, and a sizable token unlock just days away, the altcoin faces a critical juncture. Unless bulls overcome the $3.87–$4.13 wall soon, SUI risks slipping into a deeper consolidation—or worse, a near-term correction.

The post SUI Price Lags Despite $14.8B DEX Volume – Is a Crash Coming With June Token Release? appeared first on ETHNews.