- UNI surged 17% to $7.67, breaking $7.50 resistance to hit a two-month price high decisively.

- Whales accumulated 339k net UNI; spot market CVD flipped positive with 6.96M tokens bought.

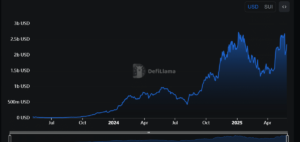

Uniswap’s UNI token gained 17% within 24 hours, reaching $7.67. This move surpassed the $7.50 resistance level that previously halted advances. The price established its highest point in two months.

Trading volume simultaneously jumped 89.5%, totaling $1.53 billion. Daily spot volume reached $901.6 million during this rally.

Large holders significantly increased UNI accumulation:

- Whale inflows hit 6.75 million UNI

- Outflows totaled 6.3 million tokens

- Net accumulation reached 339,000 UNI

Spot market activity confirmed this trend. Buy orders exceeded sell orders, with 6.96 million tokens acquired through taker buys. This flipped the Cumulative Volume Delta (CVD) into positive territory, reflecting dominant buyer pressure.

Despite strong demand, exchange data reveals a potential headwind. Uniswap Exchange Netflow remained positive for two consecutive days.

Higher exchange inflows versus outflows often signal increasing sell readiness among holders. This pattern suggests some participants may secure profits near current levels.

Technically, UNI approaches a critical juncture. A “golden cross” pattern—where a shorter-term moving average crosses above a longer-term one—could form near $7.818. This event might confirm the uptrend’s strength. However, failure to hold the $6.87 support level risks retracing recent gains.

UNI trades at roughly $7.20 per unit. Its 24-hour volume sits near $750 million, and its market capitalization stands around $4.5 billion, placing it just outside the top twenty by size. Over the past day, the price has gained about 1.5 percent, recovering from a recent low of $6.70 this week. Earlier, UNI peaked near $7.50 before meeting resistance close to $7.60.

Year-to-date, UNI found its lowest point around $4.60 in February and reached a high of $9.20 in April. These extremes show that the token’s current level remains below its yearly average, suggesting that short-term sellers have held sway recently.

The 14-day Relative Strength Index (RSI) reads about 56, which denotes moderate buying pressure without being overextended. On the other hand, the 50-day simple moving average (SMA) sits near $6.80, indicating recent support, while the 200-day SMA rests at about $8.10, a level that has acted as a ceiling in past months.

On a four-hour chart, UNI has formed a series of higher lows since last week, signaling that some buying interest has emerged as price dipped toward $7.00.

Immediate support lives around $7.00. If that zone holds, buyers may aim for the next barrier at $7.60. Should UNI break below $7.00, the following cushion lies near $6.70, close to recent swing lows.

If price climbs above $7.60, it could test the $8.10 area—coinciding with the 200-day SMA. A sustained move past that level would suggest a return of broader bullish interest.

Overall, the balance between bulls and bears is fairly even. A clear uptick in volume could push the price above resistance, while a drop under $7.00 might signal a deeper correction.

The post Uniswap Surges 17% to Two-Month High as Whales Accumulate appeared first on ETHNews.